Intermarket Analysis Pinpointing Reversals And Confirming Trends

Post on: 24 Май, 2015 No Comment

You probably know that commodity. bond. stock and currency markets interact with each other. Knowledge of this interaction provides traders with an outline to work from in investment analysis. Coupled with other buy and sell signals this information alone is quite valuable. But can we fine-tune our analysis to zero in on when one market is starting to show signs of weakness? The answer is yes.

Instead of having a vague idea that a particular market is due for a reversal in a couple of months or a year, we can implement further intermarket analysis. using global markets and particular stocks, to pinpoint when reversals are happening. These same tools can be used to confirm trends once they have begun. (See Intermarket Relationships: Following the Cycle before reading on.)

A Brief Overview of Intermarket Analysis

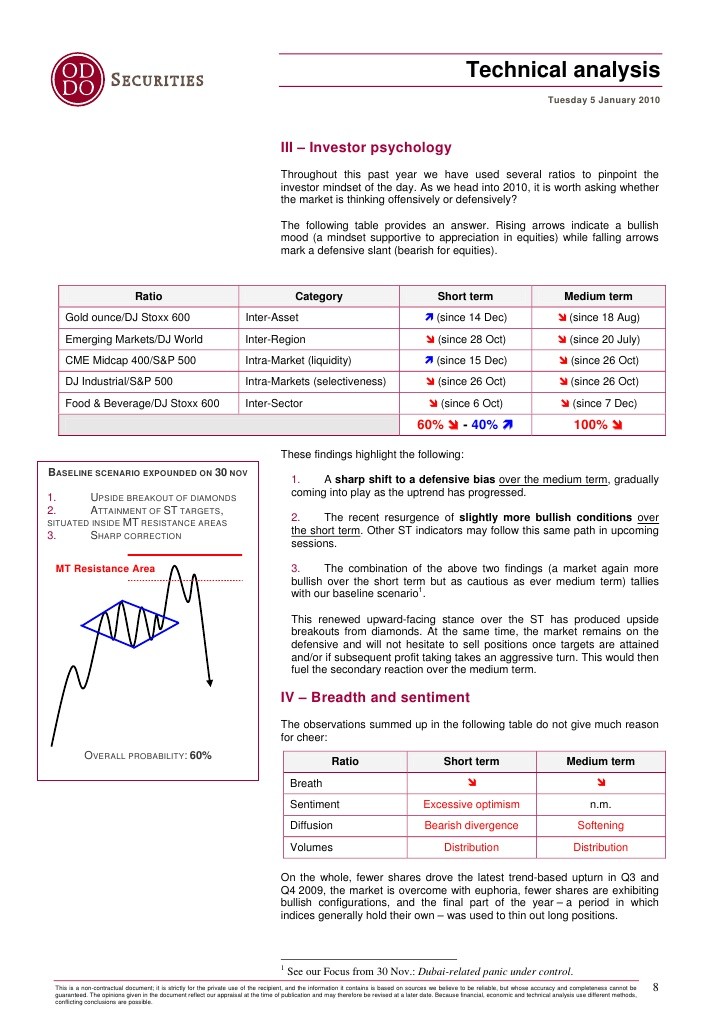

Reversals are generally forewarned by divergence. For instance, if the USD has turned higher, it is likely that commodity prices will soon begin to fall. If commodities do not drop right away, they have diverged from their natural relationship and we can expect them to start to fall soon.

Another example is if bonds have begun to fall and stocks are continuing to rise. While this can continue for some time, stocks will eventually follow bonds (in an inflationary environment). To confirm trends. we can assume the same relationships hold — if commodities are rising and bonds are falling, they will continue to fall. Also, if stocks are now falling, the trend will likely continue as long as bonds continue to fall and likely for a short period of time after bond prices start heading higher once again.

Global Divergence and Confirmation

Given these relationships, let’s gain even further confidence in our analysis by using other tools. With global markets being so interlinked, we now can use other global markets to confirm our findings.

Ideally, we want to see global markets affirming what we are seeing in our own stock market. For instance, if the U.S. stock market is moving higher and breaking through resistance areas, we can be reasonably assured the trend is strong if other global markets are doing the same thing. We don’t need to watch all markets, but we should watch any we are heavily interlinked with. These may include the eurozone. Canada and China. Since the U.S. depends heavily on these countries to supply goods and these countries rely on the U.S. to buy them, our economies will share many similar cycles.

In 2008, the global markets moved lower in sync with one another. These simultaneous moves confirm the strength of the downtrend. This is not to say there can’t be a lag between the movements of different markets, but if a trend is strong, global markets should be moving together. If all other markets are stable/performing well, it is unlikely that the U.S. markets will see a significant decline without confirmation from several global markets.

The more tools we have to confirm a likely move the better, whether that is a reversal due to divergence or a trend continuation due to markets moving in alignment with the relationships outlined. But while we have added more tools to verify a likely move, we still have not pinpointed when it will happen. (In addition, check out Taking Global Macro Trends To The Bank to learn more about trend analysis.)

Stocks That Reflect Intermarket Relationships

So, we have signals from the multiple markets that a new trend is about to emerge in a particular market. Certain stocks can pinpoint when that trend is starting. By focusing on certain stocks, we can diffuse the problems of entering the market too early or too late. The stocks we will focus on are commodity related stocks, such as stocks that are correlated to the price of oil and stocks that are related to interest rates. such as utility stocks and financials.

The reason we watch these stocks is that they lead their respective futures markets. This means that we can use their movement to forecast the moves of their respective futures markets and can thus zero in on market moves as a whole.

Commodity Stocks and Futures

As an example, in 2008 oil stocks peaked and leveled off a couple months before crude oil. Crude continued to rise. This divergence led to oil prices soon following the oil stocks lower. A commodity-linked stock will generally move in the same direction as a commodity; when they diverge it can provide an early reversal signal. (For background reading, see How To Invest In Commodities .)

Financials and Utilities

The strength in financials, which comes at the end of the market cycle (the trough), can be further confirmed when industrial and technology stocks also begin to show strength. Once again, we can either invest in these stocks, futures or an index reflecting these leading stocks. Utilities generally move with bond prices. As such, utility stocks can be used to confirm bond trends. When bonds start to turn up along with utility stocks, the stock market will soon follow it higher.

At some points, due to the lag between one market following another, we may not have a bull market in a given asset class. During this time, we can either sit on the sidelines or we can short markets. Since the above mentioned stocks are leaders, they not only lead their respective futures markets at bottoms, but also at tops. Thus, when these stocks start heading lower (once again in the context of our overall intermarket analysis) after a bull move, we can conclude that the bull market has ended and a bear market in that particular area will begin.

Remember that all decisions must be based on a broad intermarket analysis. If we react to each little up and down, we will be whipsawed in and out of the market. It is important when using this approach to look at a longer time frame, or use it as a broad confirmation for medium- to long-term trades. It is also important to be aware of events that may be affecting a specific stock or asset class that could cause a decoupling of markets.

The Bottom Line

When global markets are confirming moves in a local market, that information can be used as confirmation the trend will continue. Certain stocks also tend to lead the asset classes they reflect higher. By monitoring these stocks, we can get an early indication of when that overall market will move. Since we know how asset classes and markets interact with each other, we can determine which market will be the best place to put funds to earn a profit. However, this is based on trends and should not be used to trade every wave of the market. (For more on reversals, take a look at Retracement Or Reversal: Know The Difference .)