Goodwill as Part of a Corporate Asset Sale

Post on: 16 Март, 2015 No Comment

Photo by Noam Armonn/Hemera/Thinkstock

- When a corporation is sold in an asset sale, a separate sale of a shareholder’s personal goodwill associated with the corporation can result in the gain from the sale of the goodwill being taxed to the shareholder at long-term capital gains rates.

- Personal goodwill can be present when the owner’s reputation, expertise, skill, knowledge, and relationships with customers are critical to the business’s success and value.

- Personal goodwill may be deemed an asset of the corporation where shareholders have transferred the goodwill to the corporation through noncompetition, employment, or other agreements with the corporation.

- A sale of corporate assets and personal goodwill should be carefully planned and executed to establish that personal goodwill exists and that it is being sold in a separate transaction from the sale of the assets of the corporation.

Selling a business can require some of the most important tax planning an owner may ever need. That is particularly the case where a business has operated as a closely held C corporation and the proposed structure of the deal is an asset sale. In this situation, the owner can often significantly reduce his or her tax liability on the sale of the business by selling his or her personal goodwill associated with the business separately from the business’s assets. However, to ensure a sale of personal goodwill is respected, an owner should take steps before or during the sale transaction to establish the existence of personal goodwill and that it has been separately transferred.

This article offers practical guidance to practitioners helping clients to take advantage of this effective tax strategy early in tax planning, by explaining the importance of identifying the goodwill associated with the business, determining its ownership and value, and negotiating its sale and transfer. Through reviewing court decisions, this article also helps practitioners avoid potential planning pitfalls.

The Basics

A taxable sale of assets by a C corporation, an S corporation with earnings and profits, or an S corporation subject to the built-in gains tax (each a target corporation), followed by a liquidation or distribution of the sale proceeds to shareholders, normally results in a double tax at the corporate and shareholder levels.

While double taxation can be avoided if the transaction is structured as a stock deal, with the shareholders selling their stock in the target corporation, a purchaser may prefer an asset deal for at least three reasons, including:

- In an asset deal, the purchaser gets a stepped-up, fair market value basis in the acquired assets equal to the price paid and any liabilities assumed (the purchase price), and will therefore get higher depreciation and amortization deductions than the target corporation was enjoying.

- Unlike in a stock deal, which takes the target corporation with all its liabilities, known or unknown, an asset deal allows the purchaser to select which liabilities, if any, it will assume.

- Similarly, an asset deal allows the purchaser to select which assets it will purchase, rather than, as in a stock deal, all of the target corporation’s assets, wanted or unwanted.

Few strategies are available for avoiding the double tax cost from a taxable sale of assets. The most frequently used strategies involve payments directly to the shareholders under employment, consulting, and noncompetition agreements. While payments to the shareholders under those agreements will be taxed only once, at the shareholder level, those payments will constitute income to the shareholders taxable at ordinary income tax rates, and the employment and consulting payments will be subject to employment taxes as well.

Another strategy involves a shareholder’s sale of the personal goodwill (defined below) associated with the operation of the target corporation. For the strategy to work, it must be demonstrated that goodwill in fact exists, that it is both salable and transferable to a purchaser of the target corporation, and that it is personal goodwill owned by a shareholder rather than business goodwill owned by the target corporation itself.

Summary of Tax Benefits

A shareholder’s sale of personal goodwill creates significant income tax benefits for the shareholder of the target corporation. A sale of personal goodwill, if respected by the IRS, creates long-term capital gain to the shareholder, taxable at up to 23.8% (maximum capital gain rate of 20%, plus the 3.8% net investment income tax) rather than ordinary income to the target corporation, taxable at up to 35% plus an additional tax of up to 23.8% on the remaining balance of the purchase price distributed by the target corporation to the shareholder, leaving the shareholder with potentially approximately 76 cents rather than 49 cents for every dollar of value for goodwill after federal income tax.

In other words, the income tax is potentially more than two times (51% versus 23.8%) as much if the payments are made first to the target corporation rather than to the individual for a capital asset. And, if the choice is between personal goodwill and noncompetition payments to the shareholder, the difference is taxation at a federal rate of up to 23.8% for personal goodwill, versus as much as 39.6% for noncompetition payments.

