Is fracking affecting natural gas prices

Post on: 14 Май, 2015 No Comment

IM investigates how shale gas exploration has affected energy prices in the US, Europe

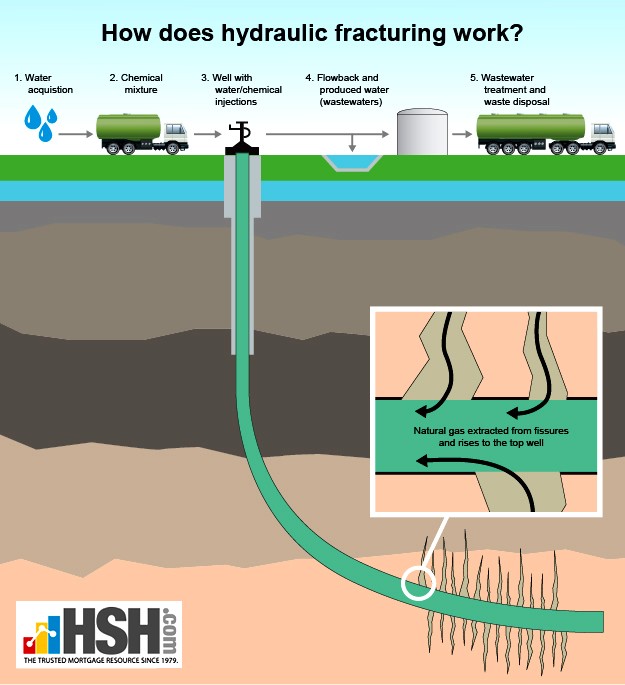

Since the US hydraulic fracturing (fracking) boom took hold in earnest in 2010, much focus has been placed on the price of natural gas, and how this new, unconventional supply, would affect the overall energy market.

Three years on, and US gas prices appear to be in freefall.

Fracking is an important end market for industrial minerals including silica sand (frac sand), bauxite and kaolin, which are used as proppant materials and bentonite, barite and others, which function as lubricants and weighting agents in drilling muds.

There are several points of reference for gas markets in the US, but the most commonly quoted is the Henry hub, which is a distribution hub on the natural gas pipeline system in Louisiana.

The US crude oil benchmark price is WTI (West Texas Intermediate) and is traded on Nymex, the commodities futures exchange.

According to data from the US Energy Information Administration (EIA), which tracks the Henry Hub, the increased amount of fracking activity has driven prices consistently below the $5/MMBtu since the beginning of 2010.

Between 2000 and 2009, natural gas prices fluctuated from spikes as high as $18.48/MMBtu in February 2003, settling down to an average of around $4/MMBtu in 2009.

Back then, before shale gas came on stream, the price of natural gas was closely linked to the price of oil, as both energy sources were tapped from the same fields.

20ring.jpg /%

US gas prices appear to be in freefall as a new supply of unconventional gas shifts the market.

Source: BAMCorp

A good example of this link between increased oil and gas prices is the market activity seen in 2008, when rising production costs caused oil prices to shift beyond the $100/bbl, which in turn hiked gas prices.

“The first six months of 2008 saw the continuation of the previous years’ increases in oil prices, spurred by rising demand that was satisfied by relatively high-cost exploration and production projects, such as those in ultra-deep water and oil sands, at a time when shortages in everything from skilled labour to steel were driving up costs of even the most basic production projects,” explained the EIA.

“An apparent lack of demand response to high prices in developing countries (. ) led to expectations of continuing high oil prices and the bidding up of prices for the inputs needed to increase supply, such as labour, drilling rigs, and other factors. Given the apparent lack of consumer response to price increases, lags in increasing supply, and the limited availability of light crude oils, some analysts believed that a price of $200/bbl was plausible in the near term,” it added.

Now, a plentiful supply of natural gas has entered the market from shale formations, which use the hydraulic fracturing technique to extract the gas, meaning new areas can be tapped and the two commodities are no longer linked.

Gas prices have begun to flatten as a result of this disconnect (see graphs ), remaining more in the region of $3-4/MMBtu over the past 18 months or so.

More recent US figures seen by IM for the end of July and beginning of August show that this trend is continuing, despite the fact that rig count numbers have dropped year-on-year.

Effect on producers

The drop in natural gas prices will be music to the ears of US politicians and residents, as it means the overall cost of energy will be cheaper while carbon emissions drop as a result of an increased use of shale gas in place of coal.

However, this is not such good news for the producers, which are fighting hard to reduce investor fears over the long-term impact of shale gas on prices. Their end goal is to maximise returns on the way they drill – and fracking isn’t cheap.

One of the biggest areas being tapped in the US is the Marcellus Shale formation, which is a prime location for both horizontal drilling and hydraulic fracturing operations.

Here, natural gas prices have been falling consistently since gas production at the Marcellus shale began in 2009. Back then, prices were around $4/mBtu. Now, prices sit around the $3.30/MMBtu mark.

This begs the question, why would producers continue to drill here if prices are so low?

The answer to this lies in two areas: the sheer size of the formation, and consequentially the amount of gas that can be extracted over an extended period of time; and the fact that liquids, such as propane and ethane, that are extracted as by-products can be sold at much higher prices.

The relatively low cost of drilling in one large region has also attracted gas companies.

Just last week the EIA more than doubled its reserve estimate for Marcellus to 31.9 trillion cubic feet. This is nearly a quarter of total US shale gas reserves.

Vikas Dwivedi, an energy analyst with Macquarie, told the Financial Times that the Marcellus shale formation is producing so well that it has “almost single-handedly been making up for the small declines everywhere else in the country”.

Discounts on gas have also been offered at Marcellus due to the infrastructure restrictions the region presents.

According to the FT a Pennsylvania trading hub called TGP Zone 4-Marcellus sold gas for as little as $1/MMBtu for this reason. However, this price is thought to be an anomaly.

Price decreases are expected to filter into the rest of the country as fracking activity spreads, with Marcellus gas potentially finding its way to Henry hub.

20gas.jpg /%