Investment outsourcing Wikipedia the free encyclopedia

Post on: 16 Март, 2015 No Comment

Investment outsourcing is the process whereby institutional investors and high-net-worth families engage a third party to manage all or a portion of their investment portfolio. This arrangement can include functions such as establishing the asset allocation. selecting investment managers, implementing portfolio decisions (both strategic and tactical), providing on-going oversight, performing risk management and other areas of portfolio management.

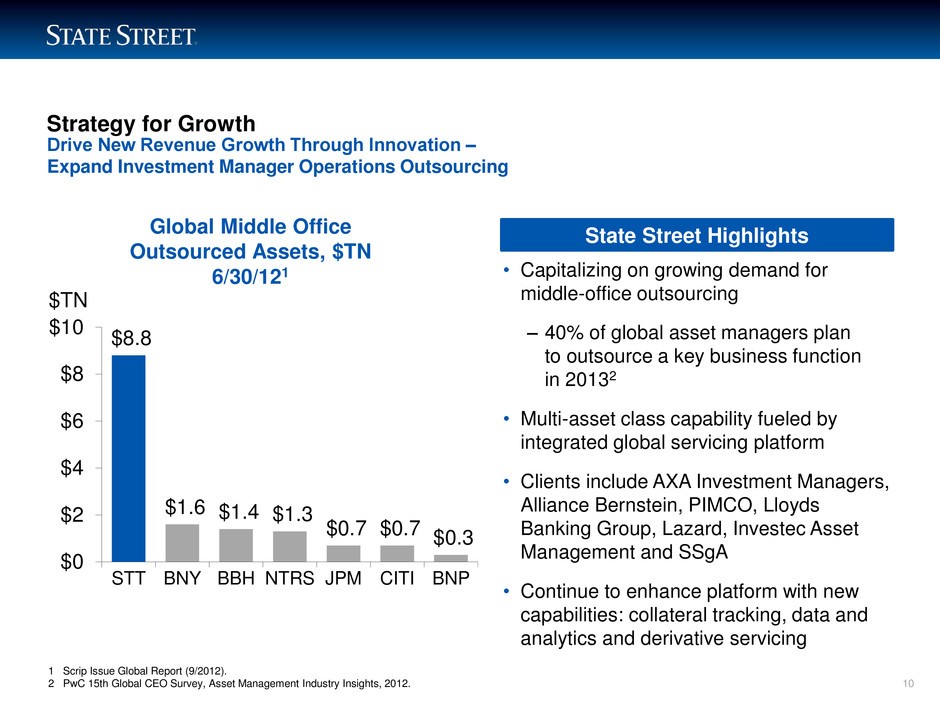

Outsourced investment management is a large and growing market segment with over half a trillion dollars currently managed by outsourced managers. [ 1 ] [ 2 ] According to a survey of outsourcers by aiCIO magazine, the volume of outsourced assets increased 200% between 2007 and 2011. [ 3 ]

The outsourcing trend began with smaller institutions that could not or did not want to build an internal investment team. According to a study by the Family Wealth Alliance, approximately four in ten wealthy families have outsourced discretionary investment authority. The trend is even clearer among families with less than $500 million in assets where two-thirds have outsourced management. [ 4 ] Similarly, just 11% of college endowments between $100 and $500 million internally manage their portfolios and instead rely on outsourced managers. [ 5 ] Increasingly, however, it is not just small investors seeking to outsource. There has been a marked increase in the number of multibillion outsourcing engagements since the 2008 financial crisis as firms grapple with increasing complexity and the need for better risk management. [ 6 ]

Investment outsourcing goes by many names including fiduciary management, “outsourced chief investment officer”, “outsourced CIO,” “OCIO,”, “CIO in a box,” and “implemented consulting.”

Contents

§ Outsourcing Models [ edit ]

§ Background [ edit ]

Jonathan Hirtle. Chief Executive Officer for Hirtle, Callaghan & Co. [ 7 ] pioneered the outsourced Chief Investment Officer (OCIO) model, which serves family groups and organizations that do not employ fully staffed investment departments. [ 8 ] [ 9 ] For his OCIO innovations, Hirtle has been dubbed the “Oracle of Outsource .” [ 10 ]

§ Current OCIO models [ edit ]

The model by which outsourced CIOs service clients is still evolving in this nascent business. The most common model is to outsource all decision making including asset allocation, manager selection and monitoring. The OCIO reports back to the client but the burden is largely lifted from the client and placed on the new provider. Among OCIOs utilizing this approach, there is a “continuum of outsourcing approaches and providers: manager-of-manager programs; funds-of-funds; former CIOs offering a diversified model portfolio.” [ 11 ] The common thread amongst these approaches is the use of commingled funds or model portfolios which creates economies of scale for the OCIO.

A different model is pursued by a small subset of the OCIO universe. The members of this group work alongside the client’s staff – not as a replacement to them. According to investment industry newsletter FundFire, “An increasing number of CIOs see outsourcing not as a threat to their job, but as a source of complementary expertise and advice, as well as investment opportunities.” Like much of the nomenclature around the OCIO business, this more customized, bespoke solution does not yet have a widely recognized name. Fiduciary Research (FRC), an OCIO who oversees about $9 billion on behalf of a small list of pension fund clients, calls itself an iCIO for integrated chief investment office. [ 12 ]

§ Fees [ edit ]

The fees charged by outsourced managers vary widely based upon a number of factors but are generally between 30 and 100 bps with some firms also charging an incentive fee in addition to their base management fee. [ 13 ] [ 14 ] [ 15 ] In a panel discussion organized by CIO magazine, representatives for three different firms discussing the rise in investment outsourcing gave ranges of between 25 and 65 bps with some of the difference explained by the use of internal or proprietary funds or a purely open-architecture approach. [ 16 ] In some quarters discontent has been voiced about investment outsourcing firms which allocate client capital to proprietary products charging a second layer of fees. [ 17 ]

§ Investment Outsourcers By Assets [ edit ]

The next two tables use data from Charles Skorina & Company’s “Ultimate Outsourcer’s List” and is divided into two categories: 1) outsourcers who advise on a diverse set of mandates including pensions, non-profits and family trusts and 2) university endowment-style outsource managers. [ 18 ] The list curated by Skorina & Company is more expansive than the other most commonly referenced list prepared by Pensions & Investments (P&I). The P&I list counts only the top 25 and is available only to paid subscribers.