Learning the Forex Trading Terminology

Post on: 4 Июль, 2015 No Comment

Although trading on the Forex Market is easy, it is essential to understand Forex terminology to become a proficient currency trader. If you already know basic stock trading terminology you will be familiar with Forex vocabulary.

We will look at some of the key terms you will use in various situations while trading on the Forex Market.

Selecting the Correct Broker

As with stock trading, brokers do the actual deals in the Forex Market based on instructions you give to them. You will have to hire a broker while using Forex and there are hundreds to choose from. They all offer deals for traders and the majority of them offer commission free trades. However, you should carefully read any agreement before signing it to make sure there are no hidden costs involved in the trades.

To understand how these brokers make their money, you will need to know about spreads and we will cover what spreads are later in this article. For now, it is enough to know that the smaller the spread, the better for you, which means you should research a broker that you are looking hire and make sure they have a small spread.

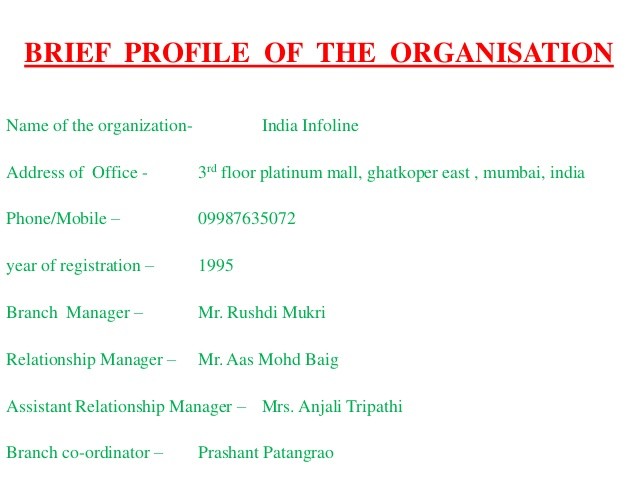

You should also look for a well-established and reputable broker that has good relationships with major banks and/or financial institutions and has status as a Futures Commission Merchant (FCM).

Position

When you are ready to do business on the Forex Market, you grab a position. which is the act of performing an open trade on the Forex Market. Every time you grab a position on the Forex Market, it is basically like announcing your intention to do business either buying or selling a currency pair.

Currency Pairs

Currencies in the Forex Market are always expressed in pairs. A currency pair is the value of one currency relative to the value of another currency. The currency that is used as the reference is called the counter currency or quote currency and the currency that is quoted in relation is called the base currency or transaction currency.

For example, the Canadian Dollar and the American Dollar is a common currency pair, expressed as; USD/CAD. In that currency pair, the USD is the base currency and the CAD is the quote currency.

Long & Short

In the Forex (foreign exchange) Market, you are trying to make profit by buying and selling money.When you purchase a currency and you expect it to increase in value, that is called going long.

In contrast, when you buy currencies and you go short, you want the currency to decrease in value because the more it decreases, the more money you make. You could view more information about Going Long and Going Short .

Bid and Offer Prices

When looking at prices of currency pairs, you will actually see two numbers. The first number is the Bid Price and it is the price that a broker wants to purchase the pair for.

The second number is the Offer (or Ask) Price, and it is the price that the broker wants to sell the pair for.

The bid price will always be lower then the offer price. For example, in the currency pair USD/CAD = 1.2000/05. the Bid Price = 1.2000 and the Offer Price = 1.2005. If you wanted to purchase this currency pair, you would look at the Offer Price to see how many Canadian dollars the market will charge for U.S. dollars. According to the Offer Price, you can buy one U.S. dollar with 1.2005 Canadian dollars.

To sell this currency pair, you would look at the bid price. It tells you that the market will buy US$1 base currency for a price equivalent to 1.2000 Canadian dollars.

Spread and PIPs

A Spread is the difference between PIPs in the Bid and Offer price in currencies. And a PIP is the measurement of the price change in a currency pair trading on the Forex Market. For example, the spread between the currency pair USD/CAD = 1.2000/05 is 5 PIPs because the bid price is 1.2000 and the offer price is 1.2005.

Because most currency pairs are quoted to the 4th decimal place, a PIP usually equals 1/100th of 1%. However, remember that not all currency pairs are quoted to the 4th decimal place. The USD/JPY currency pair is usually only quoted to the second decimal place, for example.

Forex brokers earn money from the spreads so for you, it is more beneficial for the spread to be smaller in PIPs. Spreads are different amongst different brokers in the Forex market so shop around amongst the various brokers to find a good deal.

Bull and Bear Markets

These two animalistic words are used to describe the general state of a market. A bull market is when the general market goes upward and a bear market is when the general market moves downward.

Order Types

An Order is the act of Buying or Selling in the Forex Market. There are many types of orders for different trading scenarios and as you become increasingly comfortable with trading on the Forex Market, youll get to know what order types are more relevant and efficient for you.

- Market Order This is an order where a Trader buys or sells at the current price.

- Limit Order This is an order where the Trader is able to specify at the beginning of the position the exact price at which he or she would buy or sell. This type of order allows a Trader to buy below the market price or sell above the market price.

- Stop-Loss Order With this type of order, you are able to prevent additional losses if the market is going against you. For example, if you decide to go long on a NZD/USD pair at .8567, and the New Zealand Dollar starts to lose value, you can set your stop-loss order to .8547 to prevent a catastrophic loss. Your loss would be minimal at 20 PIPs.

- Stop-Entry Order This type of order is used when you see a currency going up and you want to purchase it when it hits a certain price. For example, if you see a trading price for the currency pair of NZD/USD at .8565 and its heading up and you believe the price will continue to rise, you can place a Stop-Entry Order so that it automatically purchases this pair at .8570 if it hits that point. You are also able to make this purchase manually when it hits .8570 if you choose.

- Good Till Cancel (GTC) Order This is an order that remains active until you decide to cancel it.

- Good for the Day (GFD) Order This order type remains active in the market until the end of the trading day in your region. While the Forex Market is a 24/7 worldwide, each region has set hours when the market is considered open in that region.

For example, the hours in Eastern Standard Time are 8 a.m. to 5 p.m. so if you lived in New York and you set a GFD order, it would remain active until 5 p.m. EST. Its important for you to confer with your own broker so you both agree as to what time constitutes the end of the trading day, as each platform could have their own separate guidelines that they follow.

To be successful in the Forex Market, make sure you memorize and understand the terminology provided above. Study all the order types in-depth so you get used to them and know when the best time is to use each one.

And dont forget to do additional research using our reference points above in order to make a solid and comfortable decision with your choice of broker. It will be worth your while to research potential brokers well. Once you get used to trading on the Forex Market and get used to the terminology, it is extremely easy.