Learning to Offset Risk with Options Futures and Hedge Funds Trading Tutorials

Post on: 14 Июнь, 2015 No Comment

Learning to Offset Risk with Options, Futures and Hedge Funds

Rate this post

Many beginning traders will be tentative when they explore their options in the investment field, especially when they are just getting used to their options. One of the biggest deterrents for many traders when it comes to getting more involved with their trading environments is often attributed to their discomfort with risk. What many are not aware of, however, is that it is entirely possible to offset risk with options, futures and hedge funds, significantly reducing large hits to funds with the right resources. By looking into the right investment strategies, investors will be able to establish a much more comfortable environment where they can experiment with different strategies.

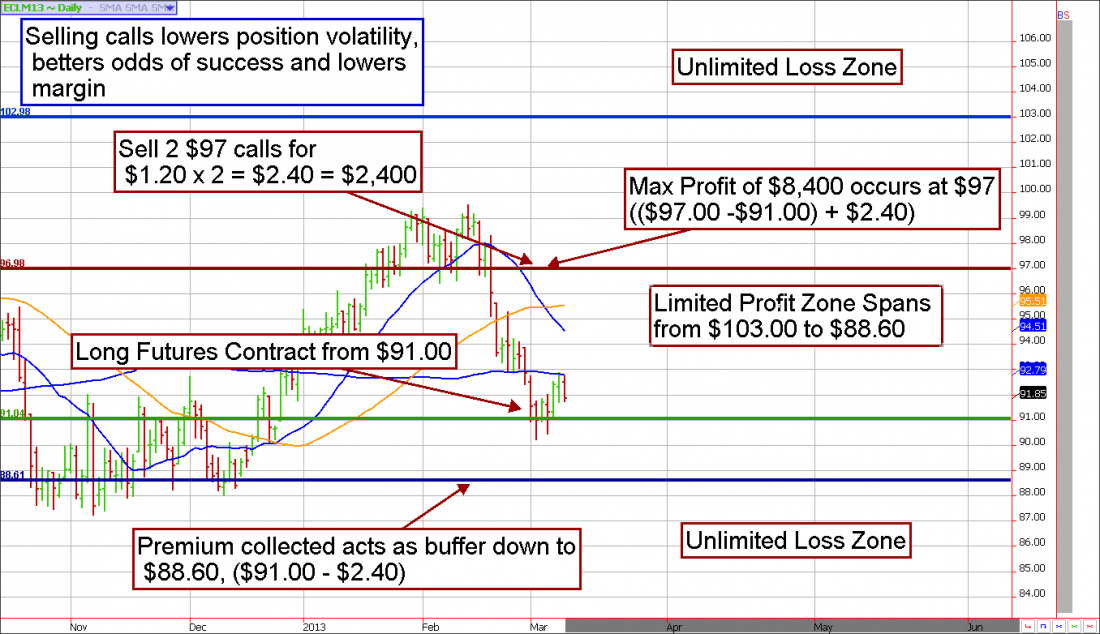

Typically, a regular exchange traded option can be one of the most versatile financial instruments that individuals can use to offset their potential risk. Most options strategies that protect against certain risks can be completed through the use of more than one option. Different strategies can include covered calls, which can protect against small price movements by giving the seller the proceeds. Option buying can be combined with other strategies in order to effectively offset larger degrees of risk. While the act of buying is not the hedge itself, it can be a good way to become more familiar with the trading environment and to wait for conditions to become more familiar.

Much like options can be used in certain situations to help offset risk, futures can also provide individuals with a variety of different advantages. Because most of the underlying assets of futures contracts are larger, individual investors may want to become accustomed to options before moving forward with futures. However, as soon as personal comfort is established, individuals are encouraged to get used to futures in order to better offset market turmoil. In such turbulent conditions, investors will have the opportunity to neutralize systematic risks to their portfolios with the right futures investments. Investors may choose to engage in this over time so as to produce semi pure and pure alpha. In order to do this successfully, individuals should calculate their aggregate beta and multiply it by the capital.

Hedge funds can be another extremely good way to help offset risk. While they have a somewhat notorious reputation among investors, they can be very useful in certain situations. When a certain investor or institution has a particularly large number of assets, they become preoccupied with the inherent risks of such an accumulation. With hedge funds, however, individuals will be able to move forward with market neutral funds and help eliminate systemic risks. Most market neutral funds, by nature, will constantly try to achieve returns that are made up of pure alpha. By looking into the aforementioned ways to offset risk with options, futures and hedge funds, individuals can expect to be met with much more success during their trades, without having to worry so much about potential risks.