Have Oil Prices Hit Their Floor

Post on: 16 Апрель, 2015 No Comment

New market equilibrium could come from U.S. shale drilling

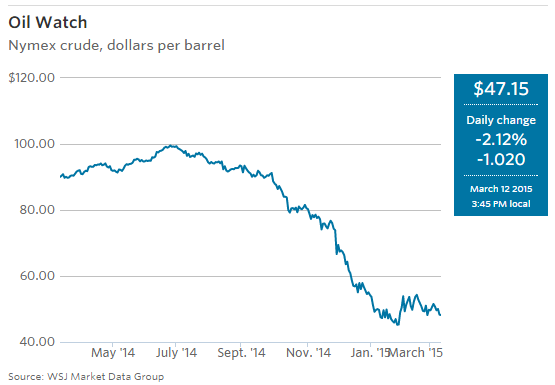

After their sharp drop late last year, oil prices have been trading in a relatively steady band for more than a month, raising an obvious question: Has the market hit a bottom?

A number of fundamentals suggest not yet: Global storage levels are brimming. Economies in the U.S. Europe and Asia are all mixed, clouding demand forecasts. And some of the world’s biggest producers—including Saudi Arabia, its fellow OPEC members and Russia—are still pumping at full speed. All of that means the global glut of oil that caused the big price drop in the first place isn’t likely to ease soon.

More Reading

Still, some investors and analysts expect a new market equilibrium to eventually take hold, one based on the assumption that U.S. shale producers can react to prices much faster than conventional drillers. Some say it may already be happening.

“We think (shale production) is a lot more responsive to price changes,” said Antoine Halff, head of oil and markets at the International Energy Agency, the global watchdog for consuming countries, in a recent speech. “This will make this recovery much different than previous ones…we see the market to be a little more smooth and balanced than in previous price swings.”

U.S. shale production is now a key component of global supply—growing from almost nothing to 3.6 million barrels a day last year, according to the IEA. That is still a fraction of the approximately 30 million barrels of crude that members of the Organization of the Petroleum Exporting Countries pump each day. But shale capacity can be switched on and off much more quickly than conventional wells, providing a more-immediate supply response to price moves, analysts say.

Shale producers drill more wells than conventional producers. Those wells can vary widely in costs, but to curb output, producers can simply slow down the drilling and completion work of some of these wells. That is a lot easier than “shutting in” production—or turning wells off—which can be costly and take months or even years to reverse.

Oil lost more than half its value in the last six months of last year and into the first weeks of 2015, the type of huge swing that has happened only once a decade or so over the past half century. Prices recouped some of their losses in early February and have since stabilized.

ENLARGE

Workers install a shale-gas pipeline in Pennsylvania. Photo: Associated Press

U.S. crude has been trading between about $47 per barrel to $53 per barrel. Still, that is well below the $107 a barrel it fetched in June of last year. Brent, the international benchmark, has been stuck in a recent range of around $56-$62 per barrel. Late Thursday in New York, U.S. crude was down nearly 2.3% on the day. trading around $47.

Last week, money managers increased their bullish bets on the direction of Brent, boosting long positions by about 5%, according to data provided by Intercontinental Exchange Inc. At the same time, though, traders pared back long positions on U.S. crude, according to U.S. Commodity Futures Trading Commission data.

Georgi S. Slavov, head of research at London-based commodities brokerage Marex Spectron, said crude hit its floor, at least for now, as Brent approached $40 a barrel in January. At that level, about half of the world’s output wasn’t profitable. he figures, suggesting producers would have to pull back.

“When oil came close to $40 in January, production capacity was quickly withdrawn, which caused the rebound,” he said. “This forms the floor.”

Indeed, the number of U.S. oil drilling rigs—a proxy for activity in the oil industry—has fallen sharply since prices headed south last year. There are now about 40% fewer rigs working since a peak in October.

That hasn’t yet translated into a drop in actual output, even though it has squelched production capacity. The U.S. Energy Information Administration earlier this week forecast that output in four of the five biggest shale production areas in the U.S. will fall next month, though overall production is still expected to rise by about 1,000 barrels a day.

Still, the magnitude of the U.S. drilling pullback is enough to support prices, Mr. Slavov said. At the same time, at $60 a barrel, “this spare capacity is brought back,” making that level an approximate “ceiling,” he said.