Goldsilver ratio continues to fall

Post on: 23 Июль, 2015 No Comment

Yesterday the big news for physical gold and silver markets was the increase in import duties on both metals in India.

The import duty for both gold and silver has been raised from 8% and 6% respectively to 10%. As many people reminded us on Twitter, we all know how successful Prohibition in the US was. These measures are likely to go down just as well. The increased taxes hurt even more than usual when one considers the weak Rupee.

For many gold investment bears the measures being taken by the RBI, combined with rumoured tapering, are a sign that the gold game is up. However it is worth noting that Julys gold imports to India were still above those in June. Measures taken by bordering countries are also signs that Indias appetite to buy gold will not be easily suppressed.

Despite an increase in import duties, HSBC said yesterday that the Indias demand for both gold and silver bullion will pick up ahead of Diwali in November. Whether this is through official import channels or alternative ones, was not mentioned.

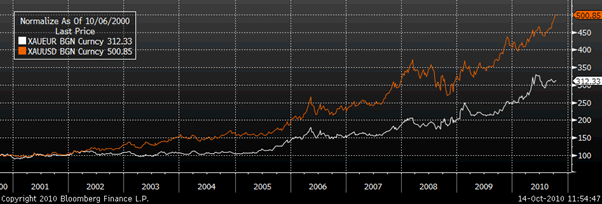

September silver futures continued to impress yesterday, reaching a seven-week high. The gold-silver ratio should be closely watched at present, having been around 65-66 it is now closer to 61 as silver holds its own against the yellow metal. UBS believe the ratio will fall to around 50, as a long-term average. The ratio hit a three-year high of 67.11 in July, this fall in the ratio (and increase in silver price) is likely down to investors looking to benefit from silvers role industrial role which is significant in the face of an economic recovery.

Silver has, of course, benefitted somewhat from the import duties on gold in India. 2013 imports so far suggest that this year will be a record year for India and silver buying. Whilst 1,200 tonnes of the silver bullion was imported in 2012, 2,400 tonnes was imported in the first half of 2013.

Fed keeps teasing

Yesterday the Fed tried again to send out mixed messages, this time via Atlanta Fed President Dennis Lockhart, who said the mixed US recovery had left the FOMC unable to plan a clear path for future monetary policy.

Comex gold finished the day lower than the previous session thanks to a stronger dollar index and some positive economic data. It feels like weve had a couple of days of taper free talk, but after yesterdays US retail data chatter surrounding this issue is likely to continue into this week.

Data yesterday and today from the European Union has impressed analysts. Both France and Germanys GDP data was reported higher than predicted. The German ZEW economic expectations index for August showed a vast improvement on that in July, jumping from 36.3 to 42.

Golds new-found strength

Golds strength this week has been thanks to promising data from China, both economically and in terms of gold imports. Barclays earlier warned that in order for the spot gold price to climb physical gold bullion purchases must reassert themselves given the backdrop of ETF outflows, futures and OTC markets price influence. The 54% increase in Chinese gold investing demand should surely be an example of gold asserting itself.

Barclays states that gold and silver are up 8.5% and 10%, respectively, in the quarter-to-date. Whilst sentiment surrounding the economy and the apparent financial recovery are improving, there is an underlying concern surrounding inflation from which both gold and silver are benefiting from.