Managed Futures and ETFs (12

Post on: 11 Июнь, 2015 No Comment

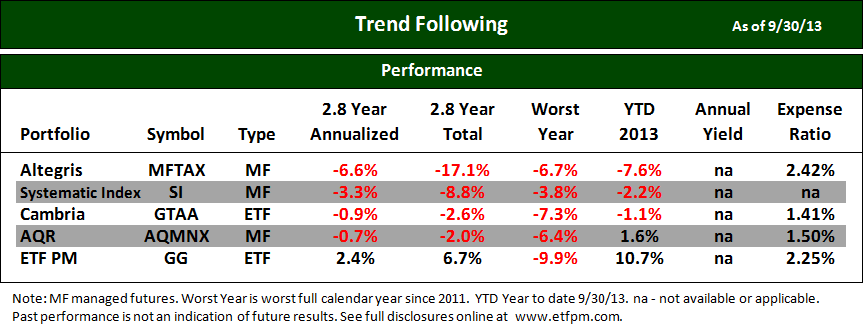

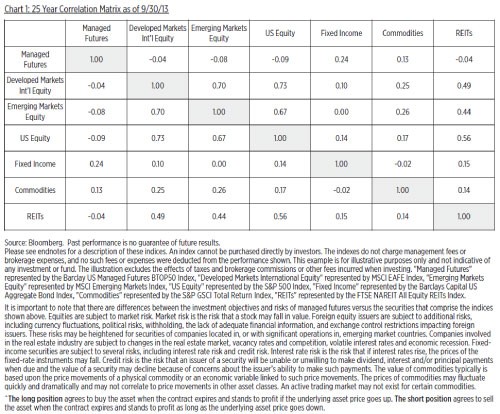

Investors are now able to employ trend following using managed futures, exchange-traded funds (ETFs), or both.

CTAs Break Their Losing Streak, Up For Two Months Now

By Tabinda Hussain, 12/17/13

The trends which were distinctly not in favor of the CTAs for most of this year, changed for the better in the past two months. Credit Suisse Managed Futures index rose 2.26% in November and 3.45% in October, a major rise considering that the last time the index generated a positive return over a 30-day period was in April of this year. Same goes for Eurekahedgel; their CTA/Managed Futures Hedge Fund Index was also up 1.22% in November and up 1.9% in October, reducing YTD loss to -0.94%.

Trends are now Friendlier

CTAs, which follow complex algorithms to narrow down market trends, also had a good run in the first few weeks of September, with all the benefits that came from no-taper announcement, however the returns did not last long.

A few macro trends that came back with a bang in November were the short JPY and short AUD trades, as we have noted earlier. Precious metals, especially gold, continued their downward journey whereas crude oil rallied in last month. CTAs also rode the rise of the euro and benefited from positive activity in the U.S equity markets.

David Krenices, who is the founder of ETF Portfolio Management (ETF PM), a platform that follows ETF trends rather than managed futures, said that November was marked by continued weakness in commodities and precious metals and strength in U.S equities. He added, “The ETFs that track oil (USO) and the commodities asset class (DBC) both fell in November by -3.5% and -0.9%, respectively. These declines reduced their year-to-date returns to 0.3% and -8.2%, respectively.”

On being asked what trends are likely to stand out going forward, Krenices said, “Human emotion has proven to be a liability in portfolio management, and short-term market trends have often surprised even the best long-term investor.” and for that reason such analysis is avoided at ETF PM, he further added, “As for the CTA industry, I believe the marketplace will eventually favor ETF trend following over managed futures. In using ETFs, we are able to participate in equity bull markets far more than CTAs.”

ETF PM’s trend following strategies are up 7% to 15% year-to-date, and the firm has outperformed during the financial crisis, proving the benefits of ETF trend following over traditional CTAs.

Man Group, Cantab, Winton record gains

Meanwhile the traditional CTAs also climbed up in the last couple of months. Man Group’s AHL Diversified rose 0.5% through November 25 whereas and AHL Evolution was up 1.9% until Nov 22.

BlueCrest Capital Management’s BlueTrend Fund gained 0.3% in November, trimming YTD loss to -8.65%.

Graham Capital gained 6.7% in one of its CTA in November, Graham Global Investment Fund 15V, taking up the total return to +15.34%. Graham Capital is the largest U.S based CTA, its funds recorded gains across other trend following and macro portfolios as well.

Winton Capital’s Winton Futures Fund was up 10.8% YTD after adding a +4% return in November. Winton Evolution was also up in the same period. Renaissance Technologies’ Institutional Futures Fund was up 1.78% in November. DB Platinum Advsiors also gained its trend following strategy which was up 2.5% in November, bringing up the YTD gain to +6.6%.

Cantab Capital’s Aristarchus fund recorded a gain of 2.8% in November, however the fund is still down 22.7% year-to-date, though it has scaled back the huge losses it had at the end of August. Anthony Todd’s Aspect Diversified was down 4.3% YTD after rising +2% in last month.