Inverse and Leveraged ETFs

Post on: 24 Апрель, 2015 No Comment

by Cara Scatizzi

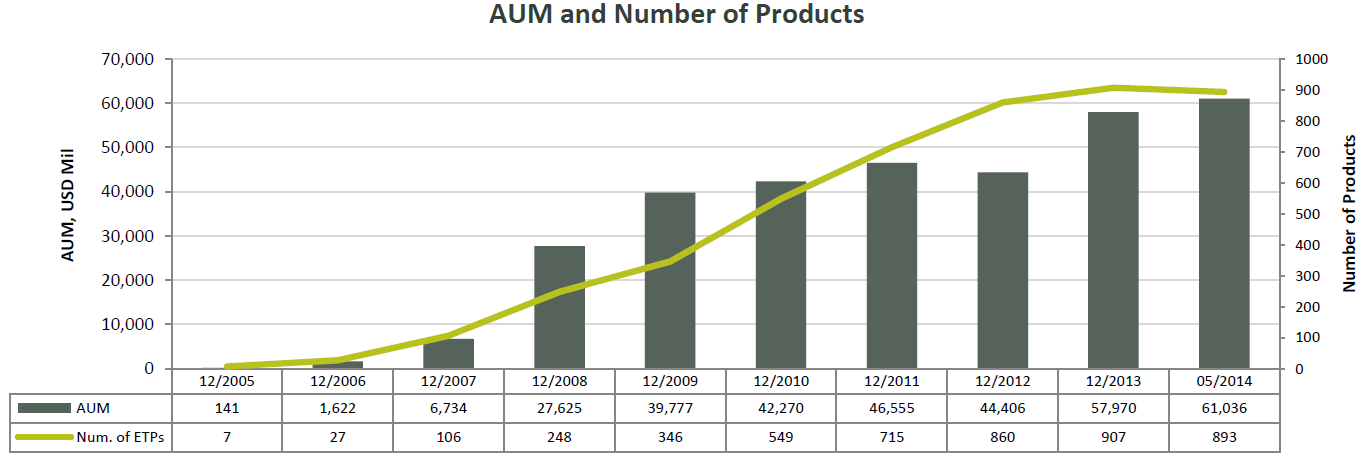

As exchange-traded funds (ETFs) have grown in popularity, the types of ETFs have grown as well.

In addition to traditional ETFs that track well-known stock market indexes and ETFs designed to track the movements of a specific sector, investors have the option to invest in inverse ETFs, leveraged ETFs, or even inverse leveraged ETFs.

How It Works

Leveraged and inverse ETFs use a variety of investment strategiesincluding the use of futures contracts, short selling, buying put options, and employing other strategies of leveragethat are designed to either magnify the performance of the index the ETF is designed to track, or perform in the reverse direction of the underlying index.

An inverse ETF increases in net asset value as the underlying assets decrease in value, and vice versa.

Leveraged ETFs are designed to return twice or more of the underlying index value.

There are also inverse ETFs that provide leverage. This means that if the underlying index goes up, the value of the ETF moves down to an even greater degree, losing two or even three times as much, depending on the leverage. On the other hand, if the underlying index goes down, the value of the ETF goes up to an even greater degree.

While these ETFs sound like a great way to leverage the market or to bet against it, the mechanics of these investments are complicated. Leveraged and inverse ETFs use daily rebalancing. Behind the scenes, managers are constantly trading derivative securities in order to maintain the correct leverage and inverse relationship the ETF advertises. That means that these ETFs perform as advertised on a daily basis. But that performance does not necessarily translate into the advertised performance over the longer term. In other words, an inverse ETF will on a daily basis move in the opposite direction of its underlying index, but its longer-term performance will not necessarily be the mirror image of the long-term performance of the index.

Mechanics

Leverage

ETFs that use leverage typically include the word Ultra in their names. Typically, they will track two to three times the underlying index.

