Implications of Algorithmic Trading in FX Markets During Times of Crisis

Post on: 16 Март, 2015 No Comment

Dec 8, 2011

The increased participation of the hedge fund community in foreign exchange markets has been scrutinized over the years due to their herding behaviors that have exacerbated the already volatile and illiquid markets during times of crisis. A more recent phenomenon developing among hedge funds that has garnered attention is the growing use of algorithmic trading and High Frequency Trading ( HFT ) in particular.

Adam Reichert

Foreign Exchange Products,

BMO Capital Markets

In order to grasp the implications, both positive and negative, that algorithmic trading has on the foreign exchange markets and its participants, a closer look must be taken at how HFT firms function. HFT is a specific type of automated trading that uses computer algorithms to identify opportunities through a multitude of strategies and then executes trades within milliseconds, essentially taking advantage of information before other players have had time to react. They profit by trading a large number of small sized trades making multiple small profits within milliseconds, effectively minimizing the risk per trade. HFT has been a rapidly evolving phenomenon in the equity markets for years now and has been making significant inroads into the FX markets, which will have a significant impact on the structure and dynamics of the FX market and its participants going forward. One of HFTs most important characteristics comes from its equity origins in that it is able to act like an order-driven system. These firms take advantage of their high speed platforms by sending multiple small trades to several different trading venues via multi-bank electronic crossing networks ( ECNs ) in order to detect the order flows and create execution strategies based on this information. In doing so, they inflate the true market depth and liquidity.

The emergence of algorithmic trading has provided several key benefits to clients during normal market conditions in the form of increased volume, improved efficiency, and narrowing spreads, by increasing the flow across multiple trading venues and reducing price gapping that was often apparent in the interbank market. While the customers perceive these implications as beneficial in terms of spread compression, the longer term implication on market-making activities may have significant negative effects in the form of reduced liquidity for larger Institutional and Corporate flow that occur daily for global trade related purposes, as dealers may become less willing to make markets for block trades if the spreads are not reflective of the risk.

HTF firms are not mandated to market-making activities and therefore seem to disappear from the markets as soon as volatility increases and/or liquidity decreases, which is the case during times of crisis or immediately before key economic data is released. This hedge fund-type herding behavior has been blamed for many of the large swings experienced in both the equity and FX markets. While there is very little evidence or empirical studies to prove this, several events that have occurred recently have suggested this behavior, such as the May 6th 2010 flash crash or the March 17, 2011 JPY 3% decline within 25 minutes. 1 Similar activity has been witnessed during key economic releases:

During the minutes following the US non-farm payrolls announcement, when volatility is high, the share of liquidity provided by algorithmic traders decreases relative to human traders. This suggests that it is unlikely that computer traders provide sufficient liquidity when there is an adverse shift in price due to new information. ( Chaboud et al (2009))

In an environment like the current one, where event/headline risk is the single most influential risk that affects intra-day price movements, the herding behavior which has now been magnified by HFT firms is detrimental to a healthy and functioning currency market.

Another perceived problem, that has been dubbed the Liquidity Mirage, is the false sense of liquidity and market depth created by HFT through its ability to submit bids/offers across multiple trading venues and pulling them as soon as one is filled. In times of crisis, all their bids/offers evaporate instantaneously leaving dealers to continue their market-making activities in an elevated risk scenario. Dealers argue that the tight spreads created by the emergence of HFTs do not properly reflect the risk associated with pricing larger transactions that cannot be filled at the reflected price. This has a detrimental effect on the dealers market-making activities, especially during times of stress. Over time, dealers will become more cautious and selective in their market making activities; an effect that has implications for all clients needing access to the FX markets for global trade and capital flows.

Questions of integrity, which have become paramount, arise in regard to HFTs ability to detect larger trades through its use of multi-bank ECNs and complex algorithms and to execute trades based on this information. This appears to share similar characteristics to front-running which is certainly an unacceptable practice in todays markets. The problem is that they are using commonly accepted and employed procedures that have been around for decades, but when executed at speeds hundreds of times faster than other participants, it creates a significant advantage and profit opportunity for these HFT firms.

