I Have No Deb Can I Live Off Investment Income The Simple Dollar

Post on: 16 Март, 2015 No Comment

A young, forward-thinking man wrote to me and asked this simple question:

Right now, Im twenty years old. I am willing to take a large percentage off the top of my salary for the rest of my working life in order to be able to retire very young and live off of my investment income and do volunteer work. How many years would I have to work if I saved 20% of my income?

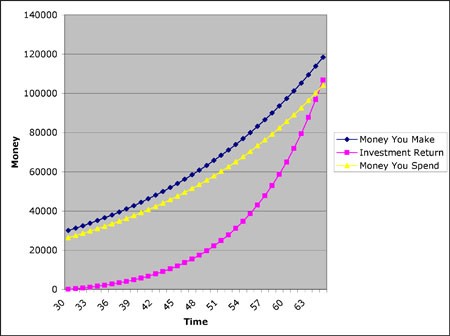

He went on to name a number of other specifics about his situation, but theyre really not important. If you were to take 20% of your annual income starting at age 20 and put it in a S&P 500 index fund, that index fund continues to grow at the long-term historical rate (12%), and you received a 4% raise each year, you could walk away from your job and live off the interest at age 41 matching your current salary, or quit at 43 and be able to give yourself a 4% raise each year from the interest, which is probably the better plan because it combats inflation. Raise the amount to 25% and youre done at age 38 and able to live in perpetuity at age 40.

Obviously, some people are going to balk at this and state that it cant be done. The truth is that it can be done if you have the willingness to live below your means and authentically behave as if 20% of your total salary doesnt exist.

It is challenging, dont get me wrong. Lets take the case of Roger, who makes about $60,000 a year. He brings home a paycheck every month in the amount of $3,200. In order to save 20% of his whole annual salary ($12,000), Roger would have to be willing to immediately take $1,000 of that take-home paycheck and put it straight into an investment and not touch it at all. This takes an amount of financial fortitude and willpower that, quite honestly, most Americans dont have the courage to do.

My advice to this young man is that if this is truly your goal, then it is achievable, and I offer the following points of advice:

Make that saving automatic. Figure out what exact dollar amount you need to remove from each paycheck to equal 20% of your total salary, then set things up so that amount is withdrawn automatically. Since youre planning on retiring so young, it will have to be placed into a non-tax sheltered investment account, which is fine if you invest it right

Buy and hold. Buy into a very broad-based investment, like the Vanguard 500, and just keep adding money to it and dont move it around. This will set you up to pay only long-term capital gains tax when you withdraw it, meaning that your tax time in the future when you start liquidating it to live will actually be quite pleasant (just long-term capital gains tax, if that even exists then).

Learn to appreciate frugal living. With an email like that, Im already sure that you are more likely to buy a sturdy late model used car than a new Lexus, but its important to state just the same: you can easily save that 20% youre wanting to save by making good lifestyle choices. Youll find that if youve made the investments automatic, youll easily learn to live on whatevers left over.

Good luck, and I hope to hear from you when youre 40 and retired!