Gold Gets Physical

Post on: 8 Июль, 2015 No Comment

Actively Managed ETFs News:

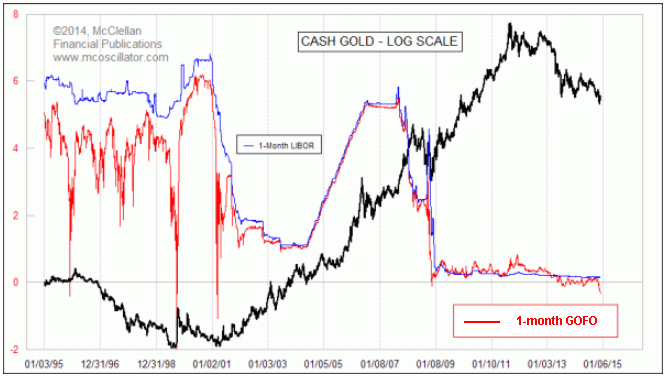

Its happening again – the gold cost of carry as defined by the one month gold forward rate has swung sharply into negative territory. This means that an investor is able to earn a positive carry from owning gold. This is unusual for gold markets and a relatively rare occurrence – the more common scenario is that because of the storage costs associated with gold, an investor would expect to have to pay a cost of carry to hold gold. Prior to the instance in July 2013, the last time that gold forward rates went negative was in November of 2008.

By way of a brief primer we define the cost of carry of gold in dollars as the London Bullion Markets Association 3 month Gold Forward Offered Rate (GOFO). GOFO is published every day by the LBMA and is calculated as US dollar Libor minus the gold lease rate.

Gold Forward Offered Rate = USD Libor – Gold Lease Rate

With the gold lease rate being the interest rate at which investors can borrow or lend gold. GOFO then is effectively the rate at which an investor can borrow (lend) gold with dollars posted (received) as collateral. The most visible characteristic of a market in which the cost of carry is positive is that the spot price of gold rises above the price of gold for future delivery.

The sharp negative swing in gold forward rates is a positive development for gold investors as in recent history a negative forward rate has typically signaled demand to buy physical gold which has helped to support and at times move prices higher.

The chart above shows the one month gold forward rate (GOFO) on the left hand axis with the spot price of gold in dollars per ounce on the right hand axis, over the last 18 months. The red circles highlight the periods when the gold forward rate moved from positive into negative territory, an event that was more often than not associated with the gold price stabilizing or even moving higher.

Why are negative forward rates often a positive signal for the gold price? Reviewing first the formula for the gold forward rate (= US Libor – Lease Rate). The gold lease rate (the gold interest rate) is primarily a function of the cost of storage and the unobservable “convenience premium” (the premium that an investor is willing to pay to own gold today versus a owning a claim to receive gold in the future). For forward rates to turn negative the lease rate would need to be greater than Libor. With Libor broadly stable the effect must largely then be attributable to a rise in the lease rate. A scenario that can occur and one which we believe largely explains the negative forward rate is where there is a rise in demand for physical gold, possibly related to settling gold futures contracts, and this is coupled with an environment where the supply of physical gold is constrained. In this scenario the “convenience premium” can rise as an investor’s preference to own physical gold rises. This in turn pushes up the lease rate thereby causing the forward rate to turn negative. The net result of which is that the spot price of gold rises above the price of gold for future delivery.

A detailed examination of this relationship is beyond the scope of this discussion piece but there is certainly some evidence in past months to suggest that it has been constrained supply in the physical market coupled with settlement demand in the futures market that has underpinned the gold price – for example negative forward rates have tended to be observed around COMEX gold delivery dates.

Gold forward rates have swung sharply into negative territory since the end of October. In fact forward rates for gold as reported by the LBMA are negative for durations out to 6 months. We believe this is a symptom of a recent surge in demand for physical gold and is likely to provide support for the gold price as we move into year end.

This article was written by Treesdale Partners, portfolio manager of the AdvisorShares Gartman Gold/Euro ETF (GEUR), AdvisorShares Gartman Gold/British Pound ETF (GGBP), AdvisorShares Gartman Gold/Yen ETF (GYEN) and AdvisorShares International Gold ETF (GLDE).