Managed Futures Easier To Get But Harder To Love

Post on: 31 Март, 2015 No Comment

Advertisement

According to recently enacted federal law, private is going to look a lot more like public, at least as far as so-called commoditypools are concerned.

A commodity pool is the technical designation for a managed futures fund — most often marketed, like other hedge funds, as a privately placed limited partnership.

WhenPresident Obama signed the Jumpstart Our Business Startups(JOBS) Act in April, a door was jarred to let these limited partnerships out of the closet. Under a little-noticed section of the JOBS Act, commodity pools will now be allowed to advertise. Specifically, the billlifts prohibitions which prevented these funds from presenting their performance or investment strategies to outsiders.

Heretofore, hedge fund interests were afforded an exemption from registration under the 1933 Securities Act as long as their offerings were kept private, meaning there werent general solicitations to investors. Essentially, the peddling of hedge fund interests had to be limited to one-on-one introductions.

The JOBS Act now directs the Securities and Exchange Commission to revise the 33 Acts Regulation D — specifically, Rule 506 — which bans general solicitation and advertising. The final rules are supposed to be written within 90 days of the bills signing.

wealthmanagement.com/investment/managed-futures-mainstreamed ), futures hedge funds provided substantial portfolio protection during the 2008-2009 market meltdown.

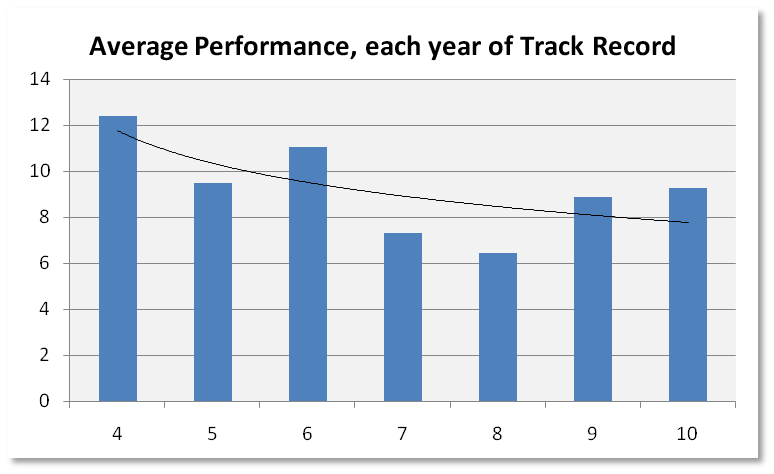

Lately, though, managed futures returns havent been stellar. Midway through 2012, the Dow Jones Credit Suisse Core Managed Futures Hedge Fund Index — an asset-weighted compendium of a half-dozen large commodity pools — was still under water.

Managed futures funds, have, in fact, been middling investments since 2011. The hedge fund indexs average annual return is just south of zero compared to a weakly positive S&P 500.

Thats not to say that commodity trading advisors havent added value. The long-only Thomson Reuters Jeffries/ CRB Index — a portfolio of 19 energy, metal, agricultural and livestock futures — lost ground at a 12 percent annual clip (see Table 1).

Given the volatility of commodity prices over the past 18 months, its not surprising that actively managed funds fared better than long-only futures positions. After all, commodity trading advisors (CTAs) can just as easily short sell as purchase commodity contracts. Smart traders, in fact, have recently had a field day with short positions in soft commodities like sugar, cocoa and cotton.

Despite the near-30 percent decline in soft commodities last year, managed futures hedge funds still pull up short against a buy-and-hold position in large-cap stocks proxied by the S&P 500. While these funds did provide a hedge — their r-squared coefficient was just 0.01 — they couldnt crank out a positive alpha.

While nobody likes losses, managed futures 1.6 percent setback seems less significant when weighed against the asset class beta. The small current loss may be transitory, since most CTAs are momentum players. Managed futures funds tend to fare better in trending markets — either up or down — and, when equities are down, futures tend to be up.

