How Long Will Equity Income ETFs Remain Strong_3

Post on: 15 Май, 2015 No Comment

22 August 2013

Strong growth for strategy in July across major geographies, finds Deutsche Bank

Hedge fund performance has improved in the past month, taking the global cumulative median fund performance to 4.85%, according to the Deutsche Bank Hedge Fund Capital Group monthly industry snapshot.

The bank found the average hedge fund gained 0.93% in July, while equity long/short strategies continued to outperform other strategies.

European long/short equity funds have gained 8.17% since the start of the year, while US long/short equity funds have gained 9.21% and Japanese long/short equity strategies have returned 17.21% year to date.

Deutsche Bank said that the global dispersion of returns across strategies remained high — long/short equity funds were in the the 75th percentile, with average returns of 4.35% for July, while CTA/Managed futures and Macro funds were in the 25th percentile and had returned negative results of 5.19%.

The bank found the US continued as the largest source of new inflows, accounting for around 60% of new assets. Deutsche Bank found macro and equity hedge strategies had accounted for more than half of gross inflows throughout the first half of the year.

It also found a clear bias towards large, well-established managers among institutional investors, accounting for 57% of inflows to asset management houses with firms having AuM of $5bn or more.

Deutsche also found a third of managers had experienced declining interest from clients in fund of funds, while 24% reported institutional client growth and over a fifth (21%) specifically noted increasing demand from funds.

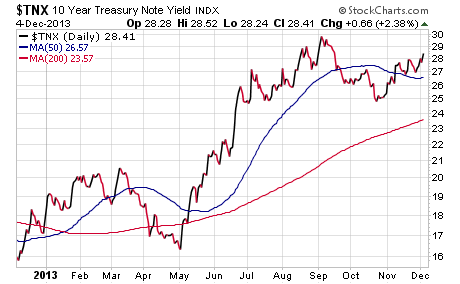

The Hedge Fund Capital Group also examined US fiscal policy and the role of US labour market improvements in interest rate-setting. It noted that a 7% unemployment rate was a guidepost for the end of asset purchases, with a 6.5% unemployment rate as a loose starting point for rate rises.

Our analysis suggests that the unemployment rate is most likely to fall to 7% in Q1 2014, 6.5% in Q4 2014, and 5.6% in Q1 2016. However, the balance of risks suggests that the unemployment rate may fall more gradually than this baseline scenario, it noted.

If the Fed begins raising rates in H1 2015, as we anticipate, the pace of rate hikes will have to be much faster than the market expects and the Fed’s forward guidance has implied.

On the outlook for Europe, Deutsche Bank said recent PMI PMI data implied that the Euro zone would return to growth in the second half of the year.

Across the major European economies, Deutsche said Germany and Spain were likely to experience improving business spending and credit conditions, respectively, but was less optimistic about the prospects for France and Italy.

Have your say

All comments are subject to editorial review.

All fields are compulsory.