Gauging Forex Market Sentiment With Open Interest

Post on: 14 Август, 2015 No Comment

Market sentiment is the most important factor that drives the currency market, and assessing market sentiment is one aspect of trading that is often overlooked by traders. While there are quite a few ways of gauging what the majority of market participants are thinking or feeling about the market, in this article, we’ll take a look at how to do this using interest analysis.

Open Interest in Forex

Open interest analysis is not uncommon among those who trade futures, but it is a different story for those who trade spot forex. One of the most important points to note about the spot forex market is that information pertaining to open interest and volume is not available, because transactions are carried out over-the-counter, not through exchanges. As a result, there is no record of all the transactions that have taken place or are taking place in all the “back alleys,” Without open interest and volume as vital indicators of the strength of spot price moves, the next best thing would be to examine the open interest data on currency futures.

Spot FX Vs. FX Futures

Open interest and volume data on currency futures allow you to gauge market sentiment in the currency futures market, which also influences, and is influenced by, the spot forex market. Currency futures are basically spot prices, which are adjusted by the forward swaps (derived by interest rate differentials) to arrive at a future delivery price. Unlike spot forex, which does not have a centralized exchange, currency futures are cleared at exchanges, such as the Chicago Mercantile Exchange. which is the world’s largest market for exchange-traded currency futures. Currency futures are generally based on standard contract sizes, with typical durations of three months. Spot forex, on the other hand, involves a two-day cash delivery transaction.

One of the many differences between spot forex and currency futures lies in their quoting convention. In the currency futures market, currency futures are mostly quoted as the foreign currency directly against the U.S. dollar. For example, Swiss francs are quoted vs. the U.S. dollar in futures (CHF/USD), unlike the USD/CHF notation in the spot forex market. Therefore, if the Swiss franc depreciates in value against the U.S. dollar, USD/CHF will rise, and Swiss franc futures will decline. On the other hand, EUR/USD in spot forex is quoted in the same manner as euro futures, so if the euro appreciates in value, euro futures will rise as the EUR/USD goes up.

The spot and futures prices of a currency (not currency pair) tend to move in tandem: When either the spot or futures price of a currency rises, the other also tends to rise; when either falls, the other also tends to fall. For example, if the GBP futures price goes up, spot GBP/USD goes up (because GBP gains in strength). However, if the CHF futures price goes up, spot USD/CHF goes down (because CHF gains in strength), as both the spot and futures prices of CHF move in tandem.

What Is Open Interest?

Many people tend to get open interest mixed up with volume. Open interest refers to the total number of contracts entered into, but not yet offset, by a transaction or delivery. In other words, these contracts are still outstanding or “open.” Open interest that is held by a trader can be referred to as that trader’s position. When a new buyer wants to establish a new long position and buys a contract, and the seller on the opposite side is also opening a new short position, the open interest is increased by one contract.

It is important to note that if this new buyer buys from another old buyer who intends to sell, the open interest does not increase because no new contracts have been created. Open interest is reduced when traders offset their positions. If you add up all the long open interest, you will find that the aggregate number is equal to all of the short open interest. This reflects the fact that for every buyer, there is a seller on the opposite side of transaction.

Relationship Between Open Interest and Price Trend

Overall, open interest tends to increase when new money is poured into the market, meaning speculators are betting more aggressively on the current market direction. Thus, an increase in total open interest is generally supportive of the current trend, and tends to point to a continuation of the trend, unless sentiment changes based on an influx of new information.

Conversely, overall open interest tends to decrease when speculators are pulling money out of the market, showing a change in sentiment, especially if open interest has been rising before.

In a steady uptrend or downtrend, open interest should (ideally) increase. This implies that longs are in control during an uptrend, or shorts are dominating in a downtrend. Decreasing open interest serves as a potential warning sign that the current price trend may be lacking real power, as no significant amount of money has entered the market.

Therefore, as a general rule of thumb, rising open interest should point to a continuation of the current price move, whether in an uptrend or downtrend. Declining or flat open interest signals that the trend is waning and is probably near its end.

Putting it Together when Trading Forex

Take, for example, the period between October and November 2004, when euro futures embarked on a trend of higher highs and higher lows. There were several opportunities to go long on euro, whether by trading breakouts of resistance levels or by trading bounces off the daily up trendline. Open interest of euro futures had been increasing gradually as the euro went up against the US dollar. Note that the price movements of spot EUR/USD moved in tandem with euro futures. In this case, the rising open interest accompanied the existing medium-term trend, hence, it would have given you a signal that the trend is backed by new money.

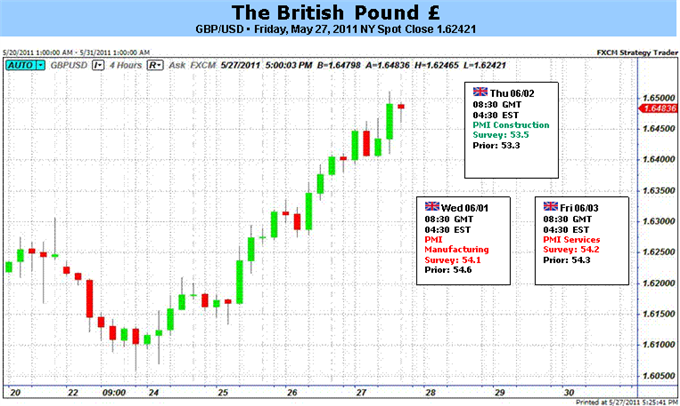

However, sometimes you may get a strong clue that a trend is of a suspect nature. This clue usually comes in the form of falling open interest that accompanies a trend, whether it is an uptrend or downtrend. The Sterling futures trended south between September and October 2006 (as did spot GBP/USD). During this same period, open interest fell, signifying that people were not shorting more contracts; therefore, the overall sentiment is not bearish at all. The trend then promptly reversed, and open interest started increasing.

Conclusion

Whether you are trading currency futures or spot forex, you can make use of the futures open interest to gauge the overall market sentiment. Open interest analysis can help you confirm the strength or weakness of a current trend and also to confirm your trade.

Grace Cheng is the author of 7 Winning Strategies for Trading Forex (2007, Harriman House).