How Higher Taxes for The Rich Actually Hurt the Poor

Post on: 16 Март, 2015 No Comment

Won’t Taxes Just get Passed on?

Do the rich actually pay for the higher taxes when they become law? Technically, the answer is yes. But the reality is that those costs are usually just passed on to other people or spending is restricted. Either way, the net effect is often a huge hit on the economy. Millions of small and medium-sized businesses fall into the target zone for higher taxation. If a small business is hit with higher costs due to an increase in fuel prices or raw goods, those increases are usually just passed on to the consumers, and those with less disposable income see their costs rise to sometimes devastating levels.

Trickle-Down Taxation

If the feed for livestock increases due to demand, that cost increase is eventually added into the price of a gallon of milk or a pound of cheese. When gas prices more than double causing the transportation costs of the milk and cheese to double, those costs are also built into the prices. And when taxes (income taxes, corporate taxes, Obamacare taxes or otherwise) are raised on the businesses that either produce, transport, or sell the milk and cheese those costs will equally show up in the price of the product. Businesses simply don’t just absorb increased costs. Higher taxes are treated no differently than other forms of increased costs and are typically trickled down and paid by consumers in the long run. This makes life harder on both the small businesses seeking to survive by keeping costs competitive but being unable to do so and Americans with less money to spend than just a few years earlier.

Middle Class and the Poor hit Hardest on Higher Taxes

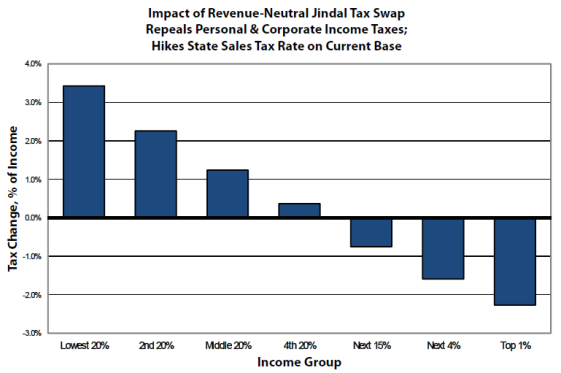

The main argument made by conservatives is that you don’t want to raise taxes on anyone — especially in rough economics times — because the burden of those costs eventually are spread out and hurt lower income Americans. As seen above, higher taxes are simply just passed on to consumers. And when you have many people and businesses involved in the production, transportation, and distribution of products, and they are all paying higher costs, the added costs built into the selling prices quickly begin to add up for the end consumer. So the question is who is most likely to be harmed by increased taxes on the rich? Ironically, it may be the income brackets that continue to demand those higher taxes on others.

Taxed More, Spending Less

Higher taxes have other consequences that can also impact the lower and mid-range income brackets more than the wealthier people those taxes are supposedly aimed at. It’s simple, really: When people have less money, they spend less money. That’s less money spent on personal services, products, and luxury items. Anyone who has a job in sectors that sell expensive cars, boats, houses, or other sometimes luxurious items (in other words, anyone in manufacturing, retail, and construction industries) should want to have a large pool of people looking to buy. Sure it’s fun to say that so-and-so doesn’t need another jet. But if I make jet parts, work as a mechanic, own an airport hangar, or am a pilot looking for a job I want there to be as many jets purchased by as many people as possible.

Higher taxes on investments also means fewer dollars spent investing as the reward starts to be less worth the risk. After all, why take the chance at losing already-taxed money when any returns on that investment are taxed at even higher rates? The purpose of low capital gains taxes is to encourage people to invest. Higher taxes means less investing. And that would hurt new or struggling businesses seeking financial backing. And taxing charitable donations at normal income rates would also reduce the amount of charitable giving. And who benefits the most from charitable giving? Let’s just say not the rich who would simply just be forced to donate less.

Liberals: Punish The Rich out of Fairness

It’s just fair to tax people who have a lot more money than everybody else. Warren Buffet said that it would raise the morale of the middle class to have the rich pay more, also using the false argument that people like Mitt Romney pay less than most middle-class Americans. In reality, a taxpayer would have to make well over $200,000 in regular income to match the Romney or Buffet tax rates. (That’s even taking into account the millions upon millions both guys give to charity, another reason for the low-for-millionaires-but-higher-than-most effective tax rate.) It’s also unfortunate to think that any individuals morale would be raised simply because the government takes more and more from someone else. But perhaps that defines the difference between a liberal and a conservative.