Introduction and Growth of VIX

Post on: 27 Май, 2015 No Comment

by Eric Mergenthaler

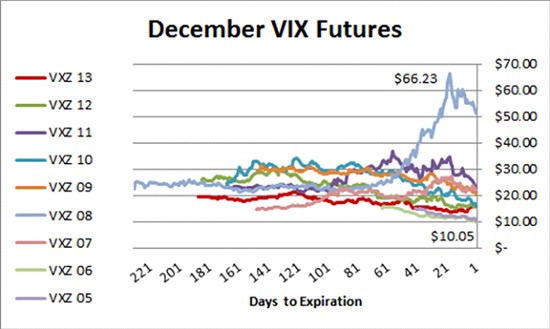

With the creation of the VIX index in 1993 and the subsequent listing of tradable futures and options in 2004 and 2006, respectively, interest in and trading volumes in VIX products have been explosive. VIX’s consistent

80% negative correlation to SPX and the broad equity markets has prompted more strategists and traders to adopt VIX futures and other VIX-based instruments to hedge their portfolios against market downturns and/or to speculate on market turmoil. VIX instruments have become a liquid and transparent alternative to OTC variance swaps.

In 2013, trading in VIX futures averaged 159,498 contracts per day, up 67% from 2012. This year, VIX futures set a new record with more than 4.4 million VIX futures contracts traded in the month of January, a 52% increase from Jan ’13 and the average daily volume for the month of February reached almost 217,000 contracts per day, up 35% from Feb ‘13.

Growth in the trading of VIX options has been equally impressive—in 2013, the average daily volume was more than 567,000 contracts per day, up 29% from 2012. VIX options recently established a new, all-time, single-day trading volume record of 2.37 million contracts and averaged nearly 792 thousand contracts per day in January 2014.

In addition to the parabolic growth in the trading of VIX futures and options, a number of VIX-based exchange traded funds and notes (ETPs) have been listed during the past five years, with an estimated $3.8 billion in combined AUM (Bill Luby, VIX and More blog and newsletter)—the addition of which has only perpetuated the cycle of interest and growth in overall trading volumes.

INTRODUCTION AND GROWTH OF WEEKLYS

Another recent development and fundamental shift in the listed options space has been the creation and adoption of “Weekly” options. In 2005, the CBOE introduced Weekly options—identical to their regular monthly counterparts but with only eight days to expiration. Weekly options are generally listed on Thursdays to allow an overlap with the previous and soon-to-expire options. More than 300 of the most actively traded option classes now include Weeklys, which can have as many as six consecutive weekly expirations available; such range provides opportunities for investors to implement more targeted buying, selling or spread trading strategies and allows traders to more efficiently take advantage of market events, e.g. earnings, government reports and Fed announcements.

By the end of 2013, Weekly options accounted for more than 20% of the overall U.S.-listed average daily options volume; in January of this year, SPX Weeklys accounted for more than 30% of the overall SPX options volume.

As Weekly options gain in popularity, and, by default, the average options trade life cycle shortens, reliable real-time data and robust trading tools become all the more crucial. The greater number of expirations coupled with expanded strike prices require complex scanning and analytical functions to help with idea generation. Similarly, more sophisticated trading strategies and execution algorithms are needed to optimally express a trader’s bias. Having functions that can scan for the most appropriate and efficient trading vehicles, help analyze profit & loss and risk scenarios, and ultimately execute your desired strategies most efficiently is crucial.

MONITORING, ANALYZING AND TRADING VOLATILITY

As the concept of trading volatility has taken hold, more strategists want to monitor and price options based on implied volatility values. Bloomberg has created and introduced its LIVE (Listed Implied Volatility Engine) pricing engine for subscribers to its services; LIVE calculates, in real time, the implied volatility and other greeks for every listed option chain. Bloomberg LIVE allows users of the Bloomberg terminal to monitor intraday implied volatility via popular functions like OMON. It also allows traders to access intraday volatility data to create custom monitors or import the data into Excel to create their own unique spreadsheets. With Bloomberg’s Volatility and Correlation Analysis function VCA. for instance, traders can easily monitor the components of an index (or personal watch list) and compare current implied volatility levels with historical and average levels.

