How To Use An Iron Condor To Profit 2015

Post on: 2 Июнь, 2015 No Comment

3A%2F%2Fironcondorcourse.net%2F?w=250 /% My story… A number of years ago I signed up for an online advisory service that showed me how to trade Iron Condors. At first my returns were amazing!

3A%2F%2Fwww.theironcondorcourse.net%2F?w=250 /% My story… A number of years ago I signed up for an online advisory service that showed me how to trade Iron Condors. At first my returns were amazing!

3A%2F%2Fsafertrader.com%2F?w=250 /% How to Trade Credit Spreads & Iron Condors: The Monthly Income Machine options income strategy & recommended specific trade entry rules for lower risk

3A%2F%2Fseekingalpha.com%2F?w=250 /% As you can see, the ‘reverse iron condor’ would have been successful for the last five trades. Each one had the required move in the underlying stock price to profit

3A%2F%2Fwww.unclebobsmoney.com%2F?w=250 /% Iron Condor Strategy Description: A Condor is the street name for a Vertical Spread. An Iron Condor is not the name of an exotic bird, but it is the street name when

3A%2F%2Fwww.optionstradingiq.com%2F?w=250 /% I have received a few questions recently about how to calculate the profit and losses on credit spread trades, so I wanted to do a post to cover the subject.

3A%2F%2Fwww.investopedia.com%2F?w=250 /% You may have heard about iron condors, a popular option strategy used by professional money managers and individual investors. Let’s begin by discussing what an iron

3A%2F%2Fwww.youtube.com%2F?w=250 /% Learn the Investools Method® for choosing the best strike prices for your iron condor options trade, which will increase your probability for success

3A%2F%2Fwww.tradingconceptsinc.com%2F?w=250 /% U.S. Government Required Disclaimer — Forex, futures, stock, and options trading is not appropriate for everyone. There is a substantial risk of loss associated with

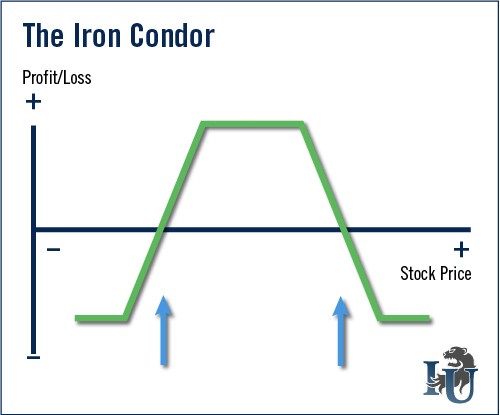

3A%2F%2Fwww.investmentu.com%2F?w=250 /% This can be done by using an options strategy called an iron condor. The iron condor combines two separate options strategies to form one powerful trading technique. An iron condor combines two vertical spreads. A vertical spread is an options spread

3A%2F%2Fetfdailynews.com%2F?w=250 /% What if you want to take a position in a stock, but instead of profiting if the stock price moves higher or lower, you want to earn a return if the stock stays in a specific range. This can be done by using an options strategy called an iron condor.

3A%2F%2Fwww.seeitmarket.com%2F?w=250 /% For many professional option traders, iron condors form the basis of in front of the short calls. Using the short strike of the credit spread as the short strike of the debit spread results in a profit tent that is sometimes referred to as a mouse

3A%2F%2Fwww.tradingmarkets.com%2F?w=250 /% A Credit Spread or an Iron Condor trade seems like such a “no-brainer” method If we’re sitting on a nice profit, but it’s late in the options cycle and a quick 10 point move in the underlying will erase everything that we’ve worked for

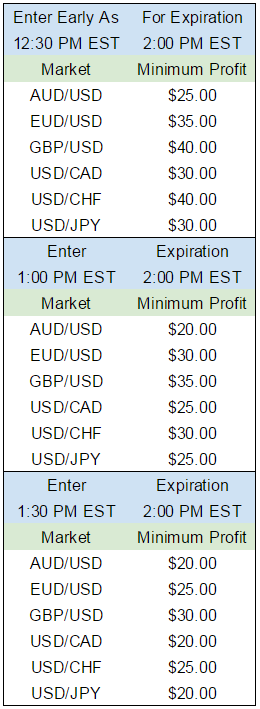

3A%2F%2Fwww.benzinga.com%2F?w=250 /% You are looking for a minimum profit of $30. If you would like to read another article to better understand how to trade Iron Condors into News Releases, see Iron Condors for News Trades using Nadex Spreads. For even more helpful informative education

3A%2F%2Fwww.danielstrading.com%2F?w=250 /% In this article, my intention is to open your eyes to a more unique trading approach, collecting premium with Iron Condors Maximum Profit Potential = Call Spread Premium + Put Spread Premium We can also use these numbers to calculate our defined

3A%2F%2Fseekingalpha.com%2F?w=250 /% I will list the strike prices I am choosing and a profit/loss chart for each trade using the ‘reverse iron condor’ spread. You may ask yourself why you should avoid using long-term options with this strategy? The answer is because the more time the stock

3A%2F%2Fwww.minyanville.com%2F?w=250 /% Therefore, this trade contains more potential profit in times of high implied volatility. An important feature of this trade is unique to iron condors. The absolute risk the necessity of risk management when using this trade structure.

3A%2F%2Ffinance.yahoo.com%2F?w=250 /% The cash collected represents the maximum profit for the position or choose a single one using different expiration months and strike prices. You’ll see how different iron condor positions perform as time passes and markets move.

3A%2F%2Fwww.moneyshow.com%2F?w=250 /% In fact, some very profitable traders exclusively use iron condors success (again based on an appropriate Delta). The iron condor option strategy is one of the best ways for an option trader to profit from an insignificant move in the price of an