Defining Goodwill

Regs. Sec. 1.197-2(b)(1) defines goodwill as the value of a trade or business attributable to the expectancy of continued customer patronage, and that [t]his expectancy may be due to the name or reputation of a trade or business or any other factor. In Rev. Rul. 59-60, the IRS describes goodwill thus:

In the final analysis, goodwill is based upon earning capacity. The presence of goodwill and its value, therefore, rests upon the excess of net earnings over and above a fair return on the net tangible assets. While the element of goodwill may be based primarily on earnings, such factors as the prestige and renown of the business, the ownership of a trade or brand name, and a record of successful operation over a prolonged period in a particular locality, also may furnish support for the inclusion of intangible value.

The Tax Court, in Staab. 1 has stated that goodwill is an intangible asset consisting of the excess earning power of a business. And the accounting profession defines goodwill as an asset representing the future economic benefits arising from other assets acquired in a business combination. that are not individually identified and separately recognized. 2

Types of Goodwill

There are generally two types of goodwill. Business enterprise, practice, or institutional goodwill is subsequently referred to as business goodwill. Personal, professional, or practice goodwill is subsequently referred to as personal goodwill.

Business goodwill is an intangible asset owned by and associated with the operation of the business entity. A company owns business goodwill where owners have relinquished managerial control and have become passive investors, its corporate interests and identity are separate from those of its shareholders, none of its shareholders is critical to its success, and the loss of any key employees would not significantly reduce its value. Other facts demonstrating the existence of business goodwill include the business’s locations, a loyal customer base, unique operating systems and procedures, and a well-trained workforce, together with its reputation for excellence, product brands and name, and a record of successful operation over a prolonged period.

In contrast, personal goodwill is owned by the shareholders of the target corporation and exists when a shareholder’s reputation, expertise, skill, and knowledge, as well as the shareholder’s contacts and relationships with customers and suppliers, give a business its intrinsic value. Stated somewhat differently, personal goodwill exists when shareholders of a target corporation are critical to its success and the loss of those shareholders would significantly reduce the corporation’s value.

To own personal goodwill, a shareholder must be intimately involved in the target corporation. Otherwise, any goodwill acquired by the target corporation would be largely due to the work of others. Thus, almost always, the target corporation will be closely held. In addition, personal goodwill is frequently found in highly technical, specialized, or professional corporations. Furthermore, shareholders of corporations with few customers or suppliers may own personal goodwill from the development of close relationships. Obviously, if a target corporation depends highly on a small number of customers or suppliers, then its shareholders must cultivate these relationships to ensure the corporation’s survival. Finally, personal goodwill is more likely to be found if a target corporation’s employment agreements with its shareholders are terminable at will or do not contain automatic renewal provisions and there are no restrictive noncompete covenants between the corporation and its shareholders.

Distinguishing personal goodwill from business goodwill is often difficult and always fact-specific. Personal goodwill may be mistaken for business goodwill and vice versa. 3 In addition, goodwill may belong to both a business and its owner, making valuation a challenge.

Tax Cases Recognizing Personal Goodwill

In three early tax cases involving the liquidations of insurance agencies, the courts determined the goodwill was personal rather than institutional because of the owner’s personal business abilities and relationships with customers. 4 In more recent cases, courts have found that absent binding noncompetition agreements, where personal contacts and relationships are important to the business, personal goodwill can exist separate and apart from, or to the exclusion of, business goodwill.

In the 1944 MacDonald case, 5 the husband-and-wife taxpayers were the shareholders of a corporation primarily engaged in the insurance brokerage business. The husband was experienced in the insurance business, and the development of the corporation’s business was due to his personal ability and relationships with customers. The MacDonalds liquidated their corporation and distributed all its assets-including goodwill-to the husband. The husband then set up a new insurance agency under the same name. The IRS argued that valuable goodwill passed from the corporation to the taxpayers when they liquidated the corporation and that, therefore, they had unreported taxable income. The Tax Court held, however, that no goodwill passed to the taxpayers since any goodwill of the business was due to the personal ability, business acquaintanceship, and other individualistic qualities of [the husband], and found that the corporation did not have any value beyond its tangible assets, since the husband’s personal ability was not a corporate asset and there was not a contract or other agreement between the husband and the corporation for his future services.