With LIVE also driving analytical tools within the Bloomberg terminal, for example, the Volatility Comparison Chart GV and the Intraday Volatility Graph GIV. strategists are able to see and compare intraday changes in implied volatility more easily than ever before and to readily analyze relationships like put/call skew and implied vs. realized volatility.

With access to robust real-time data, sophisticated analytic tools and the ability to monitor and compare implied and realized volatility, along with the other option greeks, strategists are able to conceive increasingly complicated and promising trading strategies. Tools to help traders create these strategies and tools to help them visualize the associated risks and potential P&L outcomes are essential. Thus, the ability to efficiently and confidently execute these strategies becomes the ultimate goal.

With the fragmented U.S. listed options market, made up of 12 exchanges with varying and complicated pricing schedules, the first requirement for efficient execution is an effective smart order router (SOR). Unlike the major equity markets, the options markets are quote-driven (as opposed to order-driven), with the vast majority of the liquidity provided by market makers. These market makers are often very competitive, with the competition often resulting in impressively liquid markets. But, as these market-making firms increasingly employ high-frequency-like strategies, where and how your orders are routed can have a significant impact on the bottom line. SORs need to take into account not only the immediately posted bids and offers on each of the exchanges, but also must consider historical trading volumes, exchange fees and rebate structures (which can change frequently). In fact, in the absence of intelligent routing, any individual trader could easily be put at a disadvantage if his orders are directed by their executing brokers to preferenced exchanges and/or market makers, which exposes the trader to potentially inferior (and less profitable) execution.

COMPLEX ORDERS

Complex orders, or strategies involving two or more legs contingent upon one another, are a growing percentage of the overall options trading volume. Seven of the 12 U.S. options exchanges now support their own complex order books (COBs), with volumes on these spreadbooks approaching 50% of the overall volume of the exchange. As traders become more sophisticated in their option strategies, they are not only using straightforward call buy/write, married put or simple spreads, but are also employing multi-leg strategies like butterflies, condors and risk-reversals. The growing interest in Weekly options and the associated shortening of the life cycle of the average options trade have helped fuel this increased use of complex orders because users of Weekly options often want to roll their expiring options into the next cycle. Traders need the tools that allow them to roll these strategies—or execute their other complex orders—not only on the exchange COBs, but also by accessing the individual legs between the various exchanges—tapping the additional and fragmented liquidity while managing any associated leg risk.

Tools like Bloomberg Tradebook’s PAIR algorithm are able to access all 12 options exchanges, the affiliated COBs and more than 40 equity venues. PAIR is able to simultaneously work the individual legs of a complex strategy, separately yet within the parameters of an overlying strategy, and manage any risk if the strategy is only partly executed (“leg risk”). The best complex order execution tools, like Tradebook’s PAIR, are also able to access multiple asset classes, allowing even more complex and unique cross-asset strategies to be executed within a single interface. For instance, the ability to trade options not only against an equity, ETF or index, but also against a future or currency contract; SPX and VIX traders can now efficiently trade the listed options, even multi-leg option strategies, in conjunction with the associated futures contract, even when the two instruments are listed on different exchanges.

CBOE SHORT-TERM VOLATILITY INDEX (VXST)

To address the market demand for shorter (weekly) expirations within the VIX complex, the CBOE in 2013 introduced the CBOE Short-Term Volatility Index (VXST), a nine-day variation of the VIX index. VXST uses nearby and second-nearby SPX Weekly options, with at least one day left to expiration, and then weights them to yield a constant, nine-day measure of the expected volatility of the S&P 500 Index. On February 13, 2014, the CBOE listed futures contracts based on this index and options should be listed shortly.

The availability of tradable VXST futures and the anticipated listing of the associated options contracts will open the door to some intriguing spread trading possibilities. Armed with the appropriate monitors, analytics and execution tools, traders will have new and unlimited potential.

>> Posted by Bloomberg on April 15, 2014