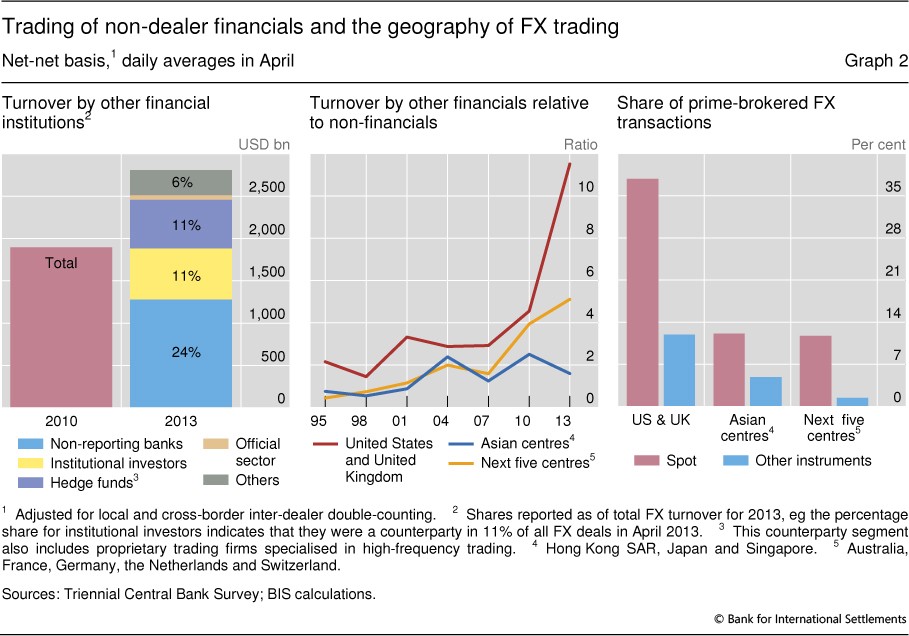

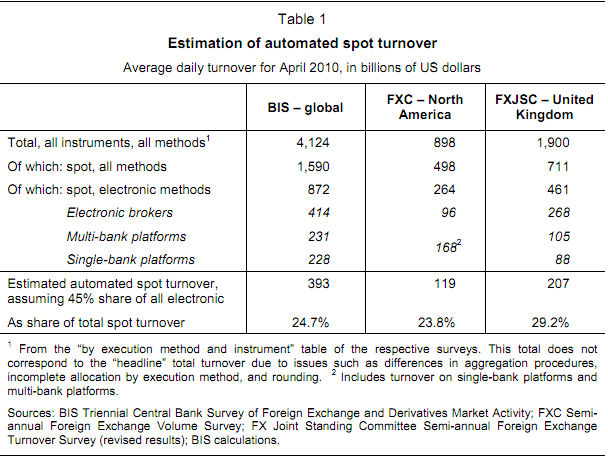

While regulators are beginning to raise concerns regarding these developments, there is very little evidence of the actual size of this market and whether the inferred effects of this type of trading can be directly attributed to HFT. One of the reasons for this is that HFT firms use prime brokers to execute their transactions, and therefore their trades end up going through the market as if their prime broker did the trade. However, one can make conclusions as to the growth of HFT by reading between the lines of an April 2010 BIS Triennial Survey, which measured the daily average global FX turnover increase to be $657 bln reaching $3.98 trillion, since April 2007, three quarters of which occurred in the spot market. It is well documented that the HFT firms trade primarily in the spot markets 2

The HFT firms are reliant on dealers. Dealers, on the other hand, are not reliant on HFT firms. If spreads compress so much that dealers can no longer warrant the risk involved, they may retaliate with some maneuvers of their own such as moving towards single-bank platforms that internalize flows. 3 Consequently, it would be wise for HFT firms to tread water carefully when it comes to compromising the integrity of these markets. On the flip side, it would be wise for dealers to increase their investment in technology to keep up with the changing landscape. As dealers and other non-HTF players continue to improve their technology, these latency advantages that HTF firms are utilizing may become more difficult to profit from as the cost-benefit trade-off of reducing execution speed past a certain point becomes negligible. Also, both parties should keep a close watch on new regulations being developed that may impact their business.

