Investing In Volatility With Equity Options

Post on: 11 Апрель, 2015 No Comment

When taking a position in volatility with the purpose of diversifying a portfolio of investments one must decide whether to buy a portfolio of delta hedged options on single stocks and indices, stick to a more passive strategy and only keep a portfolio of delta hedged index options, buy a variance swap, or to buy products or derivatives on a volatility index such as VIX. It is increasingly popular to invest in exchange listed products tracking the VIX index and to buy futures or options on the VIX-index. The main advantage of many listed volatility products is their accessibility, but normally, the best way to get the results you want is through a dynamically hedged portfolio of single stock options. Volatility investing has attracted a lot of criticism, partly as a consequence of the nature of volatility, but also because of the draw-backs of many widely used vehicles for volatility investing. There are, however, ways of mitigating these drawbacks and maintaining a long volatility position over time without cost of carry. A portfolio that can draw the full advantage of the diversifying effects of volatility will dramatically improve long term value growth, as big draw-downs are minimized or avoided all together.

VIX Futures and Variance Swaps

These instruments have the advantage of delivering constant gamma; this means that you do not need to delta hedge your position, and your volatility exposure will be almost constant no matter the level of the underlying equity index. However, some of the characteristics of both the VIX future and the Variance swap makes them both more suitable for short volatility positions than for long.

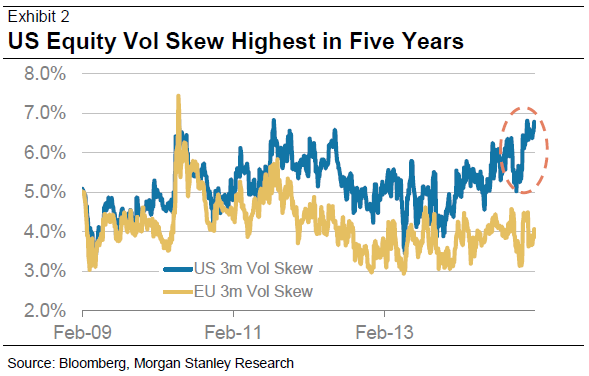

The risk premium is by default high for these products as the theoretical price of a variance swap (and VIX) is calculated from the prices of a portfolio of options representing the whole volatility surface. The variance swap strike can be thought of as a weighted average of the underlying options’ implied volatilities. Normally there is a skew present in the underlying options, meaning that the average implied volatility will be higher than the ATM volatilities of the index. The skew is normally steeper on the downside strikes than on the upside, and the downside will weight more in the final price.

As volatility swaps are hard to replicate, the liquid market is for variance swaps. Variance swaps also have a convex pay-out; this convexity has a value for the buyer and therefore also a price. So in short for a Variance swap you will pay the ATM option risk premium, pay for a steep skew if there is one and on top of that pay for convexity. Of these reasons, the Variance-swap will on average be traded at a significantly higher price than realized volatility — which might be fine for occasional timed hedges against market turmoil, but for a continuous, long volatility-position you are better off managing your own portfolio of plain vanilla options.

The nice thing about being short these instruments is that you are short vega, but not gamma and will not be hurt by the gamma in the event of a gap in the market. Being short will also on average give you an edge in form of the risk premium.

Preferred strategies for short vega should include systematic selling of vega at big spikes in market volatility done in a manner where one can withstand prolonged periods of high volatility. The option risk premium for most index options has been consistent since 1987, and amounted to an average of almost five volatility points; since 1990, the average of the VIX-index have been 20.5, while the average realized volatility has been 15.8. In only a handful of events over this 21 year period, the volatility has been significantly over what was predicted by VIX. Even counting these events, the premium to be earned over time is significant.

Another good use of short volatility is in a volatility dispersion strategy, where variance swaps might be considered as an alternative to delta hedged options.

It is easier to construct a model that find good opportunities to go long volatility than to sell short. The downside has a definitive floor at zero, but in practice, it is unlikely that we ever get to see index implied volatility underneath eight or nine for any sustained period without a significant change in the rules and function of the market. The upside is as we know harder to pinpoint.

A more conservative option than systematically shorting volatility on spikes could be to simply close your long option positions in these instances. There should be good bid in most options on these spikes making it easy to close any position. If you believe that volatility could rally even further, an alternative might be to sell a variance swap or VIX futures instead as you then would be vega neutral but still be long gamma.

Another drawback with VIX is that the VIX-index in itself is not investable, so you need to buy the VIX-future. The future, however, does not behave in an intuitive way for a non-expert. The price of the future is determined by where the market believes the VIX index will be at expiration which takes place 30 calendar days before the expiry of underlying SPX options. The expiration process in itself is complex, and only experienced expiration traders should trade the future the last days before expiration. This means that a VIX-future with expiry in August might not follow a rising VIX-index in June, if traders believes that the index will have the time to fall back again after the reporting season and before the expiry.

