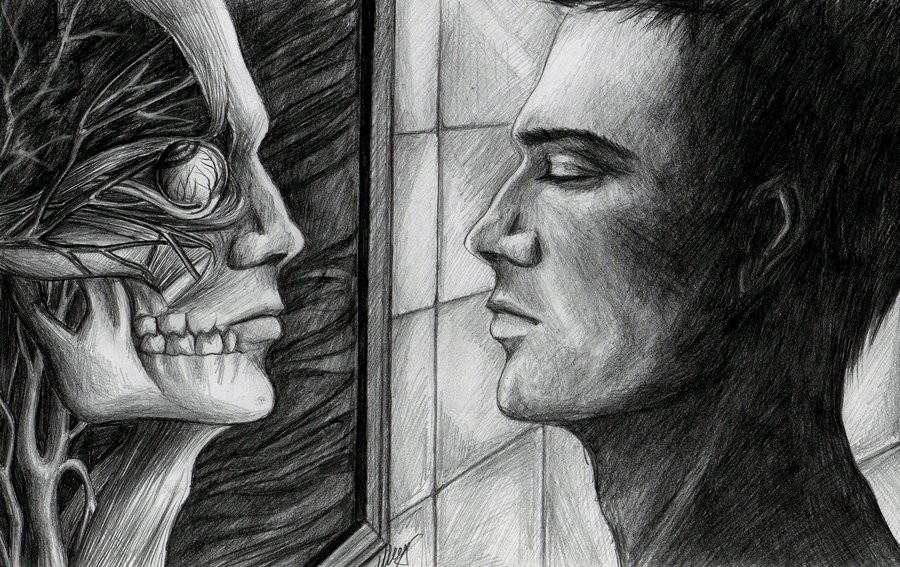

Look Inside

Post on: 25 Апрель, 2015 No Comment

Preface

It certainly is sad to hear about the numerous investors who, after working hard all their lives, have had to delay their retirement plans due to sharp losses on their nest eggs. The crash of 2008 taught many people the hard way that diversification does not mean simply investing in a basket of stocks and including a variety of sectors (technology, healthcare, etc.) or countries (i.e. U.S. India, China); virtually all equities were crushed by the market fallout. If only we had been there to advise these investors (and they in turn were willing to listen), how different their situation might be.

As co-owners of a commodity trading advisory firm, and having served clients for a number of years, we’ve had plenty of discussions about investors and the mistakes they make when investing. Here are a few of the topics from our conversations:

- all markets move similarly because price action is primarily derived from greed and fear;

- the characteristics that make an investment attractive or unattractive;

- a client’s response to an investment’s performance is often to their detriment;

- dumb money strategies, like performance chasing;

- how investors should decide whether to hold or sell an investment at any given time;

- profitability is often as much a function of an investor’s actions as the investment itself;

- the concept of gamma and how it’s underutilized in investment selection.

Although the two of us bring decades of individual investment experience to our clients, we approach the markets from very different perspectives: One of us is analytical and research oriented while the other is seemingly opposite, a real-world, tick-by-tick trader. Our approaches appear so diverse, yet in the end we arrive at the same practical and relevant aspects of investing, which actually makes us complementary in nature, just as investments should be in a wellbalanced portfolio.

Through our talks, we came to realize that despite the plethora of investing books available, there seemed to be a great need for a book about proper investment decision-making. We began with the idea of wanting our readers to understand

the special relationship between managed futures and proper portfolio diversification. Although we wanted to explain what makes managed futures so unique, it quickly became apparent that the underlying fundamental concepts were worthy of discussion by themselves. We also wanted to dispel certain beliefs about investing and give readers enough usable information to enable them to make decisions that would result in creating profitable portfolios and, more importantly, avoiding unnecessary losses. Using these concepts, our readers could build more effectively diversified portfolios that perhaps include some managed futures investments.

To that end, we’ve confined the majority of our discussion regarding managed futures to Chapter Two. Chapter One provides the introduction and the foundation underlying these concepts. But the real meat and essential reading is contained in Chapters Three and Four. Finally, we put these concepts together in Chapter Five to help you build your portfolio.

Investors also needed to learn why the traditional way of constructing a portfolio is inherently flawed and the conventional thinking of the typical investment account executive doesn’t offer them true diversification.

In order for investors to be protected, they would have to create a portfolio that’s uncorrelated in terms of return and also in terms of something called gamma. That became the basis of our book.

The concept of gamma has its origins in option trading, but we were unable to find any book or other written material that does more than define similar concepts.1 No source we are familiar with has any discussion on applying the concept to making investment decisions outside of options, or relates gamma to making life decisions. The concept we’ll be introducing in these pages is one that most investors don’t use, and frankly aren’t aware of. Investment books, whether introductory or more advanced, don’t discuss gamma. However, as you will learn, gamma is so fundamental to investing that it can be the single determining factor in an investor’s success or failure.

Investing will test your discipline and your ability to make peace with the idea of taking on risk. Therefore, the most important factor in realizing successful returns is having the right mindset, something we refer to as a positive gamma mindset. Having a positive gamma mindset will help you invest in

a contrarian manner, selecting those investments that haven’t performed well in the past, yet have excellent potential to do so in the future. Maintaining such a mindset will also help you stick with your plan and avoid the many errors induced by emotional decision-making.

Both authors contributed their experience greatly to this book, and the choice of who would be listed as the first author was arbitrary. We look forward to sharing our expertise with you and hope you find our ideas on how to make investment decisions both unconventional and thought-provoking. We believe that by following a positive gamma mindset you will undoubtedly have a better chance of achieving exceptional wealth.