Everyone agrees that both the broker-dealers and HFT firms provide liquidity and mutually benefit clients in normal market conditions. It is during times of crisis that the implications of increased HFT on both the broker-dealer side and customer side become most concerning. Longer term implications on the dealers market-making activities are becoming a serious concern for global trading partners who rely on a healthy and functional foreign exchange market. While HFT has been a part of the equity markets for years, it is still a relatively new phenomenon in the foreign exchange markets that we will continue to evolve over the coming years and change the landscape for all participants.

To learn how BMO Capital Markets can help you achieve your ambitions, email us at fxonline@bmo.com, or visit www.bmocm.com/ fx for a list of contacts in your area.

____________

1 BIS Markets Committee report, Sept 2011.

2 BIS Triennial Survey, April 2010.

3 BIS Market Committee Report.

Disclaimer: The information, opinions, estimates, projections and other materials contained herein are provided as of the date hereof and are subject to change without notice. Some of the information, opinions, estimates, projections and other materials contained herein have been obtained from numerous sources and Bank of Montreal ( BMO ) and its affiliates make every effort to ensure that the contents thereof have been compiled or derived from sources believed to be reliable and to contain information and opinions which are accurate and complete. However, neither BMO nor its affiliates have independently verified or make any representation or warranty, express or implied, in respect thereof, take no responsibility for any errors and omissions which may be contained herein or accept any liability whatsoever for any loss arising from any use of or reliance on the information, opinions, estimates, projections and other materials contained herein whether relied upon by the recipient or user or any other third party (including, without limitation, any customer of the recipient or user). Information may be available to BMO and/or its affiliates that is not reflected herein. The information, opinions, estimates, projections and other materials contained herein are not to be construed as an offer to sell, a solicitation for or an offer to buy, any products or services referenced herein (including, without limitation, any commodities, securities or other financial instruments), nor shall such information, opinions, estimates, projections and other materials be considered as investment advice or as a recommendation to enter into any transaction. Additional information is available by contacting BMO or its relevant affiliate directly. BMO and/or its affiliates may make a market or deal as principal in the products (including, without limitation, any commodities, securities or other financial instruments) referenced herein. BMO. its affiliates, and/or their respective shareholders, directors, officers and/or employees may from time to time have long or short positions in any such products (including, without limitation, commodities, securities or other financial instruments). BMO Nesbitt Burns Inc. and/or BMO Capital Markets Corp. subsidiaries of BMO. may act as financial advisor and/or underwriter for certain of the corporations mentioned herein and may receive remuneration for same. BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking businesses of Bank of Montreal, BMO Harris Bank N.A. and Bank of Montreal Ireland p.l.c. and the institutional broker dealer businesses of BMO Capital Markets Corp. BMO Nesbitt Burns Trading Corp. S.A. BMO Nesbitt Burns Securities Limited and BMO Capital Markets GKST Inc. in the U.S. BMO Nesbitt Burns Inc. in Canada, Europe and Asia, BMO Nesbitt Burns Lte /Ltd. in Canada, BMO Capital Markets Limited in Europe, Asia and Australia and BMO Advisors Private Limited in India.

TO U.S. RESIDENTS: BMO Capital Markets Corp. and/or BMO Nesbitt Burns Securities Ltd. affiliates of BMO NB, furnish this report to U.S. residents and accept responsibility for the contents herein, except to the extent that it refers to securities of Bank of Montreal. Any U.S. person wishing to effect transactions in any security discussed herein should do so through BMO Capital Markets Corp. and/or BMO Nesbitt Burns Securities Ltd.

TO U.K. RESIDENTS: The contents hereof are not directed at investors located in the U.K. other than persons described in Part VI of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2001.