Managed Futures Selection Process

Post on: 31 Март, 2015 No Comment

The selection of an appropriate futures investment is critical to the success of your portfolio. Many brokerage firms offer dozens or even hundreds of Commodity Trading Advisors (CTAs) from which to choose. We offer our clients a select number of CTAs that meet our investment criteria.

Choosing the “right” investment does not necessarily mean choosing the most profitable, as the most profitable investments often carry the highest risk as well. We believe in seek a robust futures investment that makes money in most markets.

What we Look for in a Manager

Before suggesting a CTA to our clients, Worldwide Futures Systems asks each manager several due diligence questions to determine their suitability. Three key questions for evaluating a CTA are:

- Does the investment have the ability to get returns?

- Does the CTA attempt to not loose substantial money by protecting the down-side and wealth preservation?

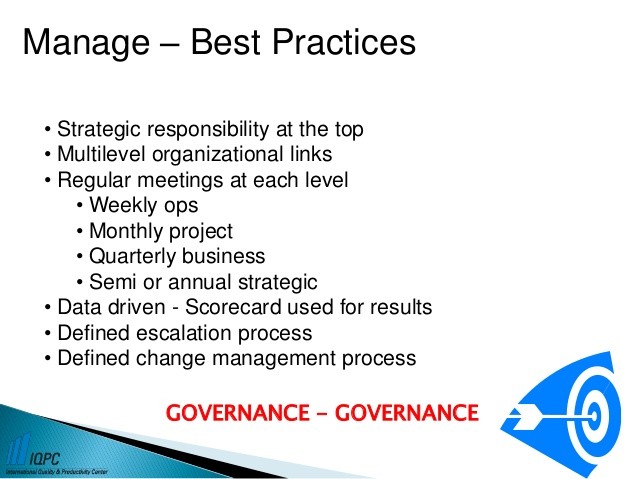

- Does the CTA show the ability to manage the business? We find successful traders but unless they know how to manage the organization it may not be a successful CTA.

Each CTA’s managed futures program goes through a thorough review before we decide to include it in any client portfolios.

Determining an investments “true risk ”

One primary consideration in the evaluation of any managed futures investment is risk. Some investment programs cite misleading figures, so we go beyond the tear sheet and dig into the numbers. What are the “true” draw-down numbers? What is the open trade equity peak-to-valley largest drawdown?

Accurate and honest drawdown figures are a critical part of determining true risk. Since risk tolerance is different for all people, the team at Worldwide Futures Systems performs an in-depth personal consultation with every client to ensure the client is completely comfortable with the true risks of all the systems we offer.

It’s about more than just returns

On the surface it seems like selecting the best managed futures returns would be the clear choice—CTA selection goes beyond just profits. We look at overall history, diversification, risk, and both long and short-term potential for the markets traded in addition to the manager and their investment strategy. In essence, past performance is not indicative of future results.

At Worldwide Futures Systems, we recommend select managed futures programs that are robust across all markets. We also constantly monitor the selection of commodities, which is critical when controlling risk.

Where to learn more about managed futures

If you’d like to learn more about managed futures, visit our managed futures education page or view these managed futures videos.

We also invite you to contact a Worldwide Futures Systems broker for how managed futures can work with your existing portfolio, or sign-up for our managed futures database to view our selection of CTAs.

The addition of managed futures to a portfolio does not mean that a portfolio will automatically be profitable, that it will not experience substantial losses or volatility and that the results of studies conducted in the past may not be indicative of current time periods or of the performance of any individual CTA.