ICE Benchmark Administration (IBA) publishes position paper on the evolution and enhancement of ICE_1

Post on: 21 Август, 2015 No Comment

LONDON, Oct 20, 2014 (BUSINESS WIRE) — Intercontinental Exchange ICE, +0.95% the leading global network of exchanges and clearing houses, announced that ICE Benchmark Administration (“IBA”) has today published a Position Paper on the Evolution of ICE LIBOR.

Having taken over the administration of LIBOR in February 2014, IBA has already established rigorous oversight and surveillance mechanisms for LIBOR and the Paper sets out:

- IBA’s key findings so far on the administration of LIBOR;

- A summary of recent improvements to the LIBOR administration process; and

- Proposals for consultation on further enhancements to the LIBOR submission process.

IBA welcomed the publication of the Financial Stability Board’s July 2014 report, “Reforming Major Interest Rate Benchmarks”, which created additional momentum for change and clearly signaled that LIBOR should be underpinned to the greatest extent possible with transaction data.

IBA now invites comments on proposed enhancements to elements of LIBOR:

- Setting a universal approach, with a more prescriptive calculation methodology using pre-defined parameters that the LIBOR Oversight Committee will keep under review

- Expanding the universe of transactions to reflect changes in recent years in activity in the interbank market

- Ensuring that transaction-based submissions are used to the extent possible and defining a waterfall methodology for use when there are insufficient transactions to produce a reliable submission

- Allowing transactions in all representative locations to be used by submitters

- Allowing all wholesale and professional entities to be regarded as eligible counterparty types, recognizing that bank funding has changed over the years

- Widening the window for eligible transactions so that LIBOR is based on as many transactions as possible

- Creating robust analytical tools to solidify the methodology to produce a matrix of eligible transaction sizes as well as minimum aggregated volume for each currency and tenor

- Defining the role of qualitative methods: expert judgment should only have a place as a fall-back of last resort

Finbarr Hutcheson, President of IBA, said: “LIBOR provides the financial markets with a common language, enabling banks around the world to do business with each other and creditors to enter into long term contracts with confidence. Today represents a significant step forward in the LIBOR journey. At IBA, we are seeking to make LIBOR ever more robust by creating a methodology that can keep pace with today’s fast moving markets. We believe that IBA’s approach to evolving benchmarks will benefit LIBOR’s many and diverse stakeholders.”

IBA is seeking feedback on its proposals from all LIBOR stakeholders. Comments should be submitted to IBA by Friday, 19th December, 2014. https://www.theice.com/publicdocs/ICE_LIBOR_Position_Paper.pdf

About Intercontinental Exchange

Intercontinental Exchange ICE, +0.95% is the leading network of regulated exchanges and clearing houses for financial and commodity markets. ICE delivers transparent, reliable and accessible data, technology and risk management services to markets around the world through its portfolio of exchanges, including the New York Stock Exchange, ICE Futures and Liffe.

Trademarks of ICE and/or its affiliates include Intercontinental Exchange, ICE, ICE block design, NYSE, New York Stock Exchange and LIFFE. Information regarding additional trademarks and intellectual property rights of Intercontinental Exchange, Inc. and/or its affiliates is located at www.intercontinentalexchange.com/terms-of-use

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995 — Statements in this press release regarding ICE’s business that are not historical facts are forward-looking statements that involve risks and uncertainties. For a discussion of additional risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see ICE’s Securities and Exchange Commission (SEC) filings, including, but not limited to, the risk factors in ICE’s Annual Report on Form 10-K for the year ended December 31, 2013, as filed with the SEC on February 14, 2014.

About ICE Benchmark Administration Limited

ICE Benchmark Administration Limited (IBA) is a UK company based in London. It was established for the sole purpose of administering benchmarks and is now a wholly-owned subsidiary of the Intercontinental Exchange group (ICE). The Wheatley Review concluded that there should be statutory regulation around LIBOR. Both administering LIBOR and making submissions to LIBOR became regulated activities from April 2013. LIBOR is the first benchmark to be regulated. As the new administrator for LIBOR, IBA became authorised and regulated by the FCA in February 2014. In August 2014 IBA became administrator for ISDAFIX, the leading global benchmark for interest rate swaps.

About LIBOR

LIBOR has global significance. It is referenced by an estimated US$ 350 trillion of outstanding business in maturities ranging from overnight to more than 30 years. LIBOR indicates the interest rate that banks pay when they borrow from each other on an unsecured basis. It is fundamental to the operation of both UK and international financial markets, including markets in interest rate derivatives contracts. LIBOR is used to determine payments made under credit products and derivatives by a wide range of counterparties including small businesses, large financial institutions and public authorities. LIBOR is published every UK business day for five currencies: US Dollars; Pounds Sterling; Euros; Japanese Yen; and Swiss Francs. Each currency has seven maturities ranging from Overnight to 12 Months. The banks’ submissions are ranked for each maturity in each currency and then the highest 25% and lowest 25% of submissions are excluded. The remaining contributions are arithmetically averaged to create the final LIBOR rates which IBA then publishes and distributes to data vendors.

SOURCE: Intercontinental Exchange

ICE-CORP

SOURCE: Intercontinental Exchange

Media Contact:

James Dunseath — Corporate Communications

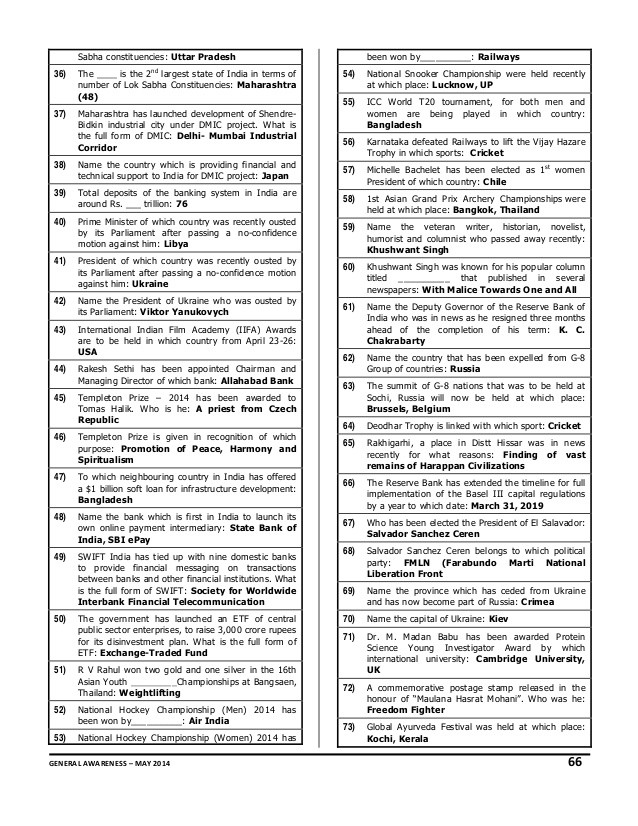

Intercontinental Exchange | ICE