HGCA Prospects Options worth their value in current market (2014 strategies)

Post on: 27 Июнь, 2015 No Comment

After a volatile period throughout December, January brought a more bearish trend to the market, reiterating the importance of a pricing strategy as the market fell by over £10/t. ‘Catastrophe Pete’ is the strategy that has shown the most resilience and is currently on top of the 2014 pricing strategy rankings.

Richard Veit, Strategic Insight team

The 2014 Price Risk Management demonstration was launched back in October 2013, designed to illustrate the pros and cons of a series of wheat pricing strategies for the 2014 harvest. This is the penultimate update examining the impact of post-harvest sales.

Current Market Trends

Despite a three-month period of resurgence in the final quarter of 2014, wheat prices over January have again taken a downturn in reaction to supply and demand fundamentals. At the start of February, at little over £122/t, nearby wheat futures were back to levels recorded in early September. With estimated costs of production for the model farm used in this illustration at £151/t, sales made on the spot market would make a loss of approximately £30/t.

Several of the strategies in this exercise have now finished their life cycles. As such, this recent fall will not affect them. However, for those with sales still to be made, the downward trend will negatively impact average prices and profitability.

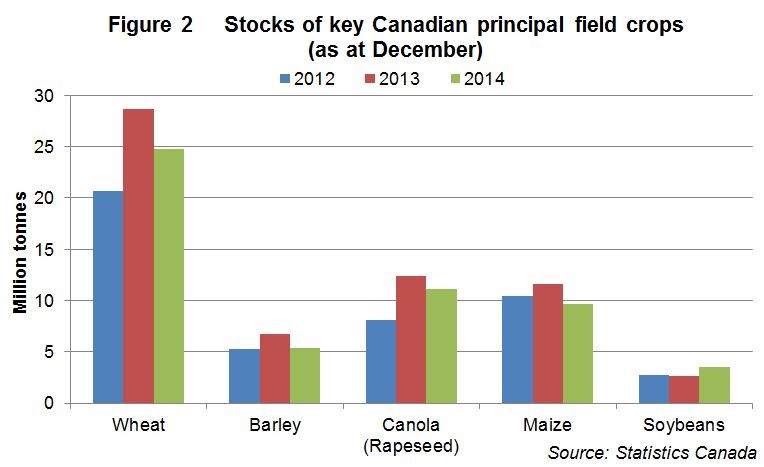

The strategies – summarised in Figure 2

Post-harvest averaging – “In hand”

At the bottom of the ranks this strategy points towards the dangers of waiting until harvest before making any marketing decisions. An effective strategy should use market information in order to effectively manage both falling, and rising markets. With the entire crop sold post-harvest, this strategy was left completely exposed to the downturn between April and October.

This strategy failed to manage falling markets and left the business vulnerable to further losses. The upturn in the final quarter helped lift average prices, but the market direction has again turned. A significant proportion of the crop remains unsold and exposed to the risks of a falling market.

Averaging – “Average Joe’s”

This strategy made regular sales over the course of the 2014 calendar year, which allowed it to manage some of the volatility and the downturn in the market. The strategy finished in December 2014 and is currently ranked 6th. The low ranking is partly due to the timing of sales. The strategy started in January 2014, and only three sales (out of 12) were made above the estimated cost of production.

If the strategy had started forward sales at planting, or used market information to bring forward sales scheduled for later in the year, “Average Joe’s” would have finished with higher average prices, and hence higher in the overall rankings.

Three thirds – “Simplicity”

“Simplicity” aimed to manage risk through both the pre and post-harvest sales period. Sales were split into three lots, with two sold pre-harvest, and the remaining volume spread over the post-harvest period.

“Simplicity” is currently ranked second, with 15% of the harvest currently unsold. The strategy benefited from forward sales made before the market fell through the farm’s break-even price. However, if the market had turned a week or two earlier, the second sale would have been below the cost of production.

