Journal of Asset Management Aftermarket performance of industrial American Depository Receipts

Post on: 16 Март, 2015 No Comment

Journal of Asset Management (2007) 8, 259266. doi:10.1057/palgrave.jam.2250080

After-market performance of industrial American Depository Receipts: Does level of issue and market timing affect returns?

Mark Schaub 1

Correspondence: Mark Schaub, Northwestern State University, College of Business, 201 Russell Hall, Natchitoches, Louisiana 71497, USA. Tel. +1 318 357 5704; Fax: +1 318 357 5990; E-mail: schaubm@nsula.edu

1 is the Hibernia National Bank Endowed Associate Professor of Finance at Northwestern State University of Louisiana.

Received 11 January 2007; Revised 11 January 2007.

Abstract

In this study, I examine New York Stock Exchange-listed American Depository Receipts (ADRs) from industrial firms to determine overall short- and long-term investment performance and whether the level of issue (emerging versus developed) or timing of issue (before or during the US bear market) affects ADR performance relative to the S&P 500. Early performance results suggest a slight underperformance by the industrial portfolio; however, emerging issues significantly underperform the market index while developed issues outperform the S&P 500 during the first month of trading. After three years of trading in the US markets, industrial ADRs return roughly the same as the S&P 500; however, emerging issues underperform developed issues and ADRs listed before 1/1/98 drastically underperform the market index while those listed after 1/1/98 substantially outperform the market. These results provide evidence that level of issue and timing of issue affect portfolio returns when investing in industrial ADRs.

Introduction

Industrial companies represent the backbone of the productive capacity of an economy. These include firms that produce and/or provide industrial equipment, chemicals, services and transportation. Most are large-cap, financially sound companies. Of the foreign industrial firms traded as American Depository Receipts (ADRs) on the New York Stock Exchange (NYSE), 36 new equities were listed from 1st January, 1990 through 31st December, 2002. But how did these firms’ equities perform relative to the S&P 500 index in the early and long-term investment horizons? Also, does performance differ for emerging market industrial ADRs than for those issued in developed markets? Does market timing relative to the US bull and bear markets make a difference in long-term performance? In this study, I seek to answer these questions by examining the performance of the industrial ADR portfolio relative to the S&P 500 index. Performance measures are also segmented to capture differences based on level of issue and timing of issue. This paper is organised with sections reviewing the literature, describing the sample and methodology, presenting the results of the analysis and concluding the study.

Literature review

ADRs were created by the firm of J.P. Morgan in an effort to allow US investors to take positions in foreign equities without having to deal with foreign exchanges and currency markets. Essentially, a large bank buys shares of foreign stock and bundles them until their translated price into US dollars closely resembles the average stock prices of US equities. A receipt is issued against the packaged shares and is traded like a share of stock on US exchanges and in the over-the-counter market. Essentially, the investor in an ADR is taking a direct position in the company and an indirect position in foreign exchange (as changes in the exchange rate affect translated values). But just as Jiang (1998) and Officer and Hoffmeister (1988) found taking a position in ADRs provides US investors with international diversification benefits, Choi and Kim (2000) also found that including ADRs from several different countries reduces much of the exchange rate risk.

Previous studies examine ADR performance in the short- and long-term investment horizons. While Callaghan et al. (1999) found that ADRs outperformed the market index in both investment horizons, Foerster and Karolyi (2000) found the opposite effect. Schaub (2003) suggests that no significant difference in performance occurred in the short run but ADRs underperformed in the long run. Obviously, the sample sizes, dates and composition were different for all three studies explaining the difference in the findings. Schaub and McManis (2007) report that the average ADR three-year holding period returns for those listed on the NYSE from 1990 through 2002 are 23 per cent lower than the S&P 500 index return. They found that issues listed after 1997 performed better than those listed before 1998, developed ADRs outperformed emerging ADRs and European ADRs outperformed both Latin American and Asia Pacific ADRs. The two most significant determinants of ADR performance were US market index movements and exchange rate movements for the 304 ADRs included in the sample.

Studies involving the long-term effects of market timing on ADRs include Schaub (2004). who found that Asia Pacific ADRs exhibited a huge market-timing-related difference in performance while European ADRs showed little evidence of the same. Schaub and McManis (2007) report average ADR holding period excess returns by year that suggest ADRs listed from 1990 through 1998 underperformed the market index, except in the year 1991. Afterwards, ADRs listed from 1999 to 2002 all outperformed the market index on average. Apparently, the long-run performance of ADRs suggests that when the US market is correcting, ADRs do well and vice versa. Therefore, ADRs provide great diversification benefits for US portfolios.