As stated before, the leveraged ETFs aim to deliver their stated multiple of the index return on a daily basis.

Lets look at an example. ETF ABC uses 200% leverage against index XYZ. An investor purchases one share of ABC at $50 while the index XYZ is at 1,000. The next day, index XYZ rises to 1,100, an increase of 10%, so shares of ABC should increase by 20% to $60.

Now, lets say index XYZ falls back to 1,000 the next day. This is a decline of 9.09%. The value of ABC will fall by twice that amount, or 18.18%, to $49.09. After two days, the index value is unchanged, but the share price of the ETF will have fallen 1.82% (from $50 to $49.09) due to the daily rebalancing.

The stated leverage essentially refers to an investor holding the ETF for one day, or if the index keeps moving in the same direction every single day. Any reversal in the index value will leave a leveraged ETF worse off than would be expected based on its stated leverage.

Inverse

Inverse funds are also priced on a daily basis, leading to similar issues as with leveraged ETFs.

Lets look at a similar example. An investor purchases an inverse ETF, ABC, for $40 per share. If the ETFs underlying index then falls from 1,000 to 900 in one day, that is a decline of 10%; shares of ABC would rise by 10% to $44. If the next day, the index rises back to 1,000, this is an increase of 11.11%, and the inverse ETF would fall by 11.11%, from $44 to $39.11 [$44 (1 0.1111)]. Over the two-day period, the index value started and ended at the same value, yet the ETFs value fell 2.22%.

Inverse and Leveraged

As expected, the inverse and leveraged ETFs have the same issues with daily rebalancingbut they are magnified.

These simple examples assume the ETF is exactly following the underlying index in the advertised manner. In reality, fund managers cannot exactly mimic the index, therefore the tracking error must be taken into account (the difference between the index tracked and the actual ETF value). Add fees and expenses, and the returns could be much lower.

Get full access to AAII.com, including our market-beating Model Stock Portfolio, currently outperforming the S&P 500 by 4-to-1. Plus 60 stock screens based on the winning strategies of legendary investors like Warren Start your trial now and get immediate access to our market-beating Model Stock Portfolio (beating the S&P 500 4-to-1) plus 60 stock screens based on the strategies of legendary investors like Warren Buffett and Benjamin Graham. PLUS get unbiased investor education with our award-winning AAII Journal. our comprehensive ETF Guide and more – FREE for 30 days

How to Invest

You can invest in inverse and leveraged ETFs through the ETF fund sponsor or through your brokerage firm.

Investor Suitability

Inverse and leveraged ETFs are not suited for most investors. They are highly risky and extremely volatile.

For an investor to consider such investments, they should comprise only a small portion of a well-diversified portfolio.

Inverse and leveraged ETFs are generally geared toward short-term traders rather than long-term, buy-and-hold investors.

Tax Implications

The tax implications on these specialty ETFs are complicated and might require the help of a tax professional.

In order to magnify returns, leveraged ETFs might use swaps and futures, which disqualifies ETFs from the traditional in-kind redemption process that has given ETFs a reputation of tax efficiency.

The Pros

Simple to Buy

For investors with a high tolerance for risk and volatility, leveraged ETFs are an easy way to gain magnified exposure to the market on a daily basis.

Inverse ETFs allow for investors to bet against the market on a daily basis without having to make complicated trades using short sells, swaps, futures or options.

The Cons

High Risk

Inverse and leveraged ETFs are extremely risky. The daily rebalancing means the performance may not be what you would expect. As the examples showed, you may end up losing much more than you bargained for.

Complex Tax Rules

Due to the nature of the investments that are made to maintain the advertised structure of the ETF, investors are subject to a different set of tax rules. While plain-vanilla ETFs are known for tax efficiency, inverse and leveraged ETFs may not have that same characteristic.

Additional Information

AAIIs ETF Guide

Each year, AAII publishes a Guide to ETFs. You can read this years guide by going to www.aaii.com/guides .