How Shiller helped Fama win the Nobel

Post on: 15 Июль, 2015 No Comment

How Shiller helped Fama win the Nobel

How Shiller helped Fama win the Nobel

Barry Ritholtz,

Washington Post October 20 2013

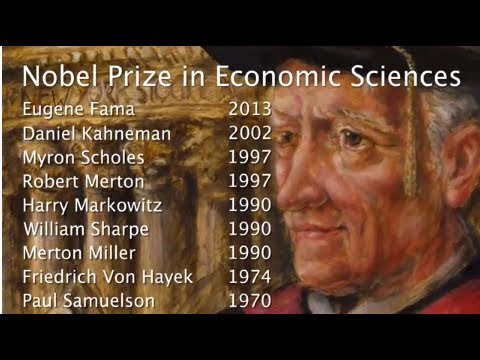

At the University of Chicago, there are two professors of economics named Eugene Fama .

The first — let’s call him Fama the Younger — started in the 1960s. He developed a profound insight about the markets. This Fama observed that over the short term, equity markets behave randomly. The day-to-day, week-to-week trading action has no rhyme or reason. Indeed, the random walk of markets makes them effectively impossible to predict in that time frame.

Why was this? Fama reasoned that the pricing mechanism of markets — what you or I would call trading — efficiently reflected all known information about stocks. Buying and selling created an “informational efficiency.” If there were any significant details known about a company, someone would discover it eventually and act on that information. Hence, all known data that exist about a company are reflected in its stock price. The Efficient Market Hypothesis, as Fama called it, meant that stock-picking was a futile exercise. He described the details in a 1965 paper titled “Random Walks in Stock Market Prices .”

The relevance to finance was soon obvious: Most investors are better off owning the entire market, rather than guessing which stocks might do better or worse. We can quibble with some of Fama’s reasoning. It turns out that prices are not all that rational and frequently deviate from known data — but Fama got the big concept right: Markets behave unpredictably in the short term.

For this, Fama is thought of as the intellectual father of indexing. The entire concept of passive investing in indexes grew around his insights. His work became hugely influential, and remains so to this day. If you own a Standard & Poor’s 500-stock index, you do so because of Fama the Younger’s observations.

Had he stopped there, Fama the Younger probably would have flown to Sweden to pick up his Nobel Prize money decades ago.

But the years went by, and Fama kept coming back to his hypothesis. He pushed it to all manner of odd places. So the Nobel committee was confronted with the problem of Fama the Elder — the second Eugene Fama. That professor built on his own work. The influence of his insight imbued the Elder with prestige far beyond what his latter flawed work should have generated. It allowed him to expand his efficient-market thesis. That, dear readers, is where our boy ran into trouble.

Fama the Elder took the idea of efficient markets to an illogical extreme. He made a leap of faith based largely on the earlier flawed analysis that led him to the correct conclusion that markets behave randomly. Because markets reflect all known information in their prices, Fama rationalized, most of the rules and regulations related to securities were unnecessary. Even worse, he reasoned, they were counterproductive because they interfered with the price discovery process.

Insider trading rules? We don’t need them! Why would we, when even nonpublic information known to insiders is reflected magically in stock prices! Indeed, we can eliminate nearly all of the rules that have been developed since the Great Depression to regulate investing and trading. After all, Fama argued, with all information reflected in the price, these rules are superfluous.

Over the next three decades, Fama the Elder exerted enormous influence. The professor shaped financial theory. He influenced generations of economics and business students nationwide. And his hypothesis swayed senators, Federal Reserve chairmen, even presidents.

This created a bit of problem for the Nobel committee working on the Sveriges Riksbank Prize in Economic Sciences. If the first Fama can rightfully be called the father of passive investments, then the second Fama is in many ways the intellectual father of the financial crisis. His thinking laid the groundwork for deregulations that had a terrible impact.

Consider the grand experiment just before the financial crisis: The Commodity Futures Modernization Act of 2000 turned derivatives into a unique category of financial instruments. They did not mandate any disclosure, they were not obligated to be traded on any exchange, and underwriters were not required to hold reserves against potential losses. The theory was that the risks would be reflected, somehow, in the price.

The repeal of Glass-Steagall was another deregulation that could be traced to Fama. Glass-Steagall acted as a firebreak between Wall Street and Main Street. When that firebreak went away, it did not cause the crisis, but it allowed its spread.

Even then-Federal Reserve Chairman Alan Greenspan fell prey to the errors of Fama’s hypothesis. Fed Gov. Ed Gramlich had brought the subprime mortgage lenders and securitizers to the Fed chief’s attention as predatory lenders with the power to destabilize the mortgage markets. Greenspan called them “financial innovators” who should not be burdened with regulation. As detailed by the Mortgage Lender Implode-o-meter. 388 of these firms went down in flames, ravaging the credit markets. Despite all of this, Fama the Elder went so far as to say, “I don’t know what a credit bubble means.”

You can see the quandary this created for the Nobel committee. On the one hand, Fama is the father of modern indexing; his influence — from the development of exchange-traded funds to retirement planning — cannot be overstated.

Fama the Younger’s work was insightful and created an immense benefit for investors. But Fama the Elder’s work was almost as bad as the earlier work was good. The premise was deeply flawed. People were not rational, profit-maximizing machines — they were emotional, error-prone actors who often operated against their own best interests. Information efficiency was a nice concept, but it simply did not work in the real world.

The Nobel committee resolved this problem quite elegantly.

Unbeknownst to Fama the Elder, he had an adversary 1,000 miles away. On the ivy-covered campus of Yale, a young man decided that the efficient-market hypothesis made no sense. Professor Robert Shiller’s data overwhelmingly showed that markets were at times as irrational as the humans who traded them. His 1989 book on market volatility found that price fluctuations in speculative markets were not rational and did not reflect all known information. Price action moved so much more than future dividends changed that something else had to be at work. That factor was human behavior.

Bubbles formed, prices detached from reality, then just as soon came back to Earth. This was hardly informational efficiency. After the 1987 crash, Shiller remarked, “The efficient-markets hypothesis is the most remarkable error in the history of economic theory.” Indeed, much of Shiller’s work over the next 20-plus years was railing against the hypothesis’s obvious failings. Warning of the tech bubble late in 1999 and then of the housing bubble in 2006 served to cement Shiller’s reputation, as well as his views that markets were irrational. Sometimes prices had nothing whatsoever to do with the available information — except the insight that people occasionally went crazy.

So the Nobel committee could recognize Fama the Younger, awarding him the prize for his work on unpredictability. But it could distance itself from the silliness of Fama the Elder, by having the Younger share the award with Shiller.

And that is how the most astute critic of the efficient-market hypothesis helped its creator win a Nobel Prize in economics.

Ritholtz is chief investment officer of Ritholtz Wealth Management. He is the author of “Bailout Nation ” and runs a finance blog, the Big Picture. Twitter: @Ritholtz .

Please use the comments to demonstrate your own ignorance, unfamiliarity with empirical data and lack of respect for scientific knowledge. Be sure to create straw men and argue against things I have neither said nor implied. If you could repeat previously discredited memes or steer the conversation into irrelevant, off topic discussions, it would be appreciated. Lastly, kindly forgo all civility in your discourse. you are, after all, anonymous.