How much depreciation of the EUR will Draghi accept

Post on: 29 Март, 2015 No Comment

Sign up for a 2-week free trial subscription to Rockfeller Treasury Services Daily Strategic Currency Briefings

Outlook:

The weekend will be a good time to ponder the Fed’s actions next week at the March policy meeting. Some analysts say the members will stay their hand from removing “patient” from the forward guidance statement because the dollar is too strong and causing dis-ruptions—wild capital outflows from Europe, emerging market currency distress, etc.

We say the members may talk about the dollar and may consider global capital flows, but don’t give a flying fig about it in the end. If they remove “patient,” it will be on domestic considerations. The real question is justifying rising inflation expectations. Where is that evidence? If they can’t point to surveys and data, the “evidence” is theory—that nearly full employment must mean inflation is pending, even if wage growth is lagging. This is sure to come under heavy critical fire.

It’s fun that economist Krugman in the NYT doesn’t address this puzzle, but instead ridicules the “dollar debasement” crowd who attacked QE and all Fed actions as failing to support the dollar (which is not the Fed’s job in the first place). The debasement crowd was wildly, seriously wrong about the dollar for easily identifiable reasons that we wrote about for years, and we agree that their silence now is gratify-ing, although it doesn’t mean they learned anything. Krugman misses that a different crowd is about to take center stage—the international monetary system is “unfair” to lesser countries and the US has its hands around their necks and is squeezing, the so-called “dollar trap” argument.

With Europe and China each retreating from the ability to deliver an alternative reserve currency, this is just too darn bad. Why anyone would imagine that Europe or China would do a better job “managing” reserve currency status is a mystery. If the world needs a better international monetary system, changing horses doesn’t provide it.

Back to the Fed. A WSJ poll of 63 economists (March 6-10) finds that 29 expect the first hike in June, 4 expect July, and 23 expect September. Here’s a kicker: “The economists’ forecasts for where the rate will be in December were essentially stable. The median estimate among economists for December 2015 was 0.75%. Looking ahead, the median estimate for December 2016 was 2.19%.

“Those estimates show some disconnect with the Fed. The central bank’s median estimate, released in its December summary of economic projections, was 1.125% for December 2015 and 2.5% for Decem-ber 2016. Investors’ expectations in the fed funds futures market are lower, at 0.515% for December 2015 and 1.365% for December 2016.”

For what it’s worth, we see the rate at year-end this year at 0.50% while the surveyed economists see 0.75% and the Fed projects 1.125%. Wow, what a discrepancy. Unless and until forward guidance gets a lot more specific, markets are vulnerable to volatility and general craziness.

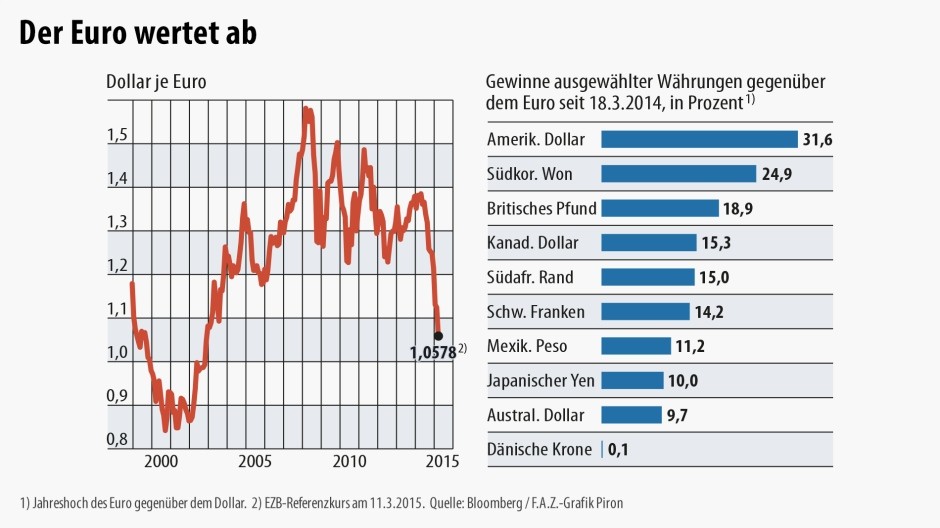

As noted above, the euro hit a wall a little under 1.0500, but we say history be damned, it’s not an inher-ently natural stopping point, long-term support line notwithstanding. As Market News points out, condi- tions are different. The last time the euro hit 1.0500 was Jan-March 2003. At that time, the ECB was in easing mode but with a low refi rate at 2.50%. This time, the Bund is hitting historic lows at 0.1855%. At the same time, the Fed funds rate was steady at 1.25% in Jan-March 2003. As a chart-reader, we respect support lines, but also know they get broken all the time. And let’s consider some-thing else that nobody is mentioning—the euro came into existence on Jan 1, 1999 but notes and coins did not go into circulation until 2002. In other words, the euro was still a relatively new currency at the time—only a year old in Jan-Mar 2003.

Amid all the talk of QE in Europe, we wonder if the most important point is Hollande letting the cat out of the bag. He said euro parity with the dollar makes life easier. “The ECB has taken bold, brave, re-sponsible decisions. These decisions lead to low interest rates, which are good for companies, and to a level of the euro that is becoming competitive.”

We have argued for a long time that Mr. Draghi is counting on depreciation to boost activity. Deprecia-tion is a far more reliable mechanism than bank lending, especially when banks are under the micro-scope for capital adequacy and something resembling decent risk management. But we also thought there would be a limit to how much depreciation the ECB would accept, especially if the German camp started getting grumpy about the weak euro. Germany has long held that a strong currency is a sign of a good and well-managed economy. France has long held that beggar-thy-neighbor is a perfectly good way to operate. So when Hollande says he favors parity, is he enraging the Germans or doing it with their complicity?

Again, we are not forecasting ECB intervention. Draghi is one smart cookie—we won’t even get any comments from Mr. Draghi until the trend looks like it’s petering out. Everyone and his brother talking about parity provides a certain amount of momentum all on its own. We can now see that a return to 0.8229, the low from October 2000, is well within reach. Hedgers should be quaking in their boots. Traders should be salivating (but watch out for the pros putting on the short squeeze). American shop-pers should be postponing their purchases of high-end European luxury goods (Ferragamo, here we come; Coach, watch out).

End of week nugget: Tomorrow in the US, the date will be written 3/14/15, and at 9:26:53, we will have the first 10 digits if pi. Better change your password right away if you are using pi—hackers will be out in force.