How to leverage market contango and backwardation

Post on: 19 Июнь, 2015 No Comment

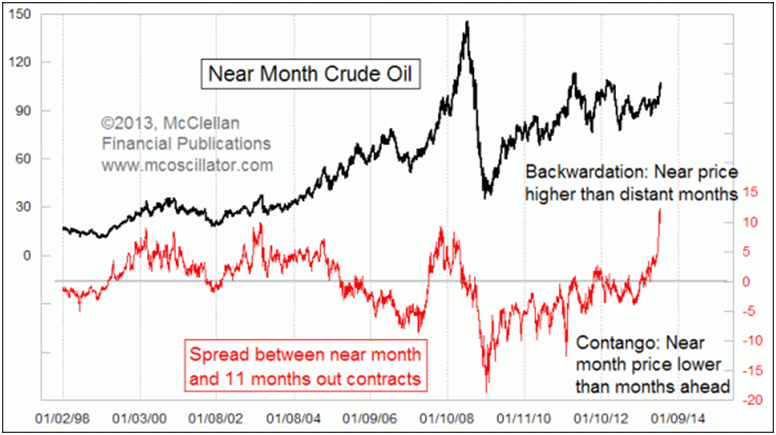

While the word contango may sound mysterious, it is used to describe a fairly normal pricing situation in futures. A market is said to be in contango when the forward price of a futures contract is above the expected future spot price. Normal backwardation, which is essentially the opposite of contango, occurs when the forward price of a futures contract is below the expected future spot price. Because contango and backwardation are known states in the market, traders can employ strategies that attempt to exploit them.

Contango and backwardation are frequently seen in commodity markets where certain factors prompt the price discrepancy between expected future spot prices and the price of futures contracts. Here, we will introduce the two market states of contango and normal backwardation, explain why they happen and how they affect futures traders.

Back to basics

A brief review of exactly what a futures contract is can be helpful when trying to understand contango and backwardation. A futures contract is a legally binding agreement to buy or sell a specified financial instrument or physical commodity at a predetermined price in the future. The buyer of a futures contract (who is long the contract) expects price to increase, while the seller (who is short the contract) anticipates that price will decrease. A futures contract is an obligation to do something in the future.

Some futures contracts are settled in cash, while others call for physical delivery. Many commodity futures are physically delivered; however, market participants can hedge or speculate in the contract without ever taking physical delivery by entering an offsetting position before the contract expiration date.

Commodities are bought and sold on two separate but associated markets: The cash market, which involves the buying and selling of physical commodities, and the futures market, which involves the buying and selling of a future obligation. In a cash market, transactions are settled on the spot (thus the name spot market), meaning that the exchange between the buyer and seller takes place in the present. An instruments spot price is its market price, or the price at which it could be bought or sold today (often the futures nearest expiration is considered the spot futures).

In a futures market, on the other hand, any exchange between the buyer and seller takes place at some predetermined time in the future. The various futures contracts (for example, the February 2013, March 2013 and April 2013 light sweet crude oil futures contracts) state the price that will be paid and the date of delivery. Few contracts result in physical delivery because most are closed with offsetting positions before expiration.