Gold Reaching New Record Levels

Post on: 7 Июнь, 2015 No Comment

On Friday morning, it was a risk off day… But as the day wore on, risk came back into the currencies…. And today, it’s REALLY a risk on day! Apparently, at some time on Friday, someone with a lick of brains realized that the Fed is going to keep their stimulus measures – which include near zero interest rates – for some time to come. Why would that deep six the dollar? Ahhh grasshopper, apparently you haven’t been paying attention in class! No worries… Here’s the skinny…

The perception in the markets is that as long as the US keeps the stimulus measures in place, the global recovery will continue to gain terra firma. And a global recovery means wider interest rate differentials to the US, and that the deficit situation in the US will continue to grow way past the already “unsustainable” levels. This is all “part of the plan” to get the dollar to do a “magic trick” and change from a 20 to a 5, so that paying back the debts isn’t as difficult to do!

And for all those people that beat on me and tell me that I’m wrong, etc. I challenge you to tell me just how the US is going to repay their debts, given what we know about the future entitlements to the Baby Boomers that started retiring a year or so ago!

WOW! Pulling out the challenges so soon on a Monday Morning…

So… The non-dollar currencies are on the rally train versus the dollar this morning… But again, this risk on/risk off just gives me a rash! Come on traders! Have some conviction! Make a commitment, don’t be so Brett like! HA!

I was doing some reading yesterday, and came across a story on one of my fave countries/currencies… Norway…

Seems that Norwegian officials are very concerned with the stimulus they provided (which they could because they were in a positive fiscal position to do so!), and how quickly they need to remove it before the economy gets to a point that large interest rate hikes will need to be put in place, which might squash the economic recovery… It’s a tricky situation that they have in Norway, not unlike other countries that have injected stimulus into their economies to help economic growth… But Norway, has already hiked rates once… And are on the docket to hike them again in the first quarter of 2010…

I think it’s “all good” for Norway… The wider interest rate differentials versus the Eurozone, the US and Japan, is “all good” for the krone ( NOK )… I see interest rates going to 1.75% early in 2010, and end the year at 2.25%, and steadily climbing to over 4% by 2012… Of course if the economic recovery in the US ever does get on terra firma, those rates in Norway could see larger moves higher.

Gold’s price has peaked again, this time moving to $1,167! I saw one brokerage house’s metals guy say that strike prices on gold futures will soon be $1,200! WOW! All you have to do is take a look at the gains in gold to know that it’s a risk on day!

I was giving an interview with Kiplinger’s on Friday, and the writer, who was very well informed on what was going on in the economy, asked me why to invest in gold in this deflationary period? I told him that while we might not have wage inflation for some time, we will experience monetary inflation, from all of the stimulus, and money supply… And that “astute investors” were buying gold now to protect them from this monetary inflation, rather than waiting for the monetary inflation to hit us right between the eyes, and buying it at much higher prices then… Inflation fears…

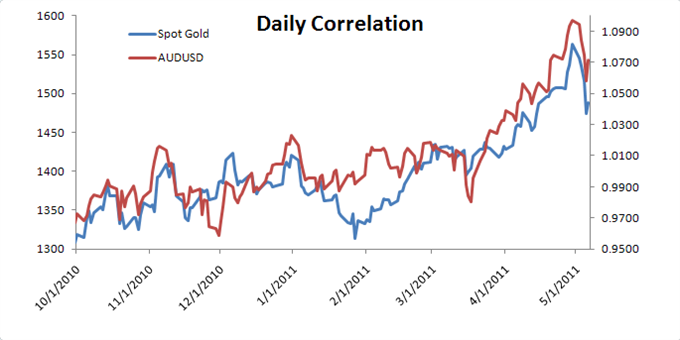

So… With gold reaching new record levels, the rest of the commodities are booking profits too… And more important to us is that the commodity currencies are pushing higher versus the dollar again… Recall last week when I told you that the commodity currencies had lost the most in the risk off session because they had booked the largest gains versus the dollar previous to the risk off session… Well… The commodity currencies are back to their old tricks, and pushing the envelope to gains versus the dollar, this morning.

