How To Setup and Rebalance TD eSeries Funds

Post on: 16 Март, 2015 No Comment

One of the ways that you can create a simple, yet effective, investment portfolio is by investing in TD e-Series Funds . There is a bit of effort you need to put in to invest in TD e-Series Funds, but it is worth it.

Setup Your Investment Portfolio Using TD e-Series Funds

First of all, you need to apply using the form available on the TD Canada Trust website . The account application is pretty straightforward. You’ll need to provide information like your name, SIN, date of birth, and banking information.

The next couple pages are the Wealth Allocation Model and the Investor Profile. Fill out the Wealth Allocation Model to provide your Total Point Score. This score will show you which asset mix is most likely right for you. TD will review this information and help you identify the asset allocation to match your score.

If you are aware of this process, its possible for you to adjust your score so that you can get the asset allocation that you feel is most likely to work for you. It requires a little thought and planning to adequately personalize your portfolio, but its worth the effort, to create the easy-to-manage portfolio you want.

The Portfolio Worksheet is where you enter the exact asset mix you want and the amount you are investing, both as a lump sum and pre-authorized purchase plan. To keep it really simple, many investors with a long enough investment time frame might benefit from a equal split into:

Once you have that all set up, you need to sign a simple Understanding & Consent form. In the Transaction Form you have to re-enter the information from the Portfolio Worksheet. These two asset mixes do need to match for you to complete your setup.

Once you finish, you need to mail it in to TD e-Series Funds Administration. The full address is on the first page of the pdf. Once everything is setup, TD will mail you your login information.

Rebalance Your Investment Portfolio

Even when youre on an investment plan, your portfolio can begin to drift. Due to the way that funds are operated, and to market conditions, you might end up with more shares of one fund than another. This can bring your portfolio out of balance, and result in sub-par performance.

In order to get back on track, once a year you should rebalance your portfolio back to your original asset mix. Look at your portfolio, and determine your next course of action. If you have a certain amount of new money available to invest, put it into the under performing funds to bring them back up to 25% of your allocation. If you do not have enough new money to re-balance, you can sell some shares of the better performing funds and then put the proceeds into the others. Rebalancing this way forces you to buy low and sell high, which is the preferred strategy when you invest.

Its also a good idea to rebalance as your goals and investing needs change. Eventually, you might want to rebalance so that you have a greater allocation of fixed-income assets. Create a reasonable investment plan that you can follow. Even with a simple portfolio composed of TD e-Series funds, its possible to change things up as you age and as you reach specific milestones. Just make sure that you rebalance according to a well-thought-out plan.

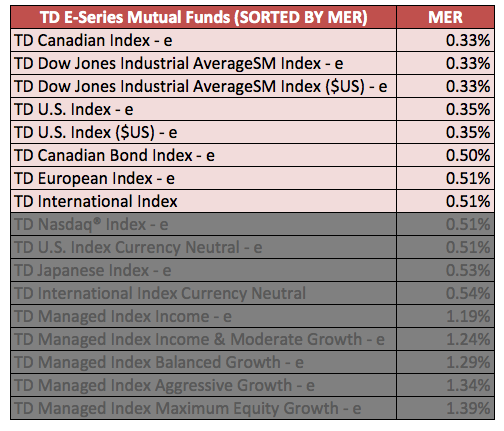

These steps will provide a diversified portfolio, investing in the entire index that the funds track. You can rebalance the portfolio yourself, avoid undue risk and stress, and you will pay a low Management Expense Ratio (MER) of less than 0.5%.

Sign up today to be the first to know about all the latest topics on one of the top personal finance blogs in Canada.