How Does The Cross Currency Swap Hedge The Long Term Equity Exposure In The

Post on: 11 Май, 2015 No Comment

Search Results for ‘how does the cross currency swap hedge the long term equity exposure in the foreign subsidiary’

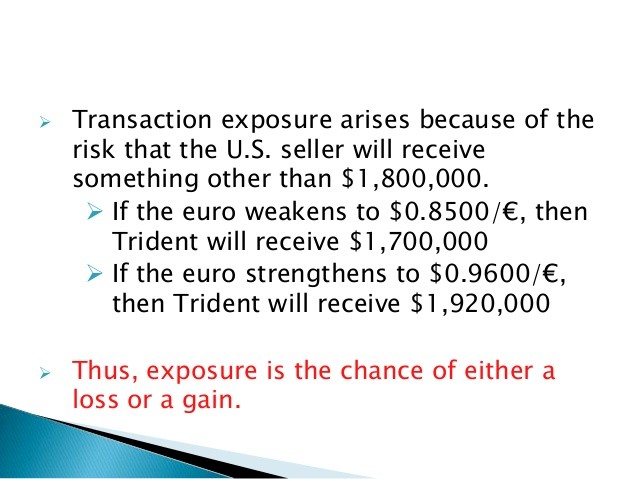

declined in the anticipated date. 2. How does the cross-currency swap hedge the long-term equity exposure in the foreign subsidiary? A cross-currency swap is said.

Southwest is not. Southwest owns long-term contracts to buy most of its fuel at the equivalent of $51-a-barrel oil through 2009. The value of those hedges soared.

and the performance in volatile and less volatile markets. The case for the long/short equity hedge fund Julien Suzor 2/1/2008 2 | P a g e Table of Contents.

countries and have an interest in keeping the same value of the assets in that subsidiary. Recognition of Foreign Currency Hedges Recognition is an important part.

became a major part of the debate. The Long Term Capital Management (LTCM) disaster showed the huge amount of risk that hedge funds can use to achieve the required.

Love Home Swap create value in terms of consumer well being? What role can marketing play in this process? 1. Introduction The notion of marketing and its role.

To provide an integrated perspective of management functioning along with a fair amount of exposure to real life cases/technical know how To hone the students.

investors about Chinas political situation Super China Exposure invests in companies that do not have strategic subsidiaries in China (eg: BHP Billiton business in.