Since the MacDonald decision, this part of the law has not changed much. In the 1998 decision of Martin Ice Cream Co. 6 the Tax Court held that a corporation could not be taxed on payments made to its controlling shareholder for his customer relationships. In so ruling, the court stated:

This Court has long recognized that personal relationships of a shareholder-employee are not corporate assets when the employee has no employment contract with the corporation. Those personal assets are entirely distinct from the intangible corporate asset of corporate goodwill. 7

In Norwalk. 8 another 1998 Tax Court decision, the court recognized a shareholder’s personal goodwill in connection with a liquidation of a corporation engaged in the practice of accounting. Holding in favor of the shareholders, the court stated that it had no doubt that most, if not all, of the clients of the corporation would have followed the accountant who serviced them if the accountant left the corporation, and therefore it was reasonable to assume that the personal ability, personality, and reputation of the individual accountants are what the clients sought. 9 In so finding, the court decided that these characteristics did not belong to the corporation as intangible assets. Central to the court’s decision, the court first found that the termination of the employment agreements with the corporation meant that the shareholders had no obligation to continue their connection with the corporation. 10 Second, the court found that the shareholders were not prevented from competing with the corporation. Third, the court found that if the shareholders had left the corporation, their clients would have followed. And, finally, the court attributed no value to the corporation independent of the accountants themselves. 11

In subsequent decisions, courts have followed Martin Ice Cream and Norwalk in recognizing that the value of goodwill attributable to the personal abilities and relationships of the shareholders and employees of a corporation are not the property of the corporation absent some contractual obligation such as an employment agreement or noncompetition agreement that transfers these intangible assets to the corporation.

For example, in H&M, Inc. 12 a 2012 Tax Court decision, the court concluded that where a corporation sold its insurance brokerage business to its competitor and its sole shareholder entered into employment with that buyer, the compensation under the employment agreement was not a disguised purchase price payment to the selling corporation. In reaching this conclusion, the court found that the shareholder had experience in all insurance lines and all facets of running an insurance agency; that it was widely believed that no other competing insurance agent knew insurance better than the shareholder, and even some of his competitors called him the King of Insurance; that the success of the corporation was due to the shareholder’s ability to form relationships with customers and keep insurance companies interested in a small insurance market; that the shareholder had no agreement with the corporation at the time of its sale that would prevent him from taking his relationships, reputation, and skill elsewhere; and that the shareholder’s personal ability and other individualistic qualities (i.e. goodwill) belonged to the shareholder and were not a corporate asset that should be taken into account as part of the purchase price.

Moreover, in Technical Advice Memorandum 200244009 (involving a complicated sale of professional practice assets to an unrelated practice management company through the use of several corporations and a transitory partnership), the IRS ruled that the goodwill associated with the [shareholder-professionals] and their [professional practice] can not be a corporate asset in the absence of an employment/noncompete agreement between the corporation and the shareholder.

Pre-Acquisition Transfers of Personal Goodwill

It is important to confirm that the shareholder did not enter into a noncompetition agreement with the corporation at any time before an asset sale transaction.

Recall that Martin Ice Cream relied on the fact that the controlling shareholder had never transferred his personal rights or relationships to the ice cream company by entering into a noncompetition agreement, and while the shareholders in Norwalk were bound by employment agreements containing noncompetition provisions, those agreements terminated when their accounting practice ceased operation.

To illustrate the problem of preexisting covenants not to compete, look no further than the 2010 district court decision in Howard. 13 In the case, Dr. Larry Howard began practicing dentistry in 1972. In 1980, he incorporated his practice as the sole shareholder, officer, and director of Larry E. Howard, DDS (Howard Corp.). Also in 1980, Howard entered into an employment agreement and a covenant not to compete with Howard Corp. The covenant stated that for as long as he held stock in the corporation and for three years afterward, Howard would not in any capacity engage in, or hold any financial interest in, a competing dental practice within 50 miles of the corporation’s location in Spokane, Wash. All parties acknowledged that as sole shareholder, director, and officer of the corporation, Howard could modify or cancel the employment agreement at any time and that he was bound by the terms of the agreement and covenant not to compete with Howard Corp. through the relevant period of this case.

