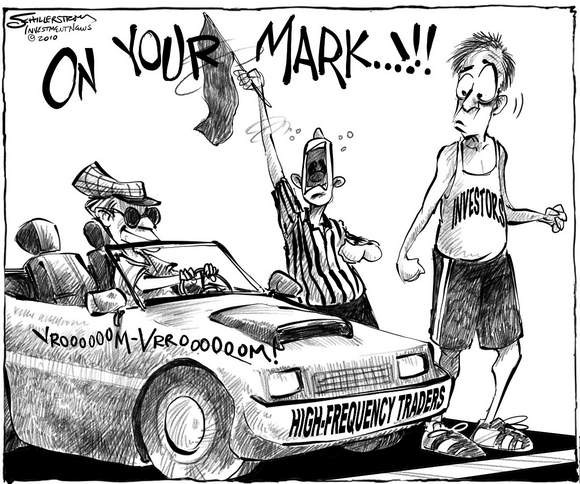

HighFrequency Trading Costs You $5 Per Trade

Post on: 16 Май, 2015 No Comment

Turn on, boot up, and jack in — if you want to save your $5, that is. While the computers behind high-frequency trading might have many benefits, one economist puts the cost to retail investors at $5 per futures contract. What does this mean for small investors without their own algorithms and supercomputers? How can the little guy compete with Stock-o-tron 3000?

Simple: Limit your potential interactions with the machines.

The study

As The New York Times reports. chief economist Andrei Kirilenko at the Commodity Futures Trading Commission found the $5 figure in his yet-to-be-peer-reviewed study. He looked at futures contracts based on the S&P 500 ( SNPINDEX: ^GSPC ) and determined:

The most aggressive [traders] scored an average profit of $1.92 for every futures contract they traded with big institutional investors, and made an average $3.49 with a smaller, retail investor. Passive traders, on the other hand, saw a small loss on each contract traded with institutional investors, but they made a bigger profit against retail investors, of $5.05 a contract.

The average aggressive high-speed trader made a daily profit of $45,267 in a month in 2010 analyzed by the study.

So on average, in each trade with a machine (at least in the futures realm), you lose out on a Subway Five-Dollar Footlong. How do they do it?

The internals of HFT

Again, the Times has an excellent primer on the subject. Basically, computers can ping for quotes and send in millions of orders per second while canceling them virtually simultaneously. This can provide the firms with information more rapidly than human traders can, and the computers can execute the trades to book profits. And along with the money made from bid and ask prices, the exchanges themselves pay fractions of a cent to the firms for each share traded.

Of course, sometimes the computers get a bit feisty, or the humans that programmed them slip up, which can lead to situations that would otherwise be unimaginable if there weren’t just a pile of electronics behind the trades. Knight Capital ( NYSE: KCG ) knows this all too well: Its computers lost $10 million per minute earlier this year. There’s also the great Flash Crash of 2010. Single stocks have also had their own mini-crashes, like Annaly Capital ( NYSE: NLY ) and American Capital Agency ( NASDAQ: AGNC ) dropped roughly 20% before recovering in July 2011.

Research on research

The growth of HFT has spawned piles of reports on its effects. It’s obvious that algorithms are behind the odd market occurrences mentioned above, but a British study suggests that otherwise, HFT has been good for investors. According to the report, HFT is not to blame for increased volatility and actually makes it cheaper and easier for investors to buy and sell stock at any time.

So far, the research has yet to reach a conclusion. And until that happens, it’s unlikely that U.S. regulation will stop the machines — although regulation that has been implemented in Canada and Europe may follow. But even if research does reach an accepted conclusion, it may be too late if profits from HFT fall too low to make it an attractive business. As Izabella Kaminska of FT Alphaville points out, HFTs could eventually cannibalise themselves out of the market, since their very presence erodes arbitrage and hastens price discovery. However, she says, iI’s also possible that price discovery has been impaired so much by HFTs that everyone’s trading around a false equilibrium point and doesn’t even know it. in which case a giant recalibration or reset may be lying just around a corner, something which would benefit all HFTs.

Anti-HFT your portfolio

If you do believe HFTs are a negative for investors, the simplest way to avoid them is to take a long-term investing strategy. The fewer trades you make, the less chance you pay a slight premium to an HFT computer. While the stocks you own in your portfolio may undergo flash crashes, understand that they are just that — a flash. If there is true value behind the companies in which you own stock, no manner of market manipulation should take that value away.

To start building a portfolio on a few simple trades on great companies to stick with for the long term, read our free report 3 Stocks That Will Help You Retire Rich. In it, we name stocks that could help you build long-term wealth and retire well, along with some winning wealth-building strategies that every investor should be aware of. Click here now to keep reading.

Fool contributor Dan Newman has no positions in the stocks mentioned above. The Motley Fool owns shares of Annaly Capital Management. Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors. The Motley Fool has a disclosure policy .