How Interest Rate Swaps Are Valued

Post on: 11 Май, 2015 No Comment

When trading in financial markets, higher returns are generally associated with higher risk. Hedging risk is integral to mitigating substantial losses. Hedging can be done by a variety of means such as diversification. options. futures and swaps.

A swap is a contractual agreement in which two parties exchange the cash flows of financial instruments. There are a wide variety of swaps utilized in finance in order to hedge risks including interest rate swaps. credit default swaps. asset swaps. and currency swaps to name a few. While a means to hedge risks, financial professionals and economists attribute a large portion of the 2008 Financial Crisis to credit default swaps .

A credit default swap provides protection against credit loss on an underlying asset in the event of a catastrophe. In conjunction with the housing bubble and subprime mortgages, credit default swaps were overextended. As a result, major companies such as AIG (AIG ) were unable to back their investments. Credit default swaps alone did not cause the worst recession since the Great Depression.

While in this instance credit default swaps were unable to hedge risk, several other swaps can be effective when not overused. In particular, interest rate swaps are an agreement in which two parties agree to exchange a stream of fixed or floating interest payments of an underlying security. Widely utilized in fixed income markets, interest rate swaps have gained steam due to their highly liquid nature in the financial derivatives market. (For more, see What is a derivative? )

Interest Rate Swaps Explained

An interest rate swap is a contractual agreement between two parties agreeing to exchange cash flows of an underlying asset for a fixed period of time. The two parties are often referred to as counterparties and typically represent financial institutions.

In an interest rate swap the principal of the asset is not being exchanged; however exchanges are on the interest accrued (the cash flows) or coupon payments in the case of bonds at a certain date (for example, monthly, annually or quarterly). Vanilla swaps are the most common type of interest rate swaps. These convert floating interest payments to fixed interest payments and vice versa. The counterparty making payments on a variable rate typically utilize benchmark interest rates such as LIBOR. Payments from fixed interest rate counterparties are benchmarked to U.S. Treasury Bonds .

In a fixed-for-floating interest swap. the party making payments with a fixed rate is recognized as the buyer, while the floating rate counterparty is the seller. The maturity of vanilla swaps can exceed 30 years depending on the value of the underlying asset. (For more, see: An Introduction To Swaps .)

Value of Interest Rate Swaps

With many moving parts, the value of an interest rate swap can be difficult to assess. For simplicity, interest rate swaps are priced as the sum of the present value of each cash flow.

Present value is defined as the current worth of future cash flows given a specific discount rate. It is generally accepted that a dollar today is worth more than a dollar in the future due to the opportunity to invest said dollar. In an interest rate swap, both counterparties assume they will increase returns in making fixed exchange payments or floating exchange payments.

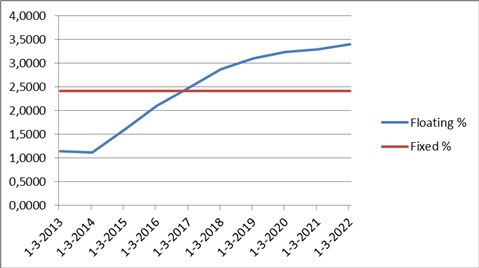

Valuing fixed rate payments of an interest swap is straightforward. Due to the unchanging nature of fixed interest rates, the discount factor utilized in calculating present value does not change. Conversely, valuing the floating leg of an interest swap can be more complex. The floating rate is established on the first payment based on current market levels and changes periodically with respect to the market. A benchmark rate such as LIBOR is used in calculating the discount factor for floating rate payments.

By definition, interest rate swaps reflect the perception of interest rates in the future. When the interest rates increase, the counterparty making fixed rate payments realize higher returns. Conversely, the value of a swap increases for the floating rate counterparty when interest rates decrease. (For more, see: How To Value Interest Rate Swaps .)

Pros and Cons

The use of interest rate swaps have been fundamental in fixed income markets. In particular, interest rate swaps have been associated with the bond market. Coupon payments on bonds represent an interest bearing asset with inherent risk. The counterparty offering a floating interest rate benefits by hedging risks associated with their security. The counterparty holding fixed interest rate payments benefit from anticipated profits.

A comparative advantage may exist where a financial institution can receive better interest rates, floating or fixed, than other borrowers. For obvious reasons, this allows an institution to gain higher returns or successfully hedge risk from other investments. As a means to hedging risk, a company may find interest rate swaps useful. Exchanging variable interest rate income for fixed rate income can provide a steady stream of cash flow not typically realized with floating interest rates.

While swaps have potential for increased returns or may hedge an underlying asset, interest rate swaps have inherent risks and disadvantages. Floating interest rates are inherently unpredictable even when benchmarked to large securities such as LIBOR. The party associated with floating rate payments will profit with decreasing interest rates and lose with increasing interest rates.

Inherent in financial trades or exchanges are counterparty risks. While trading between financial institutions is generally less risky, recent events like the 2008 worldwide financial crisis prove that even the biggest companies can fail. Overextending swaps can cause a lack of transparency in financial instruments that have been regarded as highly liquid. (For more, see: Are Derivatives A Disaster Waiting To Happen? )

The Bottom Line

Over the past 10 years, swaps have increased in popularity due to their high liquidity and ability to hedge risk. In particular, interest rate swaps are widely utilized in fixed income markets such as bonds.

While history suggests swaps have been detrimental and cause of economic recession, interest rate swaps can prove to be valuable when financial institutions utilize them effectively.