In 2002, Howard and Howard Corp. sold the practice to Dr. Brian Finn and his personal service corporation, Brian K. Finn, DDS, PS (Finn Corp.). In the asset purchase agreement, Howard was allocated $549,900 for his personal goodwill and $16,000 for consideration regarding a covenant not to compete with Finn Corp. Howard Corp. received $47,100 for its assets.

Howard and his spouse filed a 2002 federal income tax return reporting $320,358 as long-term capital gain income from the sale of goodwill to Finn Corp. In an audit of Howard’s 2002 return, the IRS recharacterized the sale of the goodwill as that of a corporate asset and treated the amount received by the Howards from the sale to Finn Corp. as a dividend from Howard’s professional service corporation of $320,358. The Howards paid the full amount the IRS charged and then filed a claim for refund of that amount, with interest from the payment date.

In deciding in favor of the IRS, the district court found that the goodwill was a corporate asset of Howard Corp. and therefore the Howards were not entitled to the refund that they sought, noting the noncompetition agreement’s terms. Therefore, even if the goodwill had belonged to Dr. Howard personally, it likely would have little value, because Dr. Howard could not have practiced within a fifty mile radius from his previous practice location for at least three years beyond the date of the Howard Corporation dissolution, the court stated. Those prohibitions would likely discourage patients from following Dr. Howard to a new location. 14

In addition to ensuring that there are no preexisting noncompete covenants, it is important that no other documents evidence a transfer of personal goodwill from a shareholder to the corporation. For example, if prior to incorporation, the business had been conducted by the shareholder as a sole proprietorship and, upon incorporation, the shareholder had executed a blanket bill of sale in favor of the corporation, transferring all assets, tangible and intangible, used in or associated with the operation of the business, then it could be argued that the shareholder’s personal goodwill was effectively transferred to the corporation on the date of incorporation. In such a case, the shareholder would want to exercise care in transferring only tangible assets and specifically excluding his personal goodwill and any other intangible assets owned by him from the transfer documents.

Finally, a careful review of any existing employment agreements is necessary. A shareholder bound by the terms of a long-term employment agreement with the business may be effectively prevented from competing with the business, even if that agreement does not contain noncompete covenants.

Transfers of Goodwill at Acquisition

Goodwill must be both salable and transferable, and in the absence of a covenant not to compete with the purchaser, there can be no transfer of goodwill. In Flower. 15 the Tax Court so held, pointing to the absence of a covenant not to compete as evidence that personal goodwill was not transferred.

In Norwalk. the Tax Court found that no goodwill was transferred to the buyer and stated: We have held that there is no salable goodwill where, as here, the business of a corporation is dependent upon its key employees, unless they enter into a covenant not to compete with the corporation or other agreement whereby their personal relationships with clients become property of the corporation. 16

In addition to covenants not to compete, the means of transferring personal goodwill depends on its makeup. If the shareholder’s contacts or relationships with customers or suppliers constitute the personal goodwill, the shareholder should be obligated to provide introductions and generally facilitate a smooth transition of these relationships to the buyer. If, on the other hand, the shareholder’s expertise, knowledge, or skill constitutes the personal goodwill, the shareholder should be obligated to teach the buyer these skills or knowledge. In both cases, the shareholder should be under contract for a sufficient period to accomplish a meaningful transfer of the personal goodwill to the buyer.

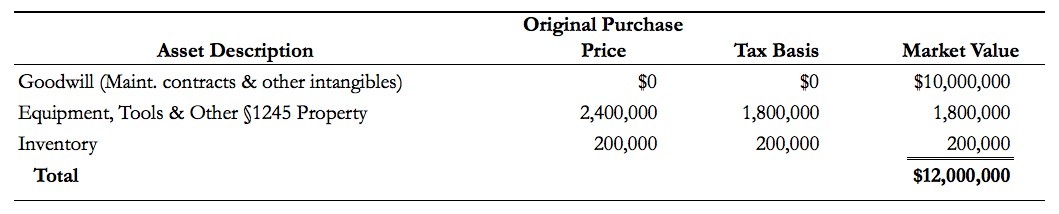

Allocations of Goodwill

If it is determined that goodwill is owned solely by the business, the portion of the purchase price allocable to goodwill should be determined in accordance with Sec. 1060. As a result, the portion of the purchase price allocable to goodwill should be the amount of the purchase price that remains after allocations have been made to all other classes of assets of amounts that cannot exceed the fair market values of those assets. If, on the other hand, both personal goodwill and business goodwill exist, determining the allocable share of the purchase price for each should be determined by a qualified business valuation. And, of course, if the goodwill is solely owned by the shareholders, the entire sum paid for it should be allocated among them.

