International Fisher Effect

Post on: 16 Март, 2015 No Comment

According to the Relative Version of Purchasing Power Parity Theory (PPP) one of the factors leading to change in exchange rate between currencies is inflation in the respective countries. As long as the inflation rate in the two countries remains equal, the exchange rate between the currencies would not be affected. When a difference or deviation arises in the inflation levels of the two countries, the exchange rate would be adjusted to reflect the inflation rate differential between the countries.

The International Fisher Effect (IFE) theory is an important concept in the fields of economics and finance that links interest rates, inflation and exchange rates. Similar to the Purchasing Power Parity (PPP) theory, IFE attributes changes in exchange rate to interest rate differentials, rather than inflation rate differentials among countries. Nominal interest rates would automatically reflect differences in inflation by a purchasing power parity or no-arbitrage system. The two theories are closely related because of high correlation between interest and inflation rates. The IFE theory suggests that currency of any country with a relatively higher interest rate will depreciate because high nominal interest rates reflect expected inflation.

International Fisher Effect, which was first proposed by Irving Fisher, suggests that there is a positive correlation between nominal interest rates and expected inflation. This hypothesis also implies that the real interest rate is constant and independent of monetary measures. He states that Nominal interest rate comprises of Real interest rate plus expected rate of inflation. So the nominal interest rate will get adjusted when the inflation rate is expected to change. The nominal interest rate will be higher when higher inflation rate is expected and it will be lower when lower inflation rate is expected. Mathematically, it is expressed as:

r = a + i + ai

i.e. Nominal rate of interest = Real rate of interest + expected rate of inflation + (Real rate of interest x expected rate of inflation)

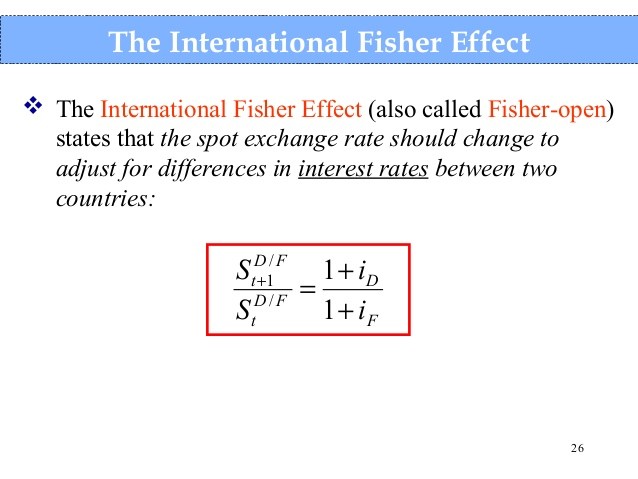

Since interest rates reflect expectations about inflation, there is a link between interest rates and exchange rates. Fisher’s Open Proposition or International Fisher Effect or Fisher’s Hypothesis articulates that the exchange rate between the two currencies would move in an equal but opposite direction to the difference in the interest rates between two countries.

A country with higher nominal interest rate would experience depreciation in the value of its currency. Investors would like to invest in assets denominated in the currencies which are expected to depreciate only when the interest rate on those assets is high enough to compensate the loss on account of depreciation in the currency value. Conversely, investors would be willing to invest in assets denominated in the currencies which are expected to appreciate even at a lower nominal interest, provided the loss on account of such lower interest rate is likely to compensate by the appreciation in the value of the currency. Thus Fisher’s effect articulates that the anticipated change in the exchange rate between two currencies would equal the inflation rate differential between the two countries, which in turn, would equal the nominal interest rate differential between these two countries. Mathematically, it is expressed as:

International fisher effect holds true in the case of short-term government securities and very seldom in other cases. The arbitrage process assumed by Fischer for equating real interest rates across countries may not be effective in all cases. Arbitration may take place only when the domestic capital market and the foreign capital market are viewed as homogeneous by investors. Usually the average investors will view the foreign capital market as risky because of lot of complexities involved and have preference for the domestic capital market. Similarly arbitration may not take place when the real interest rate on the foreign securities is higher. In the absence of arbitration Fisher’s hypothesis not seems to be hold good.