Aussie ( AUD ), kiwi ( NZD ), loonies ( CAD ), krone, rand ( ZAR ), and reals ( BRL ) are all much stronger this morning, than they were on Friday morning. I read on Friday that New Zealand’s immigration growth in October accelerated to a 5-year high, which traders viewed as positive for the economy, thus pushing kiwi higher.

Outside the commodity currencies… The Big Dog, euro ( EUR ), which looked like it was about to give back some huge gains on Friday, is nearing 1.50 again! More lives than a cat! The Eurozone PMI (manufacturing index) printed weaker than forecast, but still hit a 2-year high of 53.7…

A reader asked me to comment on something that was written in a newsletter that they receive, about the collapse of the euro… I tell you this… If I had $100 for every time I answered someone’s claim that the euro was going to collapse, I would have enough to pay the increased taxes we all will be paying for all the wonderful things the government is doing for us! NOT!

For years now – even when the euro first became a currency – there have been stories written about how it would collapse… The stories always have a good reason for this collapse… But all of them have been thrown to the roadside… Of course one day, this fiat currency will suffer the same ending as all the other fiat currencies of the past 2,000 years, but not in our lifetime! But from my grave, I’ll hear someone say… “See, back in 2009, I said the euro would collapse and it did” (never mind it was 50 years later!)

Basically, it goes like this… The euro won’t collapse unless Germany decides to leave the single unit… And if you think Germany is “hip” to leave, then you’ve got another thing coming… And the problems of Spain, Italy, Greece, and others? They aren’t going anywhere either! Spain and Italy get down on their knees to give thanks that they are a part of the euro.

Whew! That takes longer and longer every time I talk about it!

Today in Canada, we’ll see the latest retail sales figures… And tomorrow, Germany’s think tank, IFO prints their latest reading on business sentiment… Other than that, there’s not much to deal with regarding data outside of the US this week.

In the US, the data cupboard gets quite a few data prints shoved in before everyone takes off for Thanksgiving, and Friday… Yes, the markets are open on Friday, but stocks close at 1 (I think), and the volumes in currencies will dry up like they were wiped with a Sham Wow, once London heads to the pubs around noon.

Before we head to the table on Thursday, the data cupboard will yield Existing Home Sales today, GDP & the S&P/CaseShiller Home Price Index, Consumer Confidence, and the minutes of the last FOMC meeting tomorrow. Wednesday brings us my faves of Personal Income and Spending, with Durable Goods Orders, the U. of Michigan Consumer Confidence, and the Weekly Initial Jobless Claims… So… Quite a bit to digest before we head to the table on Thursday!

There was a great article in The Wall Street Journal weekend edition by the former head of the Congressional Budget Office (CBO). This article was very much what I’ve been telling you about the deficit spending going on, but this time it’s from the man who used to “keep the books”!

Here’s a snippet… “The planned deficits will have destructive consequences for both fairness and economic growth. They will force upon our children and grandchildren the bill for our overconsumption. Federal deficits will crowd out domestic investment in physical capital, human capital, and technologies that increase potential GDP and the standard of living. Financing deficits could crowd out exports and harm our international competitiveness, as we can already see happening with the large borrowing we are doing from competitors like China.

The time to worry about the deficit is not next year, but now. There is no time to waste.”

Mr. Holtz-Eakin is former director of the Congressional Budget Office and a fellow at the Manhattan Institute.

And then there was this… A quote by Bill Gross… “What a good country or a good squirrel should be doing is stashing away nuts for the winter. The United States is not only not saving nuts, it’s eating the ones left over from the last winter.”

To recap… It’s a risk on day, and the non-dollar currencies are rallying versus the dollar, as traders now feel that the US will keep stimulus measures in place for some time. Not sure when they “got the clue” but it was quite evident to us for some time! Gold continues to push higher reaching $1,167 overnight. Norway wants to remove stimulus soon before their economy overheats, and Chuck talks to Kiplinger’s.