Looking for grain futures price direction in the interdelivery spreads

Post on: 21 Июль, 2015 No Comment

Looking for grain futures price direction in the interdelivery spreads

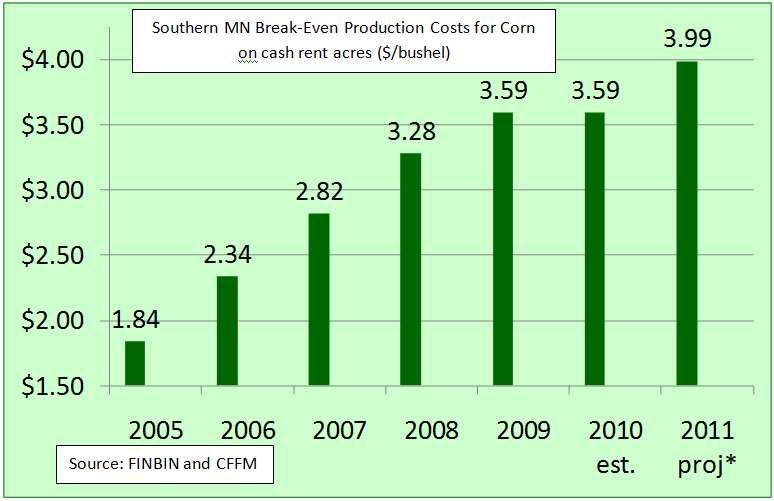

Jul'11 corn futures

I recently dedicated two class periods to examining one of the most interesting aspects of futures markets and trading: futures spreads. We discussed the soybean crush spread as an example of a raw material and product spread. We looked at several intercommodity spreads like wheat vs. corn, corn vs. soybeans, and cattle vs. hogs. We spent a little time on intermarket wheat spreads, e.g, buying Minneapolis wheat and selling Chicago wheat futures. Finally, we studied interdelivery (aka intramarket or intracommodity) spreads, or the simultaneous buying and selling of the same commodity with different delivery months (e.g. July and November soybeans).

In grain markets, interdelivery spreads are interesting, popular and the direction in these spreads will shed light on the underlying bullish or bearish tone in the market. For example, an interdelivery bull spread involves buying the nearby contract and selling deferred contracts. The bull spread takes its name from the tendency for nearby futures prices to gain relative to deferred futures in bull (rising) markets. In a bull market, carrying charges should be decreasing or, if the market is inverted, the inverse should be increasing.

An interdelivery bear spread involves the opposite selling the nearby contract and buying deferred contracts. The bear spread is named for its tendency for nearby futures prices to lose ground relative to deferred futures in bear markets. In other words, carrying charges should be increasing or, in the case of an inverted market, the inverse should be decreasing.

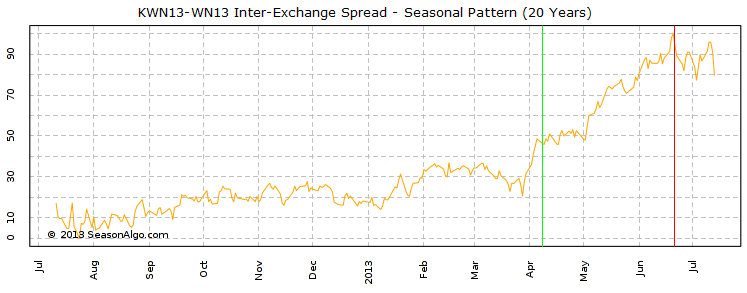

Jul'11/Dec'11 corn spread

I want to look at the corn, soybean and wheat futures markets, and look to see if the interdelivery spreads are telling us anything about the strength of the current market. In this post, I will start with corn.

The July contract has been rising steadily for months. It is interesting to note that the setback in corn prices in late February and March was matched by a sharp decline in the Jul/Dec inverse (inverses from old crop to new crop are not uncommon, but this an uncommonly sharp inverse). The July contract has since recovered and stabilized, while the spread has been wildly erratic. The inverse increased sharply in late March, only to crash again earlier this month. It has recently shown signs of another recovery.

You may draw your own conclusions, but I see the Jul/Dec spread sending a very mixed signal about the current bull market.