Information for BrokerDealer Auditors and BrokerDealers

Post on: 16 Март, 2015 No Comment

Page Content

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 vested the PCAOB with expanded oversight of the audits of brokers and dealers registered with the Securities and Exchange Commission to include  inspections, enforcement and standard-setting authority of their auditors.

Financial statements of broker-dealers filed with the SEC for fiscal years ending after December 31, 2008, must be certified by a PCAOB-registered public accounting firm.

Funding

Section 109 of the Sarbanes-Oxley Act, as originally enacted, provided that funds to cover the PCAOB annual budget, less registration and annual fees paid by registered public accounting firms, would be collected from issuers based on each issuer’s relative average monthly equity market capitalization. The amount due from issuers is referred to as the accounting support fee.

As amended by the Dodd-Frank Act, Section 109 requires that the Board allocate respective portions of its total accounting support fee among issuers and brokers and dealers, and allows for differentiation among classes of issuers and brokers and dealers.

On June 14, 2011, the Board adopted amendments to its funding rules that would result in brokers and dealers with more than $5 million in average, quarterly tentative net capital being allocated an appropriate portion of the accounting support fee. These rules were approved by the SEC on Aug. 18, 2011. The Board commenced allocation, assessment, and collection of the accounting support fee for brokers and dealers at year-end of 2011.

Inspections

The Dodd-Frank Act authorized the Board to establish, by rule, a program of inspection of auditors of brokers and dealers. The law leaves to the Board, subject to the approval of the Securities and Exchange Commission, important questions concerning the scope of the program and the frequency of inspections, including whether to differentiate among categories of brokers and dealers and whether to exclude from the inspection program any categories of auditors.

A temporary rule adopted by the Board June 14, 2011, provides for an interim inspection program while the Board considers the scope and other elements of a permanent inspection program. The SEC approved the rule Aug. 18, 2011.

Under the temporary rule, the Board is inspecting auditors of brokers and dealers and identifying and addressing with the registered firms any significant issues in those audits. The Board also expects that insights gained through the interim program will inform the eventual determination of the scope and elements of a permanent program, and the Board expects to issue a rule proposal for a permanent inspection program in 2014, or later.

During the interim program, the Board will provide public reports annually on the progress of the interim program and significant issues identified. In the absence of unusual circumstances, however, the Board will not issue firm-specific inspection reports before inspection work is performed under the permanent program and will not issue firm-specific inspection reports on any firms that are eventually excluded from the scope of the permanent program.

Broker-Dealer Audit and Attestation Standards

On July 30, 2013, the SEC amended its Rule 17a-5 to enhance safeguards for customer assets held by broker-dealers. The amendments include a requirement that broker-dealers file annual financial reports with the SEC that are audited in accordance with PCAOB standards. Additionally, the SEC adopted requirements for new compliance and exemption reports that are covered by an auditor’s report prepared in accordance with PCAOB standards.

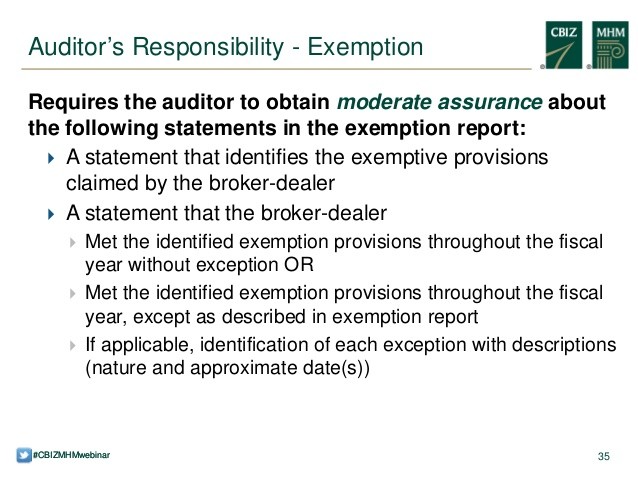

Subsequently, the PCAOB adopted and the SEC approved two attestation standards that cover the auditor’s examination regarding compliance reports and the auditor’s review regarding exemption reports of broker-dealers. The Board also adopted a new standard for auditing supplemental information that accompanies the financial statements, which applies to, among other things, the supporting schedules of broker-dealers required by SEC Rule 17a-5. These standards became effective for audits of financial statements and examinations of compliance reports or reviews of exemption reports for fiscal years ending on or after June 1, 2014, which coincides with the effective date for the broker-dealer reporting requirements issued in the SEC Rule 17a-5 amendments.

Registration

Financial statements of broker-dealers filed with the SEC for fiscal years ending after Dec. 31, 2008, must be certified by a PCAOB-registered public accounting firm. To apply for registration, an accounting firm must complete an electronic application form and pay an application fee.

Below are links to additional resources and information that may be of interest to the auditors of brokers and dealers.

Forum on Auditing in the Small Business Environment

The PCAOB holds meetings throughout the country for registered accounting firms in the small business community to learn more about the work of the Board and to give feedback directly to Board Members and staff. The program focuses on the PCAOB inspection process and the impact of new auditing standards.

Forum on Auditing Smaller Broker-Dealers

These are one-day seminars designed for auditors of smaller brokers and dealers that cover the PCAOB inspection process, compliance with standards, and other issues specific to the broker-dealer auditor community.

STANDARD SETTING AND RULEMAKING

STANDING ADVISORY GROUP

The Board has convened a Standing Advisory Group (SAG) to advise the PCAOB on the establishment of auditing and related professional practice standards. The SAG is made up of highly qualified persons representing the auditing profession, public companies, investors, academics and others.