How Do Pivot Points Work

Post on: 5 Август, 2015 No Comment

By: DailyForex.com

Pivot points are one of the more common indicators that traders use in the Forex markets. This is especially true if the trader is an intraday trader, but loses a bit of importance for the longer-term trader. The main reason why they are so popular is because they are a quick way to figure out potential support and resistance in a market.

The potential areas are based loosely upon the idea of expected volatility in a pair, and got their start in the futures pits as a quick way to look for trading opportunities during a trading session. There are people that will figure out pivots on a longer time frame, but whenever you come across them, it is almost always on a short term chart. In fact, there are short-term traders that use nothing but pivot points.

Some platforms support Pivot Points but if you use a platform that doesnt support it, you can easily calculate and plot them. For those of you using MetaTrader 4, there are plenty of indicators available for download on the forums around the Internet that will automatically calculate them, and some brokers will also offer tools to do it for you.

Pivot Levels are calculated using three types of information from the previous trading day:

High price

Low price

Close price

Obviously, to find the high, low and close price of the previous day you simply need to check the candlestick from the previous session. Many traders will plot the pivot points on shorter time frame charts like the hourly and fifteen minute version. Pivot levels can tell you when the market will reverse and change the direction as the other short term traders follow them as well. Obviously, these arent 100% predictive, but they can give you a good idea as to when the day traders may be looking to reverse the market for the immediate future.

In order to calculate these pivot points, use the following formula:

Pivot Point = ( Yesterday High + Yesterday Close + Yesterday Low )/3

Resistance 1 = ( Pivot Point x 2 ) — Yesterday Low

Support 1 = ( Pivot Point x 2 ) — Yesterday High

Resistance 2 = Pivot Point + ( Yesterday High — Yesterday Low )

Support 2 = Pivot Point — ( Yesterday High — Yesterday Low )

These are potential areas of support and resistance in the short term markets that may be a guide for the day. Often, traders will also use something like a candlestick in order to confirm the reactions that could be happening at these areas as well.

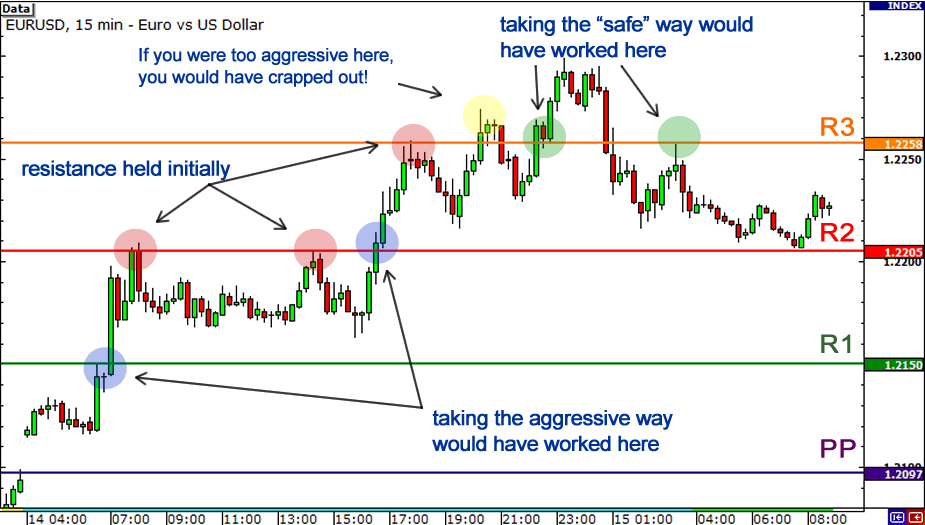

Attached is a chart showing the daily pivot points on a 15 minute chart. Notice how price has reacted to these levels as traders step in and out of the market:

As you can see, these are good guides as the where the markets may move and react to. However, it is suggested that pivot points simply be part of your system, not the entire system.