Still other studies have analysed the performance of ADRs based on industry of issue. Schaub and Casey (2002) and Schaub et al. (2004) examine ADR return behaviour in the oil and gas industry. Schaub (2005) examined ADR performance in the telecom industry, while Elliott and Schaub (2006a. 2006b ) examined ADR excess performance in the banking and financial services industries as well as for foreign food and beverage firms. Along those lines, this study investigates the excess return performance of industrial ADRs relative to the S&P 500 and also examines the impact of level of issue and market timing on such performance.

Methods and analysis

The sample of industrial ADRs used in this study was obtained and segmented based on a listing of foreign firms traded on the NYSE as retrieved from their website. These include a total of 36 ADRs listed from 1st January, 1990 through 31st December, 2002. Table 1 describes and segments the sample into emerging versus developed issues and shows the timing of listing for the ADRs.

The methodology for computing ADR returns, market returns, excess returns and testing of the returns can be found in Schaub (2003). These methods are considered to be the standard for studies involving ADR excess return performance. Daily and monthly returns for each security were computed and adjusted by the returns of the S&P 500 for the first 21 days after listing (short term) and the first 36 months after listing (long term). Excess returns were cumulated on a daily and monthly basis and tested for significance. I computed excess returns by subtracting the returns of the S&P 500 index from that of each ADR.

Equations 1. 2 and 3 mathematically describe the procedures for computing excess returns and cumulative returns for statistical testing. Equation (1) shows the excess return for each security i on day/month, t (xr it ) is the difference between the return of the security on day/month t (r it ) and the return of the market on day/month t (r mt ).

In Equation (2). the average excess return for the sample on day/month t (XR t ) is computed as the mean of the sum of the excess returns of each of the n securities on day/month t .

Equation (3) shows that cumulative excess returns as of day/month s are the summation of mean excess returns starting at day/month 1 until day/month s. where s ends on day 21 and month 36, respectively.

Mean excess returns and cumulative excess returns are tested to determine significance using a Z -score. I report the p -values used to determine significance for the entire sample and each sub-sample.

Results

In Table 2. the short-term results for the first 21 days of trading of industrial ADRs listed on the NYSE are reported. The entire sample of 36 ADRs lost nearly 1 per cent relative to the S&P 500 on the first day of trading. Throughout the month, the cumulative loss got to as high as 4.25 per cent relative to the market on the 12th day of trading, but ended the 21-day period with a non-significant average underperformance of 1.28 per cent.

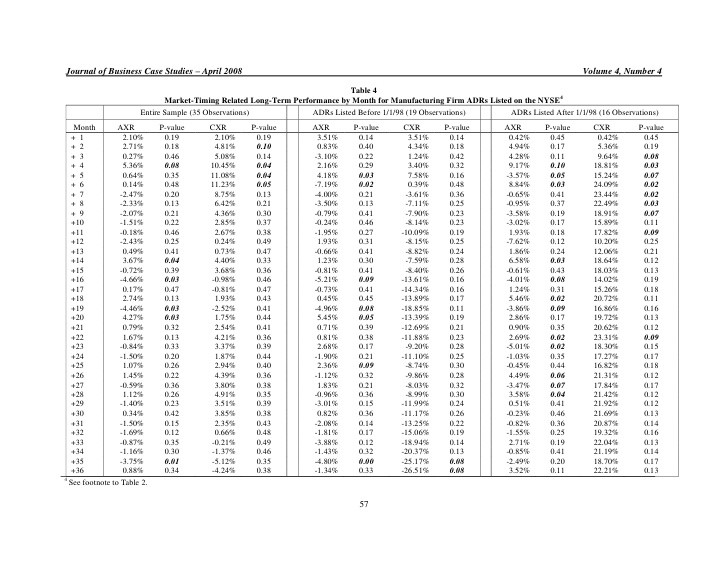

Tables 3 and 4 report the long-term performance of industrial ADRs relative to the S&P 500. In Table 3. the results for the entire sample, the emerging sample and developed industrial ADRs are compared. The overall sample encountered no early significant performance but had suffered a nearly 16 per cent significant underperformance relative to the market by the 19th month of trading. After the first three years were over, however, the entire sample had returned roughly the same as the market, outperforming the S&P 500 by only 2.55 per cent on average.