Getting Started With Technical Analysis – Support and Resistance Oriental Pacific Futures

Post on: 28 Июнь, 2015 No Comment

Technical analysis is one of the forecasting methods to assist traders in making better trading decisions. It is the study of how market prices behave to gain profits.

The objective of technical analysis is to forecast the price over a period of time in the future and then to use this information to decide whether to buy or sell your futures contracts. Traders who use technical analysis are into a very opportunistic style of trading as compared to holding on the assets or long-term investing.

The general perception is that technical analysis is all about charts, graphs and lines. While this may be true to a certain extent, technical analysis is more than that. This method of forecasting prices is also a way of managing market risk.

At the end of the day, you want to take advantage of any methods or tools that can help you to achieve your goal, which is to make profits.

The Charts

In technical analysis, price and trends rule. You must be familiar with reading prices, trends and price charts.

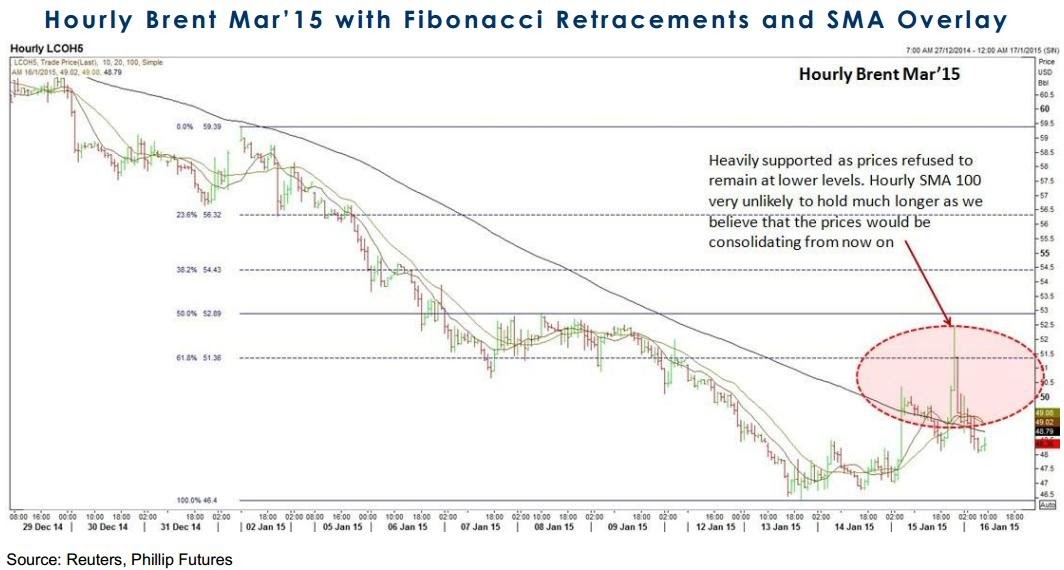

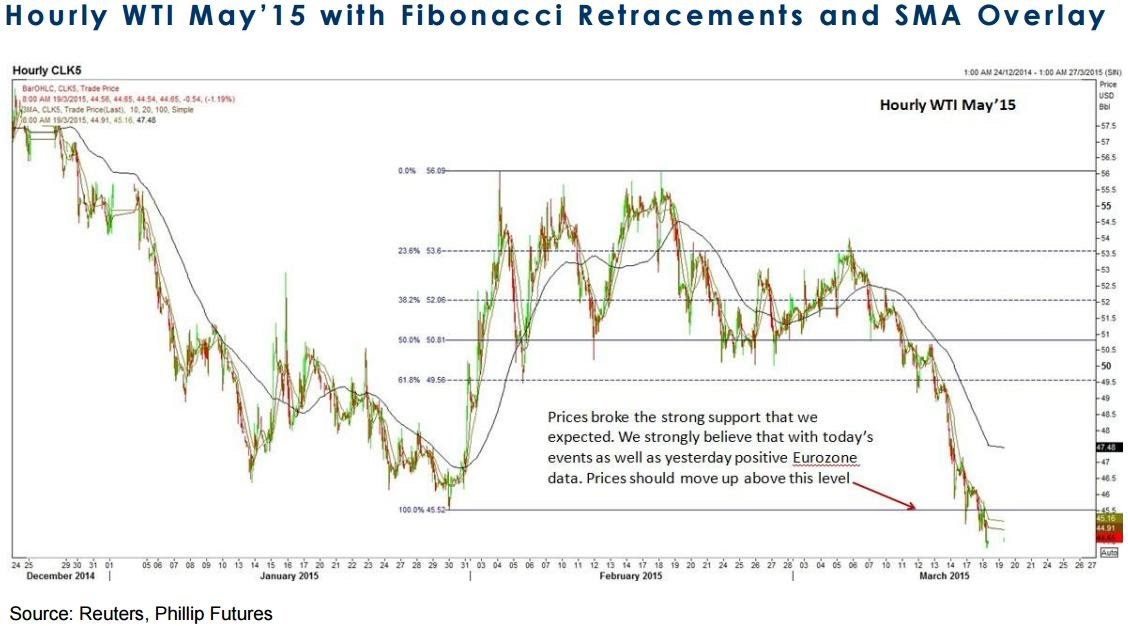

The image below shows a typical chart that you’ll see in charting software or trading programs. The chart is the workspace of technical analysis. Based on the charts, there are numerous theories and indicators that have been developed over the decades such as the Gann, Fibonacci and Elliot Wave.

As someone who starting out in technical analysis, your role is to identify key reversal trends as early as possible.

Key reversal trends are trends that tend to go in an opposite direction. For example, an upward trend reversing means it will go on a downward trend. Likewise a downward trend reversing means that it will go on an upward trend.

Support and Resistance

Support and resistance is a concept in technical analysis whereby the price movement will stop and reverse its trend.

In technical analysis, it is important to identify the support and resistance lines to gauge where the prices may reverse as well as to gauge the limits of a trend.

The more times the prices bounce off either the support or resistance lines, the stronger the support or resistance levels become.

These trends have been repeated throughout history patterns. The image below shows a historical chart of the S&P 500 Index from 1928 to 2008. You can observe the strong support and resistance lines.

Breakout

Whenever a line breaks the resistance line, it’s called a breakout. As a result, the price will keep going on an upward trend and it will take some time to find a new resistance or ceiling level.

Fallout

Fallout is the opposite of breakout. This phenomenon can also happen on the downside. Once the price goes below a support line, it will keep going on a downward trend and it will take some time to find a new support level.

Support and resistance lines are important in identifying key reversal trends. In the next article, we will look into another concept in technical analysis known as Retracements and Trend Reversal .

Other Indicators in Technical Analysis:

###

www.opf.com.my are included. However, other organizations are invited to link to articles that are available in the public area of the Oriental Pacific Futures’ Learning Resources website. No additional permission is needed for such a link.