Index Fund Investing the low correlation of alternative investments

Post on: 10 Апрель, 2015 No Comment

What are alternative investments?

Stock and bond funds are the center-of-the-plate investment. They should, in varying degrees often determined by age and risk tolerance be represented in every portfolio. Yet many investors may not be achieving the low-risk portfolio they need.

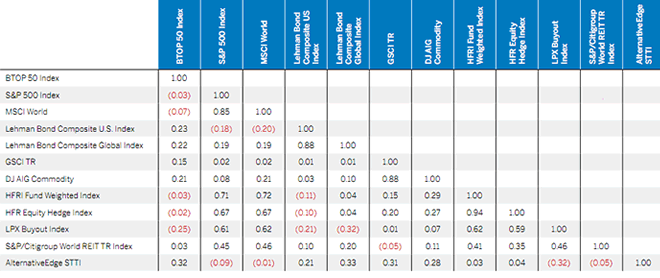

Alternative investments may include commodities, currency and real estate. Adding these investments with an index fund may lower your correlation to other investments. Correlation is often expressed as a decimal, suggesting that investments that move in tandem would be considered as having a 1.0 correlation. A zero correlation would suggest that the investments in your portfolio would move randomly, without any relation to each other.

How do you index alternative investments?

In years past, the ability to diversify your portfolio outside of the traditional stock and bond indexed fund universe was limited to some very high-cost, inflation-sensitive and tax inefficient offerings. As more investors sought these investments, the competition among fund providers to reverse those negative aspects has driven the cost down dramatically. While alternative investments may still cost more than index fund investors might expect, the low correlation may be worth the price.

What are commodity index funds?

This type of investment is global. Almost every nation in the world produces some sort of product that is either dug up, grown or manufactured. The most popular commodity indexes are the Goldman Sachs Commodity Index (GSCI) which tracks 24 different commodities. Weighting of these products in the index can have an impact on predicted returns. The GSCI is heavily skewed towards energy products. This makes this index sensitive to oil prices for instance.

How does an investor choose a suitable commodity index fund?

There is one aspect of commodity investing everyone should know: it is either feast or famine. This is why most commodity index funds use futures. Futures investing not actual ownership of the commodity. Instead it is an investment focused on price and the agreement to buy or sell based on a future price and at the point when the contract expires. This future price is estimated.

Why do commodity index funds cost more than traditional index funds?

The reason these funds cost more than equity or bond index fund is due to the fact that they are almost indexed. Fund managers must be focused on continuity or the attempt to keep the fund invested as one futures contract expires. This active management comes with a cost. Fees in these indexed funds can range from 0.75% up to 2 percent or more. Many even charges load fees as well, in part to discourage speculative investing.

What are currency indexed funds?

Currencies trade in an incredibly sophisticated marketplace. Profits in these funds come from the difference between the currency held in the fund and the value of that currency against the dollar. Exchange traded funds are perhaps the best way to access this highly speculative market. Even institutional investors and banks, who are far more experienced in these sorts of trades lose money. These investors use these ETFs to speculate on the movement of currencies, hedge against declines and/or currency risks.