How does inflation affect market Economic Times

Post on: 16 Март, 2015 No Comment

Arnav Pandya, TNN Feb 15, 2007, 03.02am IST

Equities have been feeling the heat of rising inflation over the past few sessions. Unlike debt markets, which track inflation data closely, the stock market normally reacts when there is a significant change in inflation, either ways, over a period of time. We are starting a weekly column where we take you through topics that have a bearing on the market.

What is inflation? How is it measured?

Why does inflation shown by an index and that experienced by an individual differ?

An index used for measuring inflation comprises several items having different weightage and hence the index moves according to the price changes in these items. For an individual, the various quoted price indices are usually not an exact measure of the inflation that they are witnessing because their spending will not match exactly with the inflation index composition. More important, the consumers’ expenditure basket will not be adequately represented by a price index because items like education fees or various services that they avail of are usually not a part of the price index.

How does rising inflation affect the stock market?

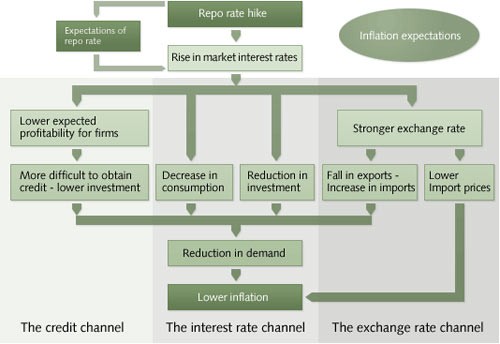

To tame inflation, the government usually hikes interest rates. This tends to make debt instruments attractive relative to equities as the former carry a lower risk (small savings instruments are risk free as they are guaranteed by the government). This results in some amount of investments shifting from equity to debt.However, high inflation is not always bad and low inflation need not always be good for equity markets, as the impact will differ for companies and sectors across different time horizons. The first thing to consider is the items where prices are rising. For example a rise in oil prices will impact a wide range of items from food products to those that require transportation.

How are companies affected by rising inflation and how does an investor view the impact?

A rise in prices of several items means that the input prices for production of various goods and services are rising. In these cases market analysts and fund managers will always consider the net impact on the margin of the entity that they are tracking.

While there might be an increase in the input prices, it has to be considered in the backdrop of the company’s ability to pass on the price hike to the end-user. If a company is able to sustain its profit margin despite high inflation, the stock price is likely to hold. If the high inflation sustains, at some stage it will lead to a chain reaction across the economy, pushing up interest rates and even affecting demand. An increase in interest rates will push up borrowing costs for corporates while lower demand will hurt growth in revenues. This is likely to impact sentiment for the stock market as a whole.