Gold ETF Is a Star

Post on: 28 Март, 2015 No Comment

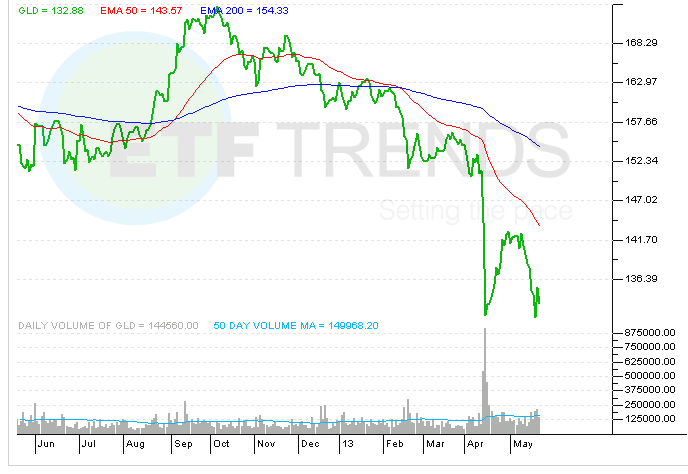

NEW YORK ( TheStreet ) — ETF investors piled into shares of SPDR Gold Shares (GLD ) to the tune of $828 million in March as currency concerns kept the metal attractive. A rise in the price of the metal helped push net assets under management up more than $1 billion, to a new high of $40.5 billion. In contrast, iPath S&P 500 VIX Short Term Futures ETN (VXX ) absorbed $387 million in new money, but the fund’s net asset value only increased $160 million as the price continues a year-long slide.

Inflation concerns used to be a major factor in gold buying, but one noticeable difference this month was that Treasury Inflation Protected Securities ETFs were not popular. The largest TIPS fund, iShares Barclays TIPS (TIP ) saw just $11 million in inflows, well off the inflows of $401 million in March and $1,174 million in January.

Despite being the $20 billion behemoth, TIP also saw its competitors capture more inflows last month. SPDR Barclays TIPS (IPE ) had $20 million in net inflows, bringing the total assets to $375 million. PIMCO 1-5 Year TIPS (STPZ ) had $202 million in net inflows and grew to $439 million in assets.

Also making the case against inflation fears as a driver of investment flows was the presence of two high-yield bond ETFs among the top 10 net inflows. iShares iBoxx High Yield Corp Bond (HYG ) and SPDR Barclays High Yield Bond (JNK ) saw inflows of $539 million and $480 million, respectively. If inflation led to a rise in interest rates, these funds would see their net asset value decline.

The third largest inflows were had by iShares Barclays Short Treasury (SHV ). which holds Treasury bonds with less than one-year until maturity, with $1,663 million in net inflows. SHV yields almost nothing due to the short duration of the bonds and the extremely low interest rate environment. Investors appear to have moved to the shorter end of the yield curve, as iShares Barclays 1-3 Year Treasuries (SHY ) had $318 million in outflows.

Other leading outflows came from small caps, foreign and domestic. iShares Russell 2000 (IWM ) had $1,000 million in outflows; Vanguard MSCI Small Cap (VB ) had $519 million.

With all the concern surrounding Greece and the euro, PowerShares DB U.S. Dollar Index Bullish Fund (UUP ) still had $424 million in outflows, good for fifth largest, but ProShares UltraShort Euro (EUO ) did have $40 million in inflows.

Also notable was the continued migration of assets from iShares MSCI Emerging Markets (EEM ) to Vanguard MSCI Emerging Markets (VWO ). Investors put $774 million into VWO last month and removed $695 million from EEM; this trend has been due to VWO more closely tracking the index.