How to Trade the Dow Jones Index

Post on: 28 Июнь, 2015 No Comment

More Articles

As the oldest and most widely followed U.S. stock index, the Dow Jones Industrial Average has tremendous visibility to both investors and the general public. Although you cannot trade a stock index directly, available derivative financial products let you pick the direction you think the index will move and profit from your pick if it proves correct. Futures contracts on the Dow Jones Index provide an attractive combination of liquidity and leverage to day-trade the index or go for longer trend trades.

Step 1

Open an account with a commodity futures broker. Futures brokers are registered separately from stock brokers, and your current broker may or may not offer futures trading. Check out several brokers in regard to the level of service provided, the type of trading software offered and whether or not the broker provides trading guidance or suggestions.

Step 2

Set up the trading software provided by the broker and study the characteristics of the different Dow Jones futures contracts. Three sizes of futures contracts trade against the DJIA. The contracts are valued at 25, 10 and 5 times the index value, respectively. The larger the contract value, the larger the margin deposit required to trade a contract. As a new futures trader, you probably want to start with the $5 e-mini Dow contract.

Step 3

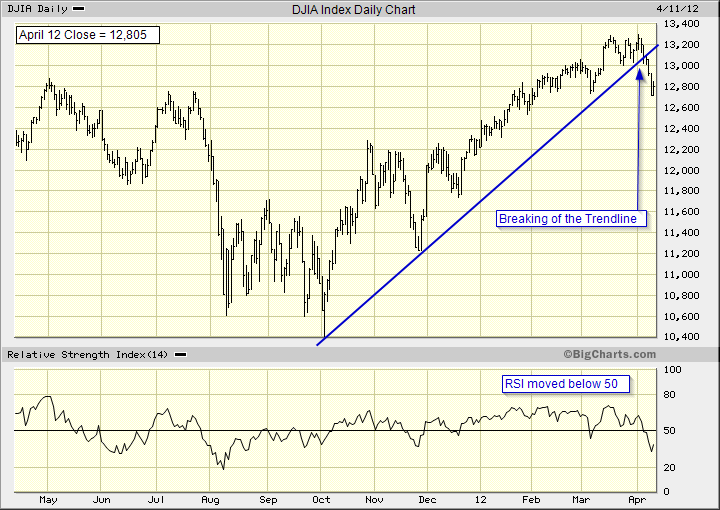

Develop a trading system or select a trade signal source for the Dow Jones index. There are numerous strategies and systems available to trade futures on the stock indexes. You can try out new strategies using a practice trading account, which most futures brokers provide along with a live, real money trading account. Do not start to trade futures with real money until you are consistently profitable in your practice account.

Trade the selected Dow futures contract by using a buy order to open if you predict the DJIA will go up, or by using a sell order to open if you expect the stock index to decline. When you enter an order, the broker requires an exchange-set margin deposit for each contract traded. As of October 2012, the initial margin amount for an e-mini Dow contract is $2,750.

Close an open futures trade by entering the opposite order type for the same futures contract. For example, if you opened with a sell order to profit from a falling Dow, you close the trade with a buy order.