Introduction to Arbitrage Traders Log

Post on: 30 Май, 2015 No Comment

Posted By: TradersLog

By Elaine Kub

Making money’s easy when a market is rocketing skyward with consistent and appreciable gains. Or at least, it always seems like it was easy when you look back on it. And if your trading program is prepared to short sell financial instruments, making money can be just as easy when a market is collapsing. It’s the volatile times when a market’s tantrums aren’t predictable in one given direction, or the doldrums when a market seems to roll along in a flat line that seem to challenge a lot of traders. The ones who’ve developed programs to make money by being neither net long nor net short in a market can thrive in all these environments.

Ok, the easiest way to be neither long nor short in a market is just not to trade that market. But you won’t make any money that way. So the other way to accomplish a net neutral position is to be both long and short in the same market. You can be assured that one of the two positions will end up being a winner. And believe it or not, that’s why there are people who actually use this apparently befuddled strategy to become quite profitable: arbitrageurs.

An arbitrageur is a trader who uses arbitrage to profit on the differences between two similar assets within the same market. An arbitrage trade has two legs: one long in the market and one short in the same market, so by being both long and short in the same market, an arbitrageur doesn’t have to have a strong bullish or bearish inclination toward the market as a whole; he just has to believe his long position will gain relatively more value (or lose relatively less value) than his short position.

Developing the decision of which side to go long and which side to go short is the major trick to this strategy. Basically, a trader just has to identify one overpriced asset within a market and one underpriced asset, and then he simultaneously sells the overpriced one and buys the underpriced one. He profits when the over/underpriced situation corrects itself.

To find two assets to pair together for arbitrage may require you to redefine what you think of as a “market.” An easy example is grain futures, which trade the same underlying commodity but with different expiration dates. So for instance, an arbitrageur could buy September wheat futures and sell December wheat futures. Equity futures or equity index futures could be used for similar calendar-based arbitrage opportunities, but with equities themselves, you have to start thinking of entire sectors moving together to make an arbitrage opportunity work. For instance, within the energy sector, Exxon Mobil stock (XOM) may be overpriced in relation to BP (BP), so an arbitrageur would sell the former and buy the latter.

The reason arbitrage is such an attractive trading strategy is because it limits overall loss. Selling XOM and buying BP could result in losses to your portfolio on both trades if the XOM share price increases while the BP share price simultaneously decreases. However, because the two assets are in the same market, as defined by an arbitrageur, they are both likely to move in the same general direction at the same time. One may gain relatively more than the other (or lose relatively less) – and that is profitable to the correctly positioned arbitrageur – but the overall energy market is likely to move either up or down together, and it doesn’t matter to the arbitrageur which way they go.

So how does a trader who wants to place an arbitrage trade decide which asset to buy and which asset to sell? It’s like any market strategy: there are as many techniques as there are types of traders. It could be a discretionary decision based on nothing but instinct, it could be based on careful stock valuations, or in the case of commodity futures, it’s often based on how the spread between two calendar months relates to the actual carrying costs of the underlying commodity. At the end of the day, it always comes down to identifying underpriced or overpriced assets, according to some definition of what those prices “should” be.

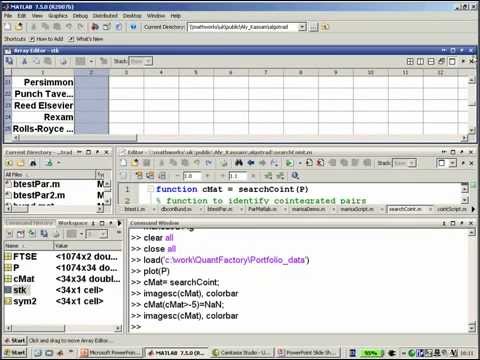

There is an entire segment of the hedge fund industry which refers to itself as Statistical Arbitrage trading (or StatArb). These traders define what assets’ relationships “should” be based on massive statistical calculations, and as such, they typically require sophisticated computer hardware to accomplish their goals on the scale and in the timeframe they need to be profitable. If XOM shares suddenly grow overpriced compared to the statistical expectation for their relationship with BP shares (i.e. the spread between them grows too large), a StatArb fund would instantaneously short sell XOM and buy BP. They would exit the trade when the relationship got back to within a statistically expected range, and their profit would be the difference between the spread when it was out of line and when it was in line with expectations. The fund would never be net long or net short in energy market equities, and therefore it would never face the risk or being incorrectly bullish or bearish overall.

To see the math of an arbitrage trade in more detail, let’s consider an arbitrageur who is long September wheat futures at $7.50 and short December wheat futures at $7.70. He is a bear spread trader, one who is effectively short the spread between September and December wheat futures (a 20-cent spread). Because he is neither net long nor net short in the wheat market overall, the bear spread trader can make money either way the wheat market moves:

- If the whole wheat market goes up. Let’s say September wheat moves to $8.00 (a $2500 gain for the trader who’s long a 5,000-bushel contract) and December wheat moves to $8.15 (a $2250 loss, because he’s short). The arbitrageur netted a $250 gain from both legs of the trade, because the September contract gained relatively more than the December contract. The spread between them narrowed.

- If the whole wheat market goes down. Let’s say September wheat moves to $7.00 and December wheat moves to $7.15. The spread between them once again narrowed by five cents, and the arbitrageur netted a $250 gain. In this case, the long September contract lost relatively less than the short December contract.

It may stick out to you that this particular wheat trader could have made a larger profit by simply going long or short in the wheat market. He could have kept the whole $2500 gain if he had just one contract and no offsetting arbitrage trade … but only if he had analyzed the bullish or bearish potential of the market correctly. And that’s risky, because he could just as easily have taken the wrong side. That’s why arbitrage is attractive in volatile markets. An arbitrageur doesn’t have to hold risky, un-hedged positions in an uncertain environment. He may be more confident in the direction a spread will move than he is in the direction an entire market will move. For instance, a 20-cent spread in the wheat market is relatively large compared to the actual costs of carrying wheat three months between September and December, so that may be why the trader in our example correctly decided to short that spread.

Still, this arbitrageur is settling for a smaller profit per trade than someone who takes the risk and goes straight long or short. That’s true of the StatArb fund, too. The change in the difference between two stock prices is almost always going to be smaller than the change in the prices themselves. Arbitrageurs make up for their smaller profits by more confidently making a greater volume of trades. It takes a lot of expertise … and a lot of trading … but by being both long and short in a market, an arbitrageur can limit his risk and make money in all kinds of market environments.