Investing 101 Six Tips for Success

Post on: 24 Июнь, 2015 No Comment

There is much to understand to be a successful self directed investor these days. Investing in stocks may seem like a complicated process. However, people with sufficient interest, motivation, and guidance can make informed decisions about which stocks to buy or sell. This article can help you decide if you have the interest and motivation to be a self directed investor.

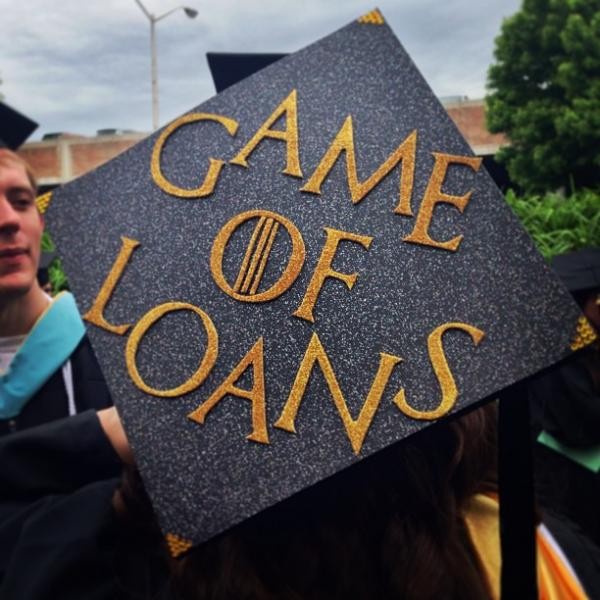

So how does a beginning investor get started without having to worry too much about making mistakes? The simple answer is learn. People spend tens of thousands of dollars and hundreds of hours going to college to study and prepare themselves for a career to support their families financially. Similarly, learning to be a successful self directed investor takes a lot of time and some savings.

1. Take Your Time

It is important to go slowly and be patient with yourself and your savings. Learn your lessons over time and you are less likely to make costly mistakes. And by all means, start small and don’t invest money you can’t afford to lose. Investors shouldn’t invest money they need to meet their monthly bills. Stocks go up and stocks go down and the road to riches is littered with stories of people who went bust and lost everything in the market. Thankfully the went bust anecdotes are the exception rather than the rule and lend a strong cautionary tale. This is why it is important to start small, diversify, and be patient as you develop and become a more astute investor.

As you become more comfortable with investing, you will feel more comfortable increasing your commitment of assets.

2. Learn How Markets Work

New investors need to understand how markets work. It doesn’t take a Ph.D. in economics or an MBA to get a fundamental understanding of markets. In the most basic form, markets are social processes where people voluntarily trade goods and services.

There are several types of markets available to self directed investors including stock markets (NYSE, Nasdaq), bond markets, futures markets, and currency markets. Stock markets facilitate the voluntary buying and selling of ownership in companies. Bond markets involve the buying and selling of debt obligations by companies and governments. Futures markets are used for the buying and selling of contracts regarding future delivery of goods, commodities, or financial paper. Foreign exchange markets are used for trading national currencies.

Learn how markets work. Pick a company and follow its share price action and news releases for a couple months. Read what analysts are saying about the company. The internet is a great place to get useful free information and articles. Price quotes, company news releases, analytical articles, and educational reports are all available for free at Self Directed Investor. There are additional sites with free content that can provide useful information on stocks like Yahoo Finance, Forbes, Seeking Alpha and others.

3. Understand Risk

There are several definitions of risk. The most common concept of risk for investors is the risk of losing capital. It is a simple concept and one that every investor can understand at a gut level. The second concept of risk used by professional investors refers to the volatility—either up or down—in the value of an asset. In statistical terms it is called standard deviation . In financial circles it is labeled beta . An investment returning between minus 10 percent and plus 50 percent over a period of time is considered more risky than one that returns between 2 percent and 10 percent over the same period. Time is also an important dimension. Over time, the effect of risk generally decreases for most equities as volatility is smoothed out along an upward trend line.

One of the least considered aspects of risk for new self directed investors is risk tolerance . Everyone has a different emotional risk tolerance. Some people are more comfortable taking positions in speculative companies like junior gold miners or biotechnology stocks. Others prefer more conservative blue chip companies with a long track record of slow and steady earnings/dividend growth. Emotional risk tolerance differs among individuals and there is no right or wrong risk tolerance level. But it is important to know where you are emotionally along the risk tolerance spectrum and to invest accordingly.

4. Understand Investing vs. Trading

Investing should not be confused with trading. Both involve the purchase of an asset in the hope it will grow in value, but that is where the similarities end. The biggest difference between investing and trading is in goal setting and time preference. Trading seeks to profit (goal) from the short-run (time preference) buying and selling of an asset. Positions are opened and closed within the same day (intraday) or over a few days months (swing trading or position trading).

Investing requires a long-run perspective (time preference) with an objective in mind like paying for an education, a wedding, or providing income for retirement (goals).

In practice, the lines between investing and trading are becoming blurred as self directed investors are increasingly using trading techniques in the wake of the market meltdown of 2008-2009. Buy and hold has lost its appeal. In many ways, investing is morphing into day-trading as investors more quickly book profits and cut losses.

5. Join an Investment or Trading Group

Join a community or online investment or trading discussion group. There is nothing more valuable than receiving critical feedback from others on your investing ideas. Every investor knows different things and you can use the expertise or knowledge of others to help you make decisions about your investments. For example, some investors know a lot about specific companies. Other investors understand the economic cycle of investments and the sectors most likely to rise or fall in the near future. All of this information can help you be a better investor.

Discussion groups can also provide emotional support during periods of market uncertainty.

My favorite online investment discussion group is subscription-based ValueForum .com. with over one thousand members and several hundred active members. There is a fee to become a member of ValueForum. The fee is sufficient to keep out charlatans and stock pumpers, but reasonable given the number of experienced and talented self directed investors who post their best ideas several times a day. There is something for everyone at ValueForum with over 125 discussion topics, 1,170 members, a stock ratings system, shared portfolios, and other very useful online collaboration tools. The site has a 7 days for $7 promotion for those wanting a trial period without making a longer term commitment.

6. Beware of Get Rich Quick Schemes

A common mistake made by new self directed investors is acting on sales pitches by hypsters with the secret system for making a million dollars overnight. If it sounds too good to be true, it is too good to be true. Yet, new investors are regularly lured into false promises of easy money. Stay away from the pitches that guarantee quick wealth.

Dont get me wrong, there are plenty of successful stock newsletters and trading instructors who have perfected a trading system or are talented at picking stocks. Some are willing to teach you their methods, but you should always take the time to learn what you are getting into before making any financial commitments.

These are just a few basic suggestions for new self directed investors. Remember, no single investment approach is a foolproof recipe for making money in the markets. And not every investment, trade, or strategy produces positive returns. But it is important to remember that learning the basics about markets and knowing your goals and risk tolerance are the first steps to becoming a successful self directed investor.