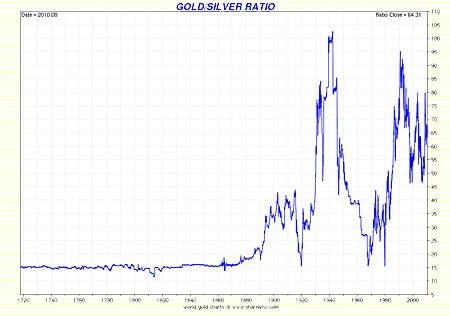

GoldSilver Ratio

Post on: 23 Июль, 2015 No Comment

Here is an article by Myra P. Saefong, Market Watch

dated July 19, 2011

SAN FRANCISCO (MarketWatch) — Silver’s recent climb has significantly outpaced gains made by gold. But a closely watched ratio based on the two prices suggests silver has even more catching up to do, analysts say.

The so-called gold-to-silver ratio, the price of gold divided by the price of silver, currently stands at 39.8 to 1. In other words, a single ounce of gold is worth 39.8 ounces of silver. That’s a decline from the end of 2010, when the ratio was around 46.

Silver has surged 29% year to date to about $40 an ounce, compared with gold’s 13% year-to-date advance, to just over $1,600 an ounce.

“Some traders look at the gold-silver ratio as a way to determine if one commodity is over or undervalued relative to [the] other,” said Paul Simon, chief investment officer at Tactical Allocation Group.

“This can open up statistical-arbitrage opportunities, where a trader may try shorting the overvalued commodity and buying the undervalued commodity, with the hope of profiting from the reversion to the mean,” he said.

Comparing gold prices to those of silver “gives a good relative feel for the price fluctuations between the two metals,” said Matt Insley, editor of the Daily Resource Hunter. “Plus, it’s another tool for metals traders to gauge future metals trends.”

But analyzing the gold/silver ratio’s levels is a complicated task.

Indications The 200-year average for the gold to silver ratio sits around 37 to 1, said Insley, and the ratio now stands very close to that historic average.

Still, “theres much more to see if you look at the chart of the gold to silver ratio,” he said. Read more of Insley’s thoughts on gold.

Since the early 1990s, the price of gold relative to silver has dropped, so the overall trend clearly shows that silver is appreciating in terms of gold, he said.

And “when you think of the current ratio compared to the naturally-occurring ratio of gold to silver in the earth — 17:1 — there’s still room for silver to run,” he said.

Gijsbert Groenewegen, a managing partner at Silver Arrow Capital Management, said he believes the ratio can fall back to 30, implying that silver will continue to outpace gold’s gains.

“A high ratio number probably indicates a ‘calm’ period whilst a low ratio probably means a market in motion,” he said.

Silver is “cosmetically much cheaper” than gold, he said, and if the whole monetary systems breaks down, “gold is likely to be confiscated to back up a new monetary system and silver would become the safe haven of choice investors could still freely invest in.”

Silver’s run this year has included a steep drop and a sudden fall. After climbing close to $50 an ounce, silver prices fell much more than gold when precious metals corrected in early May, likely due to higher margin requirements for silver futures. On May 3, silver futures sank nearly 8%, while gold lost around 1%.

Though this article is a bit dated, the gold-silver ratio is always a subject of discussion. It seems it is one of the main supporting points from the bulls indicating that the price of silver will go up 300 or 400%. Please comment.