If, in conjunction with the sale of a corporate business, an amount is separately negotiated for between the parties and is paid in consideration of the shareholders’ agreeing to refrain from entering a competing business for a specified period, the amount so paid is ordinary income to the shareholders, whether paid directly to them or to the corporation that distributes it to them. 17

However, where the covenant not to compete is made in connection with the sale of a going business and is primarily to assure the buyer the beneficial enjoyment of the goodwill acquired, the covenant is regarded as nonseverable from the goodwill and having no separate value. 18 Thus, all amounts received by the shareholders from the sale of their personal goodwill should be taxed at capital gain rates irrespective of the fact that such shareholders entered into covenants not to compete with the buyer.

Planning Considerations

Even in the best of circumstances, it is crucial to establish facts that can support a finding that the goodwill belongs to the shareholders and not to the target corporation. Unless the transaction is carefully planned, the IRS may deem the sale of goodwill by the shareholders to be a fiction.

Planning for the sale of personal goodwill should begin well before a sale of the target corporation is contemplated. All corporate records should be carefully reviewed to ensure that the shareholders have not transferred ownership of their personal goodwill to the target corporation, by a capital contribution or by entering into long-term employment or noncompetition agreements with the target corporation. Of course, if any such agreements exist, the adviser should consider whether they can be effectively terminated.

At the inception of a contemplated asset sale transaction, it should be made clear to the prospective buyer that the target corporation owns its tangible assets, while the shareholders own the personal goodwill associated with the business operations of the target corporation. Any confidentiality agreement of the prospective buyer should be addressed to both the target corporation and its shareholders as sellers.

Any letter of intent should contemplate two separate, but related, asset sale transactions-one for the target corporation’s sale of its tangible and intangible assets and the other for the shareholders’ sale of their personal goodwill. Throughout the due-diligence process, both asset sale transactions should be taken into account.

The two contemplated asset sale transactions should be set forth in two separate, but related, definitive agreements. If that is not possible, then the definitive agreement should clearly describe the two separate sale transactions. Each definitive agreement should contain the noncompete covenants of the shareholders and should clearly state how the shareholders will sell and transfer their personal goodwill to the prospective buyer.

There should be separate bills of sale under which the target corporation and the shareholders will transfer title to their respective assets to the buyer, and all other closing documents should be consistent with the two asset sale transactions.

1 Staab. 20 T.C. 834 (1953).

2 FASB ASC Paragraph 805-30-20.

3 Bateman. 490 F.2d 549 (9th Cir. 1973).

4 MacDonald. 3 T.C. 720 (1944); Bryden. T.C. Memo. 1959-184; and Longo. T.C. Memo. 1968-217.

5 MacDonald. 3 T.C. 720 (1944).

6 Martin Ice Cream Co. 110 T.C. 189 (1998).

7 Id. at 208.

8 Norwalk. T.C. Memo. 1998-279.

9 Id. at *17.

10 Id. at *22 (Because there was no enforceable contract which restricted the practice of any of the accountants at the time of the distribution, their personal goodwill did not attach to the corporation.).

11 For example, the court found no persuasive evidence that the name and location of the corporation had any value other than for their connection with the accountants themselves. Id. at *18.

12 H&M, Inc. T.C. Memo. 2012-290.

13 Howard. No. CV-08-365-RMP (E.D. Wash. 7/30/10), aff’d, No. 10-35768 (9th Cir. 8/29/11).

14 Id. slip op. at 12.

15 Flower. 61 T.C. 140 (1973).

16 Norwalk. T.C. Memo. 1998-279 at *16.

17 Cox v. Helvering. 71 F.2d 987 (D.C. Cir. 1934); Mathews. T.C. Memo. 1961-304.

18 Michaels. 12 T.C. 17 (1949).