Interest Rate Futures Contracts Explained

Post on: 26 Май, 2015 No Comment

What are Interest Rate Futures?

Buying an interest rate futures contract allows the buyer of the contract to lock in a future investment rate; not a borrowing rate as many believe. Interest rate futures are based off an underlying security which is a debt obligation and moves in value as interest rates change.

When interest rates move higher, the buyer of the futures contract will pay the seller in an amount equal to that of the benefit received by investing at a higher rate versus that of the rate specified in the futures contract. Conversely, when interest rates move lower, the seller of the futures contract will compensate the buyer for the lower interest rate at the time of expiration .

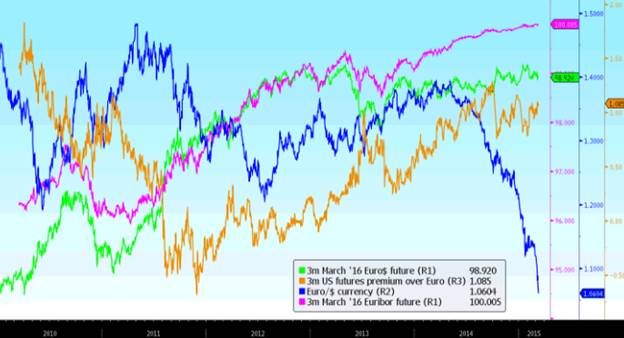

To accurately determine the gain or loss of an interest rate futures contract, an interest rate futures price index was created. When buying, the index can be calculated by subtracting the futures interest rate from 100, or (100 — Futures Interest Rate). As rates fluctuate, so does this price index. You can see that as rates increase, the index moves lower and vice versa.

How do you calculate the gain or loss on the futures contract?

Typically, the interest rate futures contract has a base price move (tick) of .01, or 1 basis point however, some contracts have a tick value of .005 or half of 1 basis point. For example, for Eurodollar contracts, a tick is worth $12.50 and a move from 94 to 94.50 would result in a $1250 gain per contract for someone who is long the futures.

Hedging with futures

Many participants in the interest rate futures market hedge their positions that have an interest rate risk with an offsetting futures contract. As the hedge becomes profitable and traders see less risk in the market, the hedge will be peeled off.

Other participants will use interest rate futures to hedge forward borrowing rates. For example, it is currently March and I need to borrow money in June for 1 month at Libor plus 2. The current LIBOR rate is 2.75% and let’s say the 3 month LIBOR futures are 3%. I will basically be locking in a 5% forward rate by shorting or selling the LIBOR June1 month LIBOR futures contracts.

What Types of Interest Rate Futures are Traded?

Interest rate futures in the US markets are traded on the CME (Chicago Mercantile Exchange ). Below is the list of short term interest rate futures contracts traded on US and foreign interest rates.

Three Month Eurodollars

Eurodollars refer to US dollars that are currently being held on deposit in foreign commercial banking institutions. The ability for banks to be able to have access to fund US dollar loans to foreign purchasers of US goods without the currency exchange rate risks makes the Eurodollar futures very attractive for hedging purposes. For this reason, the Eurodollar futures market has exploded in the last 20 years and has become the most highly traded futures contracts out there.

CME’s Eurodollar contract reflects pricing at 3 month LIBOR on a $1 million offshore deposit.

One Month Libor

One month LIBOR contract is very similar to the Eurodollar contract; however, it represents a 1 month LIBOR on a $3 million deposit.

EuroYen

Euroyen are similar to Eurodollars and represent Japanese Yen deposits outside of Japan.

13 Week Treasury Bills

Treasury backed instruments are considered risk free investments as they are backed in good faith by the United States government. T-bill futures contracts are available in quarterly contracts.

One Month Fed Funds

Federal funds represent reserves Federal Reserve member banks in excess of the reserve requirement for banks. These deposits are not interest bearing deposits and therefore banks lend these funds out to other member banks for overnight term.

91-Day Cetes (Mexican Treasury Bills)

Cetes are government issued short term paper issued in Mexican Pesos. Similar to the US Treasury market, Cetes is the basis for short term lending rates in Mexico.

28-Day TIIE (Mexican Interest Rate)

The TIIE is the benchmark interbank interest rate that Mexican banks use to borrow or lend from the Bank of Mexico.