Hedging with Commodity Futures It’s All About Managing Price Risk!

Post on: 21 Май, 2015 No Comment

This post originally appeared in FutureSources Fast Break Newsletter on February 25, 2011, where Drew Wilkins is a regular contributor on various futures trading topics.

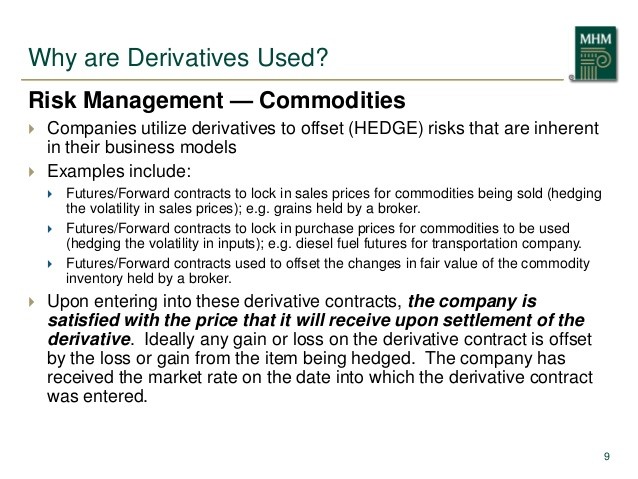

The goal of hedging is to transfer price risk from one party to another. Hedging has been used for hundreds of years to help producers and buyers protect themselves from price risk. By hedging, producers and users can set the prices they will receive or pay within a roughly determinable range. However, hedging is still an underutilized tool that many choose not to use. This article will help you to understand the benefits of using the futures markets to reduce price risk.

Why should I hedge?

That is the question you will have to ask yourself when trying to figure out the benefits of hedging. Would you like to protect your crops against a decline in value? As a buyer, do you want to insulate yourself from a significant rise in prices? The futures markets can be used to hedge the risk in both of these situations.

Cash Futures = Basis!

This is a very important formula to remember. Basis is the difference between the cash price and the futures price of a commodity. Basis consists of carrying charges and costs of transportation for the commodity to an exchange approved delivery point. For example, if the cash corn market is at $6.93 and the futures price is $7.00, the basis would be -.07 (6.93-7.00). As the delivery month draws near and the prices converge, basis approaches zero.

Long Hedges vs. Short Hedges

There are two types of hedges, long hedges and short hedges. Someone who is buying the commodity later in the cash market would be a long hedger. Someone who is selling the commodity later in the cash market would be a short hedger. A long hedger is someone who wants to protect themselves from price increases (user). A short hedger is someone who wants to protect themselves against declining prices (producer). A long hedge is also known as being short the basis and a short hedge is known as being long the basis. A hedger who is short the basis (long hedger) benefits from the basis becoming more negative. A hedger who is long the basis (short hedger) benefits from the basis becoming more positive. In the corn example above, a long hedger would want the basis to get more negative. A short hedger would want the basis to get more positive.

To sum it up, a long hedger wants to protect against increasing prices and benefits when basis weakens. A short hedger wants to protect against decreasing prices and benefits when basis strengthens.

Real-World Example

A farmer who has been on the fence about hedging decides to hedge his corn crop. He thinks that prices will remain around the current level or decrease in late August when he anticipates selling his new crop. The cash price for new crop corn is $5.52 and the September futures price is $6.28. The farmer anticipates that he will have 10,000 bushels of corn to sell. Since the farmer wants to protect himself against a decrease in prices, he will be a short hedger. His goal is to lock in the price of $5.52/bu for corn. Each corn futures contract contains 5,000 bushels. The farmer sells two September 2011 corn futures contracts at $6.28 on 2/23/11.

It is now September and the farmers instincts held true. Cash corn prices are currently at $5.00 and September futures are trading at $5.25. The farmer sells his grain in the cash market and offsets his position in the futures market on 8/28/11.