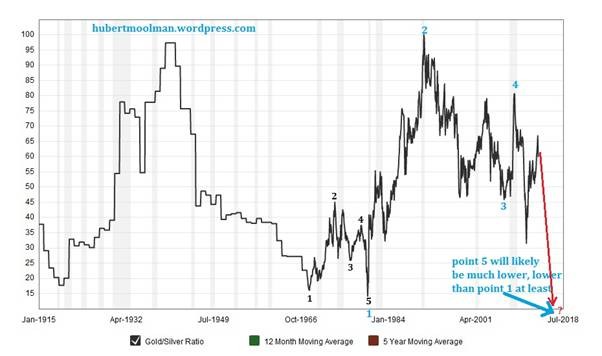

Gold silver ratio pointing to higher gold prices

Post on: 23 Июль, 2015 No Comment

Finance and Stock Trading News

Gold silver ratio pointing to higher gold prices?

In two short years, the gold:silver ratio has plummeted 62 percent from 80:1 to 30:1. That means it takes a mere 30 ounces of silver to buy one ounce of gold. The dramatic shift of fortunes has a lot of investors and analysts saying silvers overheating. Is it time to jump ship and swim for the golden shores? Perhaps. Here are three reasons to consider reallocating your portfolio in favor of gold:

1) Mean Reversion. The gold:silver ratio is at 30-year lows. Generally, relative strength relationships ‘revert to normal’ or at least move towards equilibrium over time, writes Corey Rosenbloom at AfraidToTrade.com. Suffice it to say that a gold:silver ratio of 30 is far from normal. Over the past three decades, the gold:silver ratio has averaged somewhere between 65 and 70. Over the long haul, well probably look back on today as an aberration. When the gold:silver ratio decides to revert to normal, which we assume it will eventually, it could happen quickly. And it could happen in two quite different ways: The mean reversion scenario suggests other outcomes such as a dramatic ‘catch-up’ rally in gold, Rosenbloom writes, or a ‘blow-off top’ correction down in silver. Either way points to gold as a better option.

2) Rife with speculation. The fundamentals for investing in gold and silver are quite similar. Both have historic status as a monetary metals. They even have their own symbols for trading on international currency exchanges. Logically then, both metals should have followed similar trajectories after the Fed announced its quantitative easing program, QE2, in September. Instead, gold futures have climbed 20 percent while silver shot up 150 percent. That leads me to believe the rise in silver prices has been driven by speculators and momentum traders who are attracted to the smaller, more volatile silver market. If thats the case and the momentum shifts away from silver, prices could collapse quickly.

3) Government Intervention. Over the long haul, Im convinced theres still a bullish argument for gold and silver prices. QE2 may be coming to an end in June, but unless the Fed plans to aggressively raise interest rates, inflation will start sinking its teeth into our pocketbooks. In such an environment, there are few places to retreat outside of precious metals. Hedge fund and money market managers know as much, and since they control such vast amounts of capital, entering the silver market in a large way isnt really an option. The gold market, though, has the depth and stability to absorb enormous inflows of capital. Expect gold to outperform in such an environment.

Of course, for all the pontificating of analysts and writers (myself included), theres a chance that the gold:silver ratio has been artificially high over the past few decades. Perhaps the markets shaking loose the shorts? Or maybe the sudden change in silvers fortunes is due to renewed industrial demand from the solar industry?

Eric Sprott of Sprott Asset Management helps oversee more than $1 billion in assets, and hes publicly argued that were in the midst of a watershed moment in the precious metals market. Hes went on the record calling for a gold:silver ratio as low as 10:1. Such bold predictions by respected investors could, in and of themselves, be pushing silver prices higher much faster than gold. Right now, though, the present looks very different than the past, and that should be enough to give all investors pause.