Interpreting Volume for the Futures Market

Post on: 25 Май, 2015 No Comment

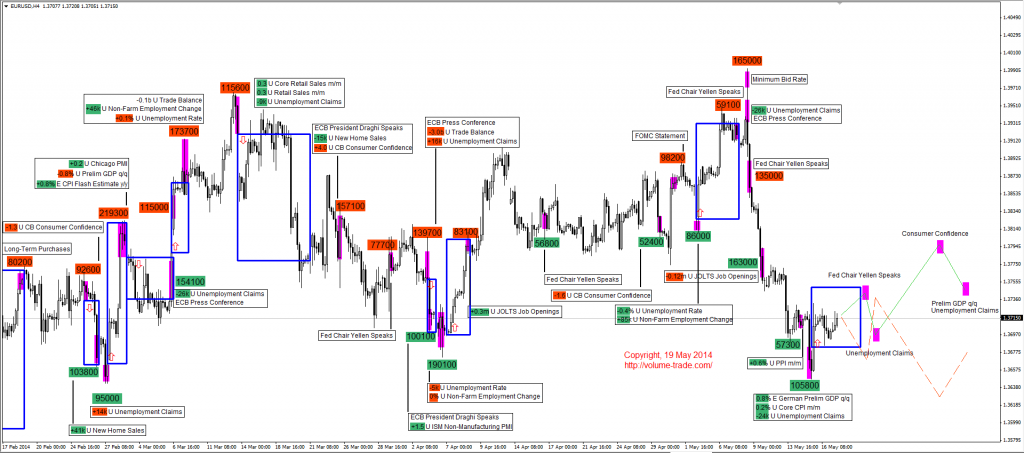

The futures market is a vibrant financial hub that provides plenty of opportunities for individuals who are willing to take risks. It is filled with contracts that involve upfront payment at a fixed for the future delivery of commodities or financial instruments. Uncertainty is inherent in the structure of these contracts as anything can happen in between but the high liquidity and promise of profits can be well worth the gamble. A person could increase his chances of success through technical analysis. The problem is that interpreting volume for the futures market has not been as intensely studied as stocks.

The Concept of Tick Volume

The volume of trading for individual contracts fluctuates according to their schedule of deliveries. These do not given a representative picture of the market. A better way to gather data is to get the aggregate volume of all the contracts in play. It may take a while before an official report with necessary figures become available so investors often use tick volume as a substitute. This is defined as the frequency of price changes for a specific period. This radical alternative works because the more contracts are at play, the more their price changes as a result of these trades.

The Concept of Open Interest

Aside from volume, another thing to consider is the open interest in the futures market. This is the figure that represents the total value of every open position at the current time. By knowing this number, an investor can gauge the maximum potential volume in that market. Whenever there is new interest coming in, there is also a corresponding increase in open interest thanks to the recent addition of buyers and sellers. The rise and fall of the tick volume and the open interest point to distinct market conditions. Investors should familiarize themselves with the methods of data interpretation.

Data Interpretation

If both the tick volume and the open interest are on the rise, then traders can see this as an evidence of a trend that they can capitalize on. Buyers are coming into the market in droves pushing the prices up. If only the volume is rising but the open interest is not, then it is the sellers who are running the show trying to liquidate their positions. This might be a knee-jerk reaction to dismal news or something similar. If the volume is on the decline yet the open interest is increasing, then this means the contracts may be experiencing a slow accumulation. Finally, drops in both the volume and the interest suggest that sellers outnumber the buyers who are willing to switch positions.

Effectively interpreting volume for the futures market is essential when trying to find the right time to step into the chaos of trading. The knowledge provides investors with a more rounded view of any given situation, enabling them to make smarter decisions.