Home Run FX Position Short Japanese Yen ETF

Post on: 3 Июнь, 2015 No Comment

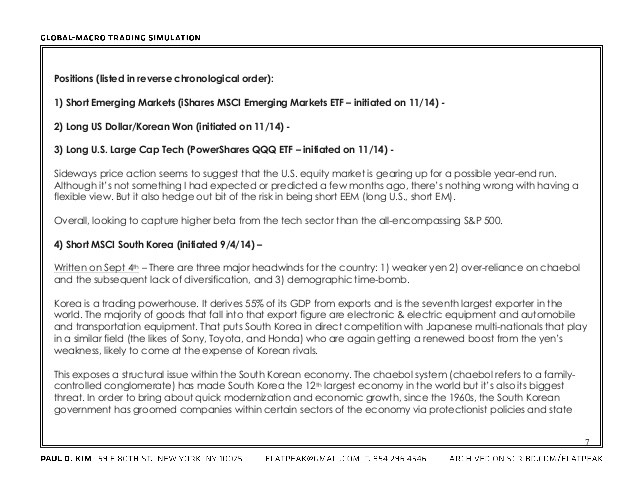

Japanese monetary policy is undergoing monumental changes since the start of Shinzo Abe reignited economic reform under the guise of Abenomics. Japanese Yen (USD/JPY) jumped from low 80s to over 100 in the last 2 years however momentum has slowed with hike in consumption tax starting from April 2014 with additional hikes expected in 2015.

The Japanese stock market had a great run in 2013 and has slowed down this year. The largest diversified international stocks ETF is the iShares MSCI EAFE. MSCI EAFE Index Performance has lagged S&P 500 by almost 50% in the last 5 years, even as 20% of the $50 billion fund contains Japanese equities which had a great couple year returns.

Japanese Yen ETFs is one way for the investors wanting exposure shorting the USD/JPY if they expect the Yen to continue weaken. One advantage of using ETFs instead of foreign exchange futures or direct FX position to short the Yen is ETFs allow more control in managing exposure to dollar yen in the portfolio. (for example FX futures is not practical for smaller investors as the face value of each contract is fixed usually at $100k USD).

(Solar Mutual Funds provided one of the best performance in alternative energy space read our research on which fund is the best for your portfolio)

There are 2 primary Japanese Yen ETFs allowing investors to gain exposure to short yen:

ProShares UltraShortYen (YCS ) which track USD/JPY

Currency Shares Japanese Yen Trust (FXY) which is an inverse of USD/JPY. By using leverage, UltraShortYen ETF targets for 200% of the daily movement in the USD/JPY.

For both Short Yen ETFs, the benchmark is the 4PM foreign exchange fixing. The ETF tracks the changes in the exchange rate movements during the hours when the market is open with a slight premium or discount. If you trade in a forex account there is a daily cost of holding position by paying interest on amount borrowed and interest earnings but because of the spread, usually there is always a negative carry. If the fund does not use leverage, then there is no negative carry.

YCS and FXY are both similar in size ($100 million) however FXY have higher value of daily trades (with volumes the same but FXY units trades at a higher price. There is one important distinction between the two ETFs. As YCS is a leveraged Yen ETF the expense is higher 0.95% vs the expense ratio of FXY 0.40%.

Comparing Japanese Yen ETF Performance

Chart below shows the performance of the YCS vs USD/JPY over 5 years. Using the same starting point YCS in blue and USDJPY in black track each closely. However there are period of divergence overtime as the cost of ETF which is equivalent of cost of carry for FX position start. The performance drag of the ETF over 5 years is around 0.80%.

YCS (Black) USDJPY (Blue)