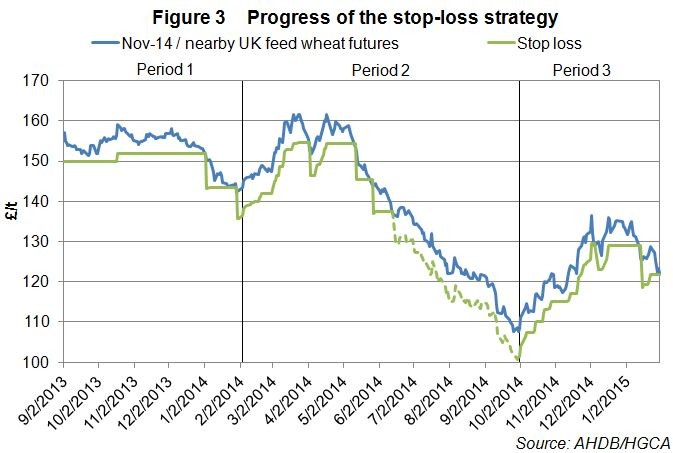

Floating stop-loss – “Trigger happy”

“Trigger happy” has consistently ranked high, both for the 2014 and 2013 harvest strategies (Click here to see the end of year report on the 2013 harvest strategies ). The strategy is designed to take advantage of any price rises, while limiting the impact of falling markets. This strategy is split into three selling periods, with four lots for each period. Any unsold lots at the end of the period are sold on the last day of that particular period.

The first selling period ran from September 2013 to January 2014. Unfortunately, the end of the period coincided with some of the lowest prices recorded over the period, and approximately 14% of the crop was sold at these prices. The second period ran from February to September. Due to the steady fall in prices since May, all lots were sold by mid-June. As such, this strategy tracked Nov-14 futures until the end of the period.

The final period opened in October and will finish in May 2015. With the gradual market strengthening in the final quarter of the 2014 calendar year, the strategy was able to take advantage of an appreciating asset. Two sales have so far been made, as the strategy mitigates the recent downturn. Two lots remain open. If the market continues to fall, both of these could be sold in a relatively short space of time.

Options I and II – “Call it” vs “Catastrophe Pete”

These two strategies both incorporate the use of forward sales, post-harvest sales and options to manage market volatility. The only difference between them is that “Call it” bought an ‘at the money’ call option, while “Catastrophe Pete” took out an ‘out of the money’ call option. Click here for key details of the strategies and the differences between an ‘at the money’ versus an ‘out of the money’ option.

Both strategies have been relatively successful in managing falling prices. The use of options secured minimum prices for the proportion of harvest sold under them. although there was a cost factor involved. Forward sales provided another avenue to manage risk, while also helping with cash flow.

The two strategies finished in December. “Catastrophe Pete” is currently ranked first, securing an average price of £2.40/t higher than “Call it”. The price difference reflects the cheaper option taken under “Catastrophe Pete”. Both options expired below their strike price, meaning that there was no additional income. It is important to note, however, that if the market had strengthened over the year, rallying beyond the strike price, “Call it” would have seen higher returns than “Catastrophe Pete”.

Options III – “White Collar”

This is a ‘minimum-maximum’ risk management strategy. A proportion of the crop was planned to be sold post-harvest (October 2014). However, to offset the risk of falling prices, a put option was bought in September 2013, thereby setting a minimum price for the grain. To offset some of the cost, a call option was also sold at the same time, setting a maximum price. This strategy requires the grain to be sold and both options closed on the same day.

“White Collar” has been relatively effective in managing the market downturn. The use of options secured a minimum price, while the overall fall in market prices meant that the potential disadvantage of a price ceiling – used to offset the cost – was not been seen. If the market had strengthened beyond this price ceiling, this strategy would not have been able to benefit as much as other strategies.

The strategy is currently ranked fifth and with 14% of the crop still unsold, exposed to both upside and downside movements in the market.

The current rankings of the 2014 pricing strategies illustrate the importance of developing an appropriate risk management strategy, using tools such as options and forward sales, and to update as more market trends becomes clearer.

Look out for the final update in June.

- An effective risk management strategy will be updated as market trends become clearer

- An effective strategy can help manage a falling market, while also taking advantage of price increases