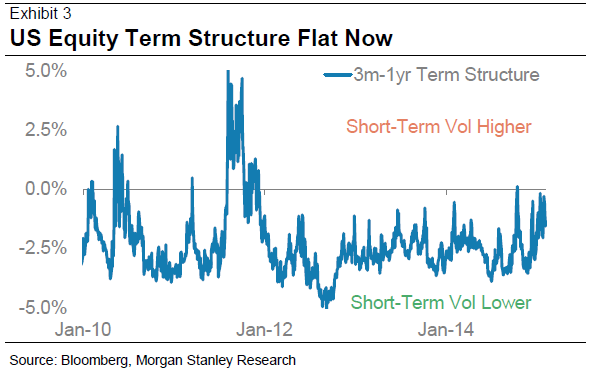

In order to establish and maintain an exposure to the VIX-index you need to hold futures of two expiration months, and reweigh continuously in order to maintain a 30-calendar day IV exposure. This reweighing activity will earn or lose the difference in price between the front and back end future, which will depend on the implied volatility term structure.

Understanding that the VIX future is priced on the expectations on the whereabouts of the VIX index a specific date in the future helps you to understand some of the futures characteristics.

The VIX derivatives relation to the underlying S&P 500 derivatives will affect the price of the futures as it affects the market makers’ ability to replicate or hedge their positions. Say that most investors of the VIX future are buyers, then market makers will be net-sellers. In order to hedge the short vega positions, the market makers must net buy volatility in the underlying market. This means they will be buyers of SPX options, options that they must dynamically hedge with SPX futures in order to be vega long and delta neutral. If they want to hedge the vega prudently they will of course need to buy a lot of downside SPX options, due to the ever present skew they will in average pay a high implied volatility for these options, a volatility that is unlikely to be realized in the S&P 500 futures market, thus creating a cost of carry for the hedge. This cost must be forwarded to the VIX-futures market in order for the market maker not to lose money.

VIX options

VIX options sound like a great way to position yourself in market volatility and even in volatility on volatility.

In reality, you need to get a firm understanding of VIX options pricing and function before you start trading. The VIX index is the underlying asset, but as with the VIX-future it is the perceived value of the VIX-index at expiration that determines the value of the options. You should consider the VIX-future with the same expiration as the underlying asset. So the same implications as with the future apply, including a complex settlement process. If you are used to trading equity options, you must keep in mind that you need to find another model for valuing the volatility options. Models used for this purpose must capture the return distribution of the VIX-future that have mean reverting characteristics; models that assume a log-normal return distribution will not work. VIX-options appear to be priced with a significant risk premium similar to what is the case with equity index options. In volatility options, the implied volatility skew have a positive slope as the large return anomalies occurs on the upside.

The volatility of the VIX future is normally significantly less than the volatility of the VIX-index. One must also keep in mind that the mean reverting nature of VIX returns, and even more so in the VIX-futures volatility, can make entry and exit of positions a matter of volatility timing rather than only of finding a good entry point in the VIX index.

There is no question that there is a lot of trading opportunities in VIX derivatives, but in my view there are other better options for the average asset manager looking for robust volatility investments in order to increase portfolio diversification.

ETF and similar VIX-futures based products

For a professional investor, I see no reason to use most of these products as one normally only will end up paying someone else for managing a simple VIX future position. Leveraged products are too costly as you will pay for a daily leverage reweighing in the product, on top of the daily calendar reweighing that has to be made in order to maintain a constant 30 calendar days duration. If leverage is needed you should rather buy the VIX future on a margin, than pay for a ETF.

The frequent futures reweighing needed will contribute to a large tracking error between the ETF and the VIX, and the result is unpredictable, partly as a result of the roll market for the VIX-future, where the futures roll might be an income but most often is a cost as the longer maturity future normally is more expensive than the front month. There are some recent more sophisticated products that try to handle the downside of daily reweighing, and others offering exposure to alpha strategies that are worth a look.

When investing in ETFs or ETNs one should look for products that either successfully manage the cost associated with rolling between the shortest maturities of the VIX future or products with a successful alpha strategy. Managing the roll costs of VIX-futures normally means holding VIX futures with longer maturities, with an added alpha strategy for extra income. Even though some of these products looks promising, most are new and lack track-record so far.

Use a portfolio of equity options instead

My favored way of investing in volatility is to use only a mix of delta hedged equity options and equity index options. At most times you should be long volatility in a portfolio of single stock options and use index options to hedge residual volatility exposure. Only an investment universe of stock options will allow you to find good value implied volatility. You will be able to choose options in order to maximize protection for your asset portfolio mix with respect to factor risk, and have the best chance of avoiding to pay the risk premium often present in index options. This makes it possible to hold the volatility portfolio without cost of carry or even to earn a positive result over time. If you want to be more ambitious, you can then easily add alpha strategies on top of this portfolio and also take opportunities to gain from dispersion strategies when they arise.

If the rest of your assets consists of stock investments, then the approach that demands the smallest amount of work would be to maintain an option portfolio with underlying stocks that mimics the sector allocation of your main portfolio, and choose the options within each sector that provides the best value. All you need is a decent method for option screening and also a robust algorithm or method for the delta hedging of your options portfolio. Your delta hedging strategy will pay for loss of time value over time.

With an efficient option screening and delta hedging method, you can keep a long volatility position over time without any cost of carry or even with a positive edge, and have a powerful hedge against the rest of your portfolio when markets turn volatile.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.