So, can we expect investors to clamor for managed futures when the advertising actually starts?

Perhaps, but that might take a while. Despite the JOBS Act mandate, insiders dont expect the SEC to spit out new marketing rules anytime soon. Id not be surprised if the SEC drags its feet on rulemaking, says David Rosedahl, a compliance attorney with Briggs & Morgan in Minneapolis. Theyve got a lot on the table.

The new rules, whenever theyre implemented, arent likely to ease the regulatory burden on advisors and broker/dealers. In fact, requirements may even stiffen. Investors will still be need to be vetted as accredited, meaning, among other things, individuals with a net worth in excess of $1 million or an annual income above $200,000. Buzz at the SEC, says Rosedahl, suggests the agency may seek to establish a higher standard of proof of investor status than the written declaration now required.

Nothing in the JOBS Act changes the registration status of advisors soliciting pool business, either. FINRA-registered representatives who havent already passed the Series 3 National Commodity Futures Examination will still be required to sit for the Series 31 Futures Managed Fund test [NB: yes, that is the title of the test]. Granted, the 45-question Series 31 exam spans a relatively narrow band of commodity market rules, regulations and responsibilities compared with the wide swath covered by the 120-question Series 3 but a test is still a test.

So, no matter how much you might want to add managed futures to your repertoire, all this — together with their usual two and twenty fee structure — makes hedge funds hard to love.

A Simpler Alternative?

Layering managed futures into a client portfolio neednt require investor accreditation or new licensure, however. There are a number of publicly traded commodity funds available for more pedestrian investors that can be marketed by reps with only a Series 7 or Series 6 registration. Topping the list are nine mutual fund products with 18-month track records and assets over $100 million (see Table 2).

RYMTX — Guggenheim Managed Futures Strategy Fund

Assets Under Management (AUM): $2.07 Billion; Annual Expense Ratio (ER): 1.97%

The largest fund in the category, RYMTX, isnt managed on a discretionary basis. Instead, it tracks the Standard & Poors Diversified Trends Indicator (DTI), a systematic rules-based trend-following strategy. The DTIs investment universe consists of two dozen futures markets, 50 percent financial futures and 50 percent physical commodities. Within each allocation, short or long positions are undertaken (except for energy contracts, which cannot be shorted) based on their prices relative to their moving averages. RYMTXs negative return over the past 18 months reflects its inability to capture the recent collapse in energy prices. The funds efficiency in delivering alpha — based on the quotient of its expense ratio over the coefficient — at -0.22, is the tables median.

AQMIX — AQR Managed Futures Strategy Fund

AUM: $1.72 Billion; ER: 1.35%

AQMIX uses proprietary quantitative models to identify price trends in equity, fixed income, currency and physical commodity contracts. Once a trend is determined, fund managers take either long or short positions, sized by that markets forecasted risk and anticipated trend persistence. On average, the funds managers target an overall annualized volatility level of 10 percent, though risk typically ranges between 5 percent and 13 percent. AQMIXs efficiency ratio is presently a second-from-the-bottom -0.47.

MFTAX — Altegris Managed Futures Strategy Fund

AUM: $1.11 Billion; ER: 3.76%

MFTAX uses a fund-of-funds approach, blending the efforts of seven CTAs including momentum players and those pursuing specialized strategies. Allocations vary between 60 to 100 percent for trend-following managers and 0 to 40 percent for specialized sub-strategies. Currently, the highest manager allocation is 35 percent. The pass-through of CTA fees is reflected in MFTAXs bottom-scraping -0.80 efficiency ratio.

MHFAX — MutualHedge Frontier Legends Funds

AUM: $916.9 Million; ER: 5.95%

Another fund-of-funds, MHFAX produced the highest positive return in the category. However, because of the high incentive fees passed through its portfolio of actively managed CTA programs, MHFAXs 3.72 efficiency ratio was just second-best.

AMFAX — Natixis ASG Managed Futures Strategy Fund

AUM: $741.6 Million; ER: 1.71%

AMFAX managers use a multi-model approach to capture market trends over various time horizons ranging from several days to several months. As risk levels change, position sizes are adjusted with the goal of maintaining a stable risk profile. Still, AMFAXs current volatility is above average for the category. That risk posture, in part, contributes to the funds -0.29 efficiency ratio.

PFFAX — Princeton Futures Strategy Fund

AUM: $457.79 Million; ER: 2.21%

Like other funds in the category, PFFAX commits a relatively small portion of its assets to margin futures positions. PPFAX targets a 40 percent allocation to futures, with the balance invested in fixed income (usually money market) securities. Because of the leverage inherent in futures contracts, though, the funds effective economic exposure to commodity and financial derivatives typically represents 90 percent to 110 percent of its assets. The funds -0.24 efficiency ratio can be traced to its high cost structure.

RYLBX — Guggenheim Long/Short Commodity Strategy Fund

AUM: $426.17 Million; ER: 1.92%

RYLBX, like RYTMX, is non-discretionary but instead follows a rules-based momentum strategy based on 14 S&P GSCI Excess Return Index components. The strategy dictates that as many as

seven top-performing constituent contracts can be held long against seven of the worst performing components. The fund maintains full exposure on a day-to-day basis by conducting its necessary trading activity just prior to the close of the U.S. financial markets. RYLBX was one of just three funds in the category to produce a positive return which, when factored against its

comparatively modest expense, yields a best-of-class 8.57 efficiency.

FCMOX — Forward Commodity Long/Short Strategy Fund

AUM: $169.5 Million; ER: 1.54%

FCOMX, too, tracks a rules-based strategy, namely the Credit Suisse Momentum and Volatility Enhanced Return Strategy (MOVERS) Index. Like the strategy underlying RYLBX, the Credit Suisse MOVERS Index is comprised of positions in S&P GSCI single commodity sub-indexes. The MOVERS Index, however, filters out ten commodities with the strongest absolute signals into an equally-weighted basket which can be all long, all short, or a combination of longs and shorts. The basket is rebalanced monthly. FCOMX is one of the three funds cranking out positive returns over the past 18 months, earning an efficiency ratio of 1.08.

MFTFX — Arrow Managed Futures Strategy Fund

AUM: $111.6 Million; ER: 1.78%

MFTFX tries to match the performance of the Trader Vic Index (TVI), a doppelgnger of the S&P DTI underlying the RTYMX fund. Thats because the DTI methodology was developed by Alpha Financial Technologies, a Dallas-based firm owned by Trader Vic (Victor Sperandeo) himself. Sperandeo licensed his methodology to Standard & Poors, which subsequently launched the DTI to serve as the backbone of the RTYMX fund, among others. Not surprising, then, that the portfolio characteristics of MFTFX and RYTMX are so similar. Still, MFTFX earns a slightly better -0.18 efficiency ratio than MFTFX.

A Quick Takeaway

The first thing youll note about this mutual fund category is how few of the portfolios — just a third — earned a positive return for the period. Two of these, RYLBX and FCOMX, are rules-based long/short portfolios. MHFAX was, in fact, the only fund thats winning on a truly discretionary basis. Clearly, alpha is not easy for active managers to snag, even if they have the ability to go long or short.

Alphas costly, too. The weighted average expense ratio for the category is 2.54 percent. Certainly the 5.95 percent cost for the MHTAX portfolio skewed the average, but that can be seen, by glass-half-full types anyway, as a sign of success. After all, MHTAX would have been cheaper to own if it didnt have to fork over those profit-based incentive fees to its CTAs. Lower fees, though, would be indicative of smaller profits. You have to pay the piper to dance here.

In sum, publicly traded products collectively have earned poorer returns and less (i.e, more negative) alpha than the universe of managed futures hedge funds.

But, given their underperformance against the S&P 500, that doesnt give the hedgies much to crow about. But crow they undoubtedly will if theyre allowed to pitch their